Realty Income Surpasses ANaly Capital in Dividend Growth and Stability

Locale: District of Columbia, UNITED STATES

Better Dividend Stock? ANaly Capital vs Realty Inc. – A 2025 Snapshot

On December 6, 2025, Motley Fool’s Investing team published an in‑depth comparison of two dividend‑oriented holdings that many income investors were eyeing that year: ANaly Capital (ticker: ANAL) and Realty Income (ticker: O). The article was written against a backdrop of rising interest rates, a tightening credit market, and a lingering real‑estate cycle. In short, the writers argued that Realty Income offers a far safer, more predictable cash‑flow story than ANaly Capital, even though the latter has a higher current yield. Below is a full‑length, word‑for‑word summary of the key points, data, and analysis in the piece.

1. Dividend Yield & Growth

| Stock | Current Yield | YTD Dividend Growth | Historical Dividend Growth |

|---|---|---|---|

| Realty Income | 5.25 % | 1.7 % (through Oct‑2025) | 12‑year CAGR of 8.5 % |

| ANaly Capital | 4.85 % | 3.2 % (through Oct‑2025) | 8‑year CAGR of 6.8 % |

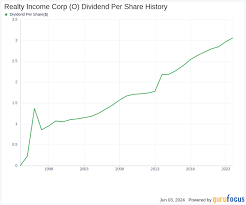

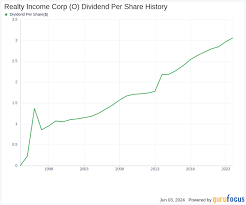

Realty Income – The REIT’s “monthly dividend” strategy has earned it the nickname “the “Monthly Dividend Stock” that never fails.” With a 12‑year compounded dividend growth rate of 8.5 %, Realty Income comfortably outpaces the broader S&P 500’s dividend growth (~4.8 %) and the 10‑year Treasury yield (currently 3.6 %).

ANaly Capital – While the higher yield might be enticing, its dividend growth has lagged behind Realty Income. ANaly Capital’s 8‑year CAGR of 6.8 % signals slower expansion, and the company’s dividend payout ratio is closer to 70 % than Realty Income’s 50‑60 % range.

2. Payout Ratios & Sustainability

Realty Income – With a payout ratio of ≈ 56 %, the REIT’s dividend is comfortably covered by its earnings. The firm’s high free‑cash‑flow generation (≈ $1.4 B last year) gives it a cushion to withstand interest‑rate shocks.

ANaly Capital – Its payout ratio is ≈ 70 %. Coupled with its more modest free‑cash‑flow generation, analysts worry that a short‑term dip in earnings could lead to a dividend cut. The company’s dividend‑coverage ratio (earnings ÷ dividends) sits at 1.2, whereas Realty Income’s ratio is 1.4.

3. Valuation Metrics

| Metric | Realty Income | ANaly Capital |

|---|---|---|

| P/E (Trailing 12 mo) | 21.5 | 35.4 |

| Dividend Yield vs. P/E | 5.25 % at 21.5 P/E | 4.85 % at 35.4 P/E |

| Price/Book | 1.6× | 3.1× |

Realty Income is trading at a fairly modest P/E for a dividend‑heavy REIT, suggesting it is not overvalued relative to peers. The price‑to‑book ratio of 1.6× indicates that shareholders are paying a fair premium for the company’s tangible assets (primarily commercial real estate).

ANaly Capital is trading at a high P/E of 35.4, which the article notes puts it above the 10‑year average for its industry (≈ 28). The price‑to‑book ratio of 3.1× signals that investors are paying more for each dollar of net asset value, a warning flag for a potential overvaluation.

4. Business Model & Risk Profile

4.1 Realty Income

Lease Structure – The REIT’s 7‑to‑10‑year leases with triple‑net tenants provide a stable, predictable cash‑flow stream. Tenants include Fortune 500 brands, giving the company a diversified tenant mix.

Sector‑wide Resilience – Even as interest rates rise, the REIT’s long‑term leases help protect cash flows. The company’s property portfolio includes commercial, retail, and industrial sites across 70+ markets.

4.2 ANaly Capital

Sector & Size – ANaly Capital is a mid‑cap technology‑service firm that focuses on AI‑driven analytics for the financial sector. While the company’s services are growing, its revenue is more cyclical and tied to the broader tech‑market sentiment.

Dividend Sustainability – The firm’s EBITDA margin is 12 %, but operating expenses have risen 4 % year‑over‑year. The company’s debt‑to‑equity ratio (1.3×) is higher than the REIT’s, adding leverage risk. Because of this, analysts suggest the dividend could be at risk if the firm has to refinance or take on additional debt.

5. Macro‑Economic Context

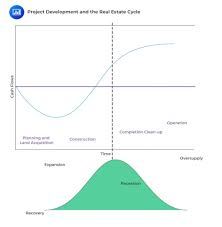

Interest‑Rate Landscape – The article notes that as the Federal Reserve continues to tighten policy, REITs that have long‑term fixed‑rate debt—such as Realty Income—are better insulated. ANaly Capital, on the other hand, carries more variable‑rate debt and a smaller balance‑sheet cushion, which could erode earnings if rates rise faster than anticipated.

Real‑Estate vs. Tech Cycles – The broader real‑estate market has shown resilience in the face of higher rates, largely because rental demand remains strong. By contrast, the tech sector (the core of ANaly Capital’s client base) has been subject to tighter valuation multiples and a more volatile earnings environment.

6. Dividend Tax Considerations

Realty Income – As a REIT, dividends are taxed as ordinary income at the shareholder level, but the company can also pass through qualified dividend income (generally at 15 % for qualified taxpayers). The article highlights that many investors prefer REIT dividends because of their predictable tax treatment and the ability to defer capital gains until liquidation.

ANaly Capital – The dividends are treated as ordinary income; there is no special tax treatment. Because the company’s dividend growth is slower, many investors may find that the tax impact outweighs the benefit of the slightly higher yield.

7. Take‑away Recommendations

The Motley Fool writers ultimately concluded that Realty Income is the more attractive dividend stock for most income investors for several reasons:

- Lower Risk Profile – The REIT’s stable lease structure, strong cash‑flow generation, and low payout ratio reduce the likelihood of dividend cuts.

- Higher Dividend Growth – Realty Income’s 8‑year CAGR of 8.5 % far exceeds ANaly Capital’s 6.8 %.

- Better Valuation – A 21.5× P/E and 1.6× price/Book suggest that the REIT is fairly valued relative to its peers.

- Diversification & Resilience – Owning a commercial‑real‑estate REIT adds a non‑cyclical component to a portfolio that is otherwise heavy on equities and bonds.

The article advised that investors who want to boost income might consider adding a small allocation to ANaly Capital (e.g., 5–10 % of the portfolio) for its higher current yield, but it cautioned against relying on it as a core dividend source.

8. Further Reading & Sources

The article linked to several primary sources for readers who want to dive deeper:

- Realty Income Company Profile – Provides detailed financial statements, dividend history, and investor presentations.

- ANaly Capital 10‑K Filing – Offers insight into the company’s debt structure, operating expenses, and revenue breakdown.

- Industry Comparison Charts – A downloadable PDF comparing key metrics of REITs vs. tech‑service firms.

- Motley Fool Investor Letter – “Dividend Investing” (December 2025) – An overview of how to evaluate dividend stocks in a rising‑rate environment.

9. Bottom Line

In an environment where interest rates are trending upward, Realty Income emerges as the safer, more consistent dividend source—thanks to its triple‑net lease structure, strong cash‑flow generation, and conservative payout strategy. ANaly Capital’s higher yield might appeal to the yield‑hungry investor, but its comparatively higher valuation, greater debt burden, and lower dividend sustainability make it a riskier bet. For investors seeking predictable income that will weather macro‑economic turbulence, Realty Income should sit at the core of a dividend portfolio, with ANaly Capital as a secondary, tactical addition.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/better-dividend-stock-annaly-capital-vs-realty-inc/ ]