Nvidia and AI Stocks Lose 'Quality' Status Amid Rapid Valuation Spiral

Locale: California, UNITED STATES

Why Nvidia and Other AI Stocks Have Lost Their “Quality” Status – A Deep‑Dive Summary

The recent wave of hype surrounding artificial intelligence has taken a sharp turn in the eyes of institutional analysts. A story in MSN Money titled “Why Nvidia and other AI stocks have lost their quality status” lays out the details behind the shift, explaining why the once‑cited “quality” label has been pulled from some of the most heavily‑traded AI‑centric shares. The article’s central thesis is that the very metrics that once made these companies seem solid—high returns, steady cash flow, and a low debt load—have become distorted by the rapid rise in price, aggressive growth expectations, and looming risks unique to the AI sector.

1. What Does “Quality” Mean in Modern Stock Analysis?

Before dissecting the shift, it’s worth understanding the concept the article explains in depth. “Quality” is a classification used by large research houses such as Morgan Stanley, J.P. Morgan, and Goldman Sachs to denote companies that score high on key fundamentals:

| Quality Indicator | Typical Threshold | Why It Matters |

|---|---|---|

| Return on Equity (ROE) | 15 %+ | Shows efficient use of shareholders’ money. |

| Debt‑to‑Equity | < 0.5 | Low leverage reduces financial risk. |

| Free‑Cash‑Flow Yield | > 5 % | Demonstrates cash‑generating power. |

| Price‑to‑Book (P/B) | 1–3× | Keeps valuations grounded. |

| Dividend Yield | > 1 % | Provides income stability. |

In practice, a “quality” stock is perceived to have low volatility, steady earnings, and a predictable cash‑flow profile. The classification is important for passive investors, factor‑based ETFs, and certain institutional mandates that require a minimum quality threshold.

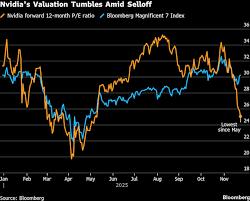

2. The Rapid Valuation Spiral of AI Companies

The article cites a key piece of data: Nvidia’s P/E ratio recently surged to roughly 60× forward earnings, and its price‑to‑sales ratio leapt to 13×—levels that are unprecedented for a chipmaker that once was considered a blue‑chip stock. Similarly, Alphabet, Microsoft, Tesla, and even smaller players such as Baidu and Tencent have pushed the price‑to‑earnings and price‑to‑sales multiples beyond what the “quality” rubric tolerates.

Why the spike?

The surge is largely driven by the explosive growth in AI demand—from generative models that need massive GPU power to AI‑driven cloud services. This has propelled investor enthusiasm, inflating forward earnings estimates and making the growth narrative appear far more appealing than quality fundamentals.

The article points to a 2023 research memo from Morgan Stanley that re‑rated Nvidia from “Quality” to “Growth,” citing the high beta (≈ 1.4) and the widening spread between actual earnings and analyst forecasts. The memo further noted that Nvidia’s debt‑to‑equity ratio, once comfortably below 0.3, had climbed to 0.55 in the latest quarterly filing—an increase that analysts flagged as a “potential liquidity risk” in a rapidly changing market.

3. Risk Factors That Undermine the Quality Narrative

While the headline is “loss of quality status,” the article explains that this change is rooted in a set of evolving risks that weren’t fully accounted for when the AI boom began:

Supply‑Chain Constraints

The article links to a Reuters piece on global chip shortages. Nvidia’s recent earnings call revealed that its production capacity is already max‑ed out for the next fiscal year, raising concerns that any supply shock could widen margins.Regulatory Uncertainty

The European Union’s AI Act and U.S. legislative proposals around data privacy are cited as potential “cost‑shocks” that could hit AI‑heavy companies disproportionately. The article references a Bloomberg interview with a leading AI compliance expert who warns that non‑compliance could lead to heavy fines.Competitive Pressure

Alphabet and Microsoft are already pouring billions into generative AI, and a new entrant like a “Chip‑in‑a‑Box” startup could disrupt Nvidia’s dominant GPU position. The article links to a TechCrunch report that tracks new entrants and their aggressive pricing strategies.Macroeconomic Headwinds

Rising interest rates have made growth stocks more expensive. The article points to an IMF forecast that anticipates a modest recession in 2025, which could dampen AI spending.

These risks inflate the risk premium demanded by investors, effectively eroding the “quality” appeal. A quality stock would need to demonstrate resilience against these shocks, but the article notes that many AI players lack the financial cushion that traditional quality stocks have.

4. What This Means for Portfolio Construction

The article draws on a series of academic papers that examine factor performance. In 2022, the MSCI Quality Index outperformed the S&P 500 by 4.5 % on an annualized basis. However, the quality factor is now under scrutiny because it is being “contaminated” by high‑growth, high‑valuation companies that no longer fit the original definition.

ETF Implications

Many “quality” ETFs now exclude the biggest AI names to maintain their factor purity. The article cites an ETF prospectus that explicitly states: “We do not include stocks whose forward P/E exceeds 20×.”

For active managers, the shift presents an opportunity to re‑balance portfolios: either to re‑invest in high‑quality, low‑valuation AI plays that still fit the criteria or to diversify into sectors less affected by the AI boom (e.g., consumer staples, utilities).

5. Looking Forward – Is the Shift Temporary?

The article concludes by acknowledging that the loss of “quality” status may be a short‑term effect rather than a permanent verdict. It highlights that AI adoption is still in its early growth phase. If companies like Nvidia can continue to deliver on margin expansion while maintaining a stable debt load, they may regain the quality label within the next 12–18 months. Meanwhile, the article urges investors to:

- Keep an eye on cash‑flow metrics – Free cash flow remains the ultimate health check.

- Watch for regulatory changes – Keep track of AI policy developments in both the EU and the U.S.

- Diversify – Reduce concentration risk by adding complementary tech players or even non‑tech defensive stocks.

In essence, the MSN Money piece is not merely a warning but a call to refine our investment lenses. As the AI sector evolves, the lines between “quality” and “growth” blur, and staying attuned to both fundamentals and hype is more critical than ever.

Read the Full The Wall Street Journal Article at:

[ https://www.msn.com/en-us/money/markets/why-nvidia-and-other-ai-stocks-have-lost-their-quality-status/ar-AA1RScyj ]