Transform Your Finances: Turn a 50-Week Plan into a Massive Savings and Investment Win

AOL

AOL

How to Turn a 50‑Week Plan into a Massive Savings and Investment Win

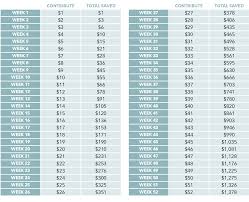

If you’ve ever stared at a bank statement and wondered, “Where did all my money go?” you’re not alone. In a time when living on a paycheck‑to‑paycheck cycle is all too common, a recent AOL Money feature (the “Save & Invest 50‑Week Massive” guide) offers a practical, step‑by‑step strategy to finally get a handle on your finances. The premise is simple: commit to a 50‑week, 12‑month savings and investing program, and you’ll find yourself with a healthy cushion and a diversified portfolio. Below is a comprehensive breakdown of the article’s key take‑aways, broken into digestible chunks so you can start turning the promise into reality.

1. Set a Concrete, Quantifiable Goal

The first thing the article stresses is that “you can’t grow your money if you don’t know where you’re heading.” Whether it’s a down‑payment for a home, a debt‑free emergency fund, or a nest egg for retirement, the plan starts with a clearly defined target amount.

- Why it matters: A specific goal turns vague “save more” into a concrete number you can measure.

- How to do it: The guide recommends using an online calculator to determine how much you need to save each week to hit the target within 50 weeks. For instance, if you’re saving $20,000 over a year, that’s $400 per week (minus any interest or investment returns).

2. Take Stock of Your Current Financial Landscape

Before you start allocating money, you have to know how much you have and where it’s going. The article breaks down this audit into three simple steps:

- Track every expense: Spend a week in a budgeting app (the article recommends tools like Mint, YNAB, or the free “EveryDollar” app). Categorize spending into essentials, non‑essentials, and savings.

- Calculate net income: Subtract total monthly expenses from your take‑home pay. This is the “money‑to‑budget” figure.

- Identify gaps: Pinpoint areas where you can trim spending without sacrificing quality of life. The article encourages cutting or re‑negotiating recurring bills (e.g., cable, streaming services, or insurance).

3. Automate Your Savings

Once you know the target and have trimmed your budget, the article stresses automation as the single most reliable method to avoid the temptation of “spending what’s left.” The suggestions include:

- Direct deposit split: Have a percentage of your paycheck directly deposited into a high‑yield savings account. Many banks offer accounts that are specifically geared toward “high‑yield” with no monthly fees and a decent APY.

- Scheduled transfers: If your payroll is bi‑weekly, set up a transfer on the day after each payday to a separate savings or investment account.

- Round‑up programs: The article highlights services like Acorns or Chime that round up purchases to the nearest dollar and deposit the change into a savings or investment account.

4. Build a Diversified, Low‑Cost Investment Portfolio

Savings accounts are great for liquidity, but they do not keep pace with inflation over the long term. The article’s next section outlines a simple portfolio that balances risk and return:

- Equity (60–70%): A mix of domestic and international index funds. The guide recommends Vanguard’s Total Stock Market ETF (VTI) or Schwab’s US Broad Market ETF (SCHB) as low‑expense options.

- Fixed Income (20–30%): Bonds or bond ETFs like iShares Core U.S. Aggregate Bond ETF (AGG).

- Alternative assets (10%): The article encourages adding a small portion to something like a REIT or commodity ETF (e.g., Vanguard Real Estate ETF, VHT).

Key take‑aways: - Keep fees low: Expense ratios can erode returns. Stick to ETFs with 0.05%–0.20% fees. - Rebalance quarterly: Every three months, shift the portfolio back toward the target allocation. This prevents overexposure to a single asset class.

5. Leverage Tax‑Advantaged Accounts

The article reminds readers that saving isn’t just about putting money into a piggy bank—it’s also about doing so efficiently. It covers two major tax‑advantaged vehicles:

- 401(k) or 403(b): If your employer offers a match, contribute at least enough to get the full match—free money.

- Traditional or Roth IRA: Depending on income and tax bracket, decide which IRA better suits your needs. The article includes a handy decision tree that weighs the tax advantages of each.

6. Monitor Progress and Adjust

Having a plan is one thing; staying on course is another. The article recommends the following checkpoints:

- Monthly review: Every first day of the month, log into your budgeting app and confirm that the automated transfers are happening.

- Quarterly portfolio review: Use tools like Personal Capital or Morningstar to assess the performance of your ETFs and rebalance as needed.

- Annual goal check: At the end of the 50 weeks, evaluate whether you hit your savings target. If you’re ahead, consider allocating the surplus to a higher‑yield savings account or an additional investment in a higher‑growth sector.

7. Bonus Tips & Resources

- Emergency Fund: The article stresses that an emergency fund (typically 3–6 months of living expenses) should be established before aggressively investing. A separate high‑yield savings account is recommended.

- Debt Paydown: If you have high‑interest debt (credit cards, payday loans), the guide suggests a dual‑track strategy: pay down the debt aggressively while still contributing a modest amount to the savings plan.

- Financial Literacy Resources: The article provides links to external reading, including Investopedia’s “How to Build a Budget” and the Khan Academy “Intro to Personal Finance.”

Wrapping Up

The “Save & Invest 50‑Week Massive” guide from AOL Money offers a clear, actionable path for anyone ready to move from financial uncertainty to financial confidence. The central thesis is simple: commit a modest, predetermined amount each week, automate the process, and invest in a diversified, low‑cost portfolio while taking advantage of tax‑advantaged accounts. By doing so, the article argues, you can build both a safety net and a growth engine—all within one year.

Whether you’re a recent graduate dipping into your first paycheck or a seasoned professional looking to sharpen your financial strategy, the 50‑week framework is adaptable. Start by defining a goal, taking inventory of your finances, automating your savings, and building a diversified investment portfolio. Then, stay disciplined, monitor progress, and adjust as life changes.

The bottom line: Your money can work harder for you, but only if you give it a plan, a schedule, and a place to grow. With a 50‑week plan, you’re no longer just saving; you’re building a future.

Read the Full AOL Article at:

[ https://www.aol.com/articles/save-invest-50-week-massive-072000668.html ]