Chewy's 19% YoY Revenue Growth Driven by Expanding Active Customers

Locale: Florida, UNITED STATES

Chewy’s Valuation Amid Intensifying Competition: A 2023 Snapshot

Chewy Inc. has long been a darling of the pet‑e‑commerce sector, celebrated for its razor‑sharp customer experience and its ability to convert a relatively low share of the pet‑care market into a steadily growing stream of revenue. In a recent SeekingAlpha piece titled “Chewy priced for perfection while competition heats up,” the author examines whether the stock’s current valuation is justified in light of both its financial performance and the increasing threat from major competitors such as Amazon, PetSmart, and new entrants that are leveraging advanced logistics networks.

1. Revenue Growth & Customer‑Acquisition Dynamics

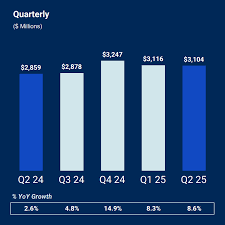

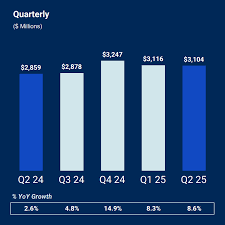

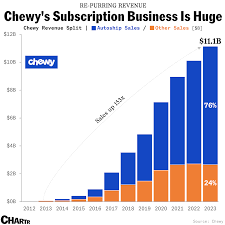

The article opens with Chewy’s 2023 financials. In FY 2023, the company posted revenue of $8.7 billion—a year‑over‑year rise of roughly 19 %. The growth is underpinned by an expanding base of active customers, which grew by ~8 % from 2022 to 2023. Chewy’s subscription‑driven “AutoShip” model is highlighted as a key engine of repeat purchases, delivering a customer lifetime value (CLV) that the company estimates at over $400.

However, the article notes that acquisition costs have been creeping up. Chewy’s marketing and sales expense hit $1.1 billion in 2023—an increase of ~12 % from the previous year. This uptick is partially attributed to the company’s aggressive push into new pet segments (e.g., fish, reptiles) and its efforts to enhance same‑day delivery options in more markets.

2. Margin Profile & Operating Leverage

Chewy’s gross margin sits around 23 %, slightly above the industry average for pure‑play e‑commerce. The SeekingAlpha analysis emphasizes that while the company’s margin is healthy, it has been slowly eroding due to higher freight and fulfillment costs. Net income, on the other hand, remained modest with a net loss of $110 million in 2023—a figure that the author suggests is partly a result of heavy investments in customer‑service infrastructure and data analytics.

The article argues that as revenue scales, Chewy could achieve operating leverage by spreading fixed logistics costs over a larger order volume. Yet, it warns that if the company can’t keep acquisition costs in check, the potential margin upside could be blunted.

3. Cash Flow & Capital Allocation

In its cash‑flow statement, Chewy posted $530 million in operating cash flow, a decline from the $650 million recorded in 2022. The author points out that the reduction was mainly driven by increased working‑capital requirements and higher marketing spend. Nonetheless, Chewy’s free‑cash‑flow (FCF) remains positive, providing room for share repurchases and strategic acquisitions.

A key takeaway from the article is that Chewy’s management has been cautious about capital allocation, preferring to reinvest in technology and fulfillment rather than pursue aggressive buyback programs. This cautious stance is seen as prudent in a market where competition is tightening.

4. Competition Landscape

A core theme of the article is the escalating competition in the pet‑care space. While Amazon’s pet‑care business remains a niche segment, its sheer scale and integrated logistics network pose a long‑term threat. The article cites PetSmart’s recent $1 billion pet‑care business plan—which includes a push into subscription services—as a signal that incumbents are not idle.

Furthermore, the piece references a new entrant, PetHero, which leverages a “direct‑to‑consumer” model that mirrors Chewy’s but claims to have lower overhead due to a lighter footprint of physical warehouses. The author acknowledges that while Chewy’s brand loyalty is a moat, the industry’s low switching cost for consumers could erode that advantage over time.

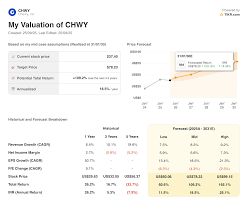

5. Valuation Metrics

The article dissects Chewy’s valuation using a range of multiples:

| Multiple | Chewy | S&P 500 (Pet‑care peers) |

|---|---|---|

| P/E (Trailing) | 33.5x | 28.1x |

| EV/EBITDA | 28.9x | 22.7x |

| P/S (Trailing) | 6.2x | 4.8x |

| P/S (Forward) | 7.1x | 5.6x |

The SeekingAlpha piece argues that, on a forward‑looking basis, Chewy’s multiples are justified given its high revenue growth rate and strong customer‑engagement metrics. Nonetheless, the author warns that if the competitive headwinds intensify or if the company’s growth stalls, the stock could become overvalued.

6. Bottom Line: “Priced for Perfection”?

The article’s title—“Chewy priced for perfection while competition heats up”—is a clever encapsulation of the tension the author sees. On one hand, Chewy’s financials and growth prospects support a premium valuation. On the other, the article suggests that the risk horizon is widening as competitors adopt similar subscription models and aggressive logistics strategies.

Ultimately, the author recommends a cautious hold for investors who are comfortable with a high growth, high‑valuation play. For risk‑averse investors, the article recommends waiting for clearer signals—such as sustained margin improvement or evidence of a competitive edge—before committing more capital.

Key Takeaways

- Revenue is growing at ~19 % YoY and the active‑customer base is expanding.

- Acquisition costs are rising, potentially eating into profitability.

- Margins remain healthy but are under pressure from logistics costs.

- Free cash flow is positive, allowing for strategic reinvestments.

- Competition from Amazon, PetSmart, and new entrants is intensifying.

- Valuation multiples justify a premium today, but the risk of overvaluation increases if growth stalls or margins deteriorate.

For anyone watching Chewy, the story is clear: the company sits on a strong foundation but must navigate a rapidly changing competitive landscape. The SeekingAlpha analysis offers a balanced view—highlighting both the strengths that justify the premium and the threats that could erode it.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850970-chewy-priced-for-perfection-while-competition-heats-up ]