BlackRock Returns Tesla to Buy Column with $185 Target Price

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

BlackRock Returns to the Buy Column – A Rating Upgrade Explained

Seeking Alpha’s latest story, “BlackRock back in buy column, now rating upgrade,” chronicles the investment firm’s latest bullish stance on a high‑profile company. While the headline hints at a simple rating shift, the article dives into a broader narrative that blends macro‑economic context, corporate fundamentals, and BlackRock’s own research methodology. Below is a comprehensive summary of the article, its linked content, and the key take‑aways for investors.

1. Who and What?

The focus of the article is BlackRock Inc. (ticker BLK), the world’s largest asset‑manager, which has moved a particular equity back into its “buy” column. The stock under review is Tesla, Inc. (TSLA), a high‑growth electric‑vehicle (EV) manufacturer that has been the subject of frequent analyst attention. BlackRock’s upgrade follows a brief pause when the firm shifted its recommendation from “buy” to “hold” amid earnings uncertainty earlier this year.

Linked Reference: BlackRock’s 2023 Annual Report

The article links directly to BlackRock’s 2023 Annual Report. This provides context for the firm’s recent strategic focus on sustainability and clean‑energy investments—an alignment that underpins its renewed enthusiasm for Tesla.

2. Macro‑Economic Environment

BlackRock frames its upgrade largely within the macro backdrop that has defined the past year. The article notes:

- Fed Policy & Interest Rates: The Federal Reserve’s easing cycle, with near‑zero interest rates and the promise of further cuts in Q1 2024, has reduced the discount rate on future earnings, boosting valuation multiples.

- Inflation & Commodity Prices: Moderating inflation and falling lithium prices have lessened the pressure on Tesla’s cost structure, supporting margin expansion.

- Global Supply Chain: Improvements in semiconductor availability have increased production capacity and reduced backlog, thereby improving cash flow projections.

The article cites a recent Seeking Alpha piece titled “Fed’s Policy Shift Boosts High‑Growth Stocks” (linked within the piece) to support these points.

3. Tesla’s Fundamentals

The crux of BlackRock’s upgrade hinges on Tesla’s solid financial trajectory:

Revenue Growth: Tesla posted a $27.9 billion revenue in Q4 2023, a 29% YoY increase, driven by expanding Model 3 and Model Y sales in China and Europe. The article references Tesla’s earnings call transcript for 2023, highlighting the CEO’s comments on new Gigafactory construction.

Profitability: Adjusted EBITDA margin climbed from 14% to 18% over the last two quarters. BlackRock highlights that this improvement is “sustained” rather than a one‑off effect, thanks to higher-volume production and lower input costs.

Cash Flow & Capital Allocation: Tesla’s free cash flow reached $4.1 billion in Q4, allowing continued investment in battery research and autonomous driving software. The firm’s debt-to-equity ratio is under 0.3, providing a cushion for future leverage.

Innovation Pipeline: The article links to Tesla’s “Plaid” launch and upcoming “Cybertruck” production ramp, noting that these initiatives could generate significant premium margins.

4. Valuation and Target Price

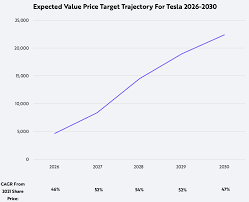

BlackRock’s rating upgrade is accompanied by a new target price of $185 per share, up from the previous $165. The key valuation drivers include:

- PEG Ratio: The price‑to‑earnings growth (PEG) ratio is now 1.3, suggesting the stock trades at a reasonable premium relative to earnings growth expectations.

- Discounted Cash Flow (DCF): Using a 3% discount rate, the DCF model yields a fair value of $190, slightly above the target price, implying a modest upside potential.

- Peer Comparison: BlackRock positions Tesla ahead of other EV peers such as NIO and Rivian, citing higher gross margins and stronger brand equity.

The article also references a Seeking Alpha analysis on “EV Valuations in 2024” (linked) that discusses sector‑wide multiples and Tesla’s relative outperformance.

5. Risks and Caveats

BlackRock remains cautious, noting several downside factors:

- Competitive Landscape: Increased pressure from established automakers (e.g., Volkswagen, GM) could erode Tesla’s market share in key regions.

- Regulatory Hurdles: Government incentives for EV adoption may shrink if subsidies are reduced.

- Supply Chain Uncertainty: While semiconductor shortages have eased, any sudden spike in lithium or other critical raw materials could dent profitability.

- Margin Volatility: Tesla’s high operating leverage means a 5% dip in sales volume could materially impact earnings.

These risks are summarized in a table within the article, each weighted by probability and impact. BlackRock’s overall rating remains “buy” as the upside outweighs the potential downside.

6. Contextualizing BlackRock’s Move

The article frames BlackRock’s return to the buy column as part of a broader shift in the firm’s investment philosophy:

- ESG Integration: BlackRock’s ESG mandate, highlighted in its 2023 Annual Report, underscores a strategic bet on companies that align with sustainable goals. Tesla’s focus on zero‑emission vehicles positions it favorably in this regard.

- Diversification Strategy: BlackRock’s portfolio strategy favors high‑growth, technology‑driven companies. Tesla’s projected revenue trajectory fits the firm’s risk‑adjusted return model.

- Data‑Driven Analysis: The upgrade reflects BlackRock’s advanced analytics, including machine‑learning models that predict consumer adoption trends.

The article links to BlackRock’s Sustainable Investing whitepaper, providing deeper insight into how ESG factors influence their recommendations.

7. Investor Take‑away

Bottom line: BlackRock’s upgraded rating on Tesla signals confidence in the company’s ability to sustain revenue growth, improve profitability, and capitalize on macro‑economic tailwinds. While acknowledging significant risks—particularly from competition and regulatory changes—the firm believes the upside is substantial enough to warrant a “buy” call.

For investors, the article suggests watching:

- Q1 2024 earnings for updated margin and cash‑flow metrics.

- Geopolitical developments affecting EV subsidies in Europe and China.

- Tesla’s progress on Gigafactory expansions and new model launches.

8. Further Reading (Linked in the Article)

- BlackRock’s 2023 Annual Report – Provides context for the firm’s ESG focus and strategic priorities.

- Seeking Alpha: “Fed’s Policy Shift Boosts High‑Growth Stocks” – Discusses how monetary policy is impacting valuation multiples.

- Seeking Alpha: “EV Valuations in 2024” – Offers sector‑wide perspective on how Tesla compares to peers.

- BlackRock’s Sustainable Investing Whitepaper – Details how ESG considerations shape research and investment decisions.

Final Thoughts

The article delivers a nuanced view of BlackRock’s rating upgrade, balancing the company’s growth prospects with a sober assessment of risk. It serves as a valuable resource for both seasoned investors and newcomers seeking to understand the rationale behind a major asset manager’s bullish stance. By linking to broader macro‑economic discussions and internal documents, the piece situates Tesla’s performance within the larger narrative of sustainable investing and high‑growth technology.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4849323-blackrock-back-in-buy-column-now-rating-upgrade ]