Three Dividend-Yield Powerhouses to Add to Your Portfolio Right Now

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Three Dividend‑Yield Powerhouses to Add to Your Portfolio Right Now

In an era where market volatility and inflationary pressures keep many investors uneasy, The Motley Fool’s recent piece “3 No‑Brainer Dividend Stocks to Buy Right Now” (published 7 Dec 2025) offers a clear, data‑driven roadmap for those who want a steady stream of income without sacrificing growth. The article zeroes in on three well‑established companies that combine a high, sustainable yield with strong fundamentals, making them “no‑brainers” for both new and seasoned dividend investors.

Why Focus on Dividend Stocks?

Before diving into the specific names, the article lays out the case for dividend investing. Key points include:

| Benefit | Explanation |

|---|---|

| Regular Income | Dividends provide a predictable cash flow that can be reinvested or used as living expenses. |

| Defensive Nature | Companies that pay dividends tend to be mature, cash‑rich, and less sensitive to economic cycles. |

| Tax Efficiency | Qualified dividends are taxed at a lower rate than ordinary income in most jurisdictions. |

| Historical Performance | Dividend‑yielding stocks historically outperform many growth‑only peers over long horizons. |

The author also notes that a healthy dividend isn’t just about the current payout; it’s about sustainability. That leads to the article’s core criteria for selecting the “no‑brainers”: high yield, low payout ratio, strong free cash flow, and a track record of dividend growth.

1. Procter & Gamble (PG)

Why PG?

PG is the quintessential dividend aristocrat—over 60 consecutive years of dividend hikes. The article highlights its “steady consumer staple” model: from everyday household brands like Tide and Pampers to premium lines such as Olay, PG’s revenue streams are insulated from economic downturns.

Key Metrics (as of Q4‑2025):

- Dividend Yield: 2.8 % (2025 average).

- Payout Ratio: 49 % – comfortably below the 60‑70 % range many dividend analysts caution against.

- Free‑Cash‑Flow Yield: 4.6 % – indicating ample cash to sustain and grow dividends.

- Dividend Growth Rate (5‑yr): 4.2 % CAGR.

Risk Factors Discussed:

The article warns about potential supply‑chain disruptions and rising raw‑material costs that could squeeze margins. However, PG’s pricing power and global distribution network mitigate these risks.

Follow‑Up Links:

Readers are directed to a Motley Fool analysis on “Dividend Aristocrats” and a detailed earnings call transcript where PG’s CFO discusses cash‑generation strategies.

2. American Tower Corporation (AMT)

Why AMT?

A real‑estate investment trust (REIT) that owns cell‑tower infrastructure across North America and Latin America, AMT combines the high yields typical of REITs with a stable lease structure. The article notes that AMT’s 99‑year leases and diversified tenant mix (telecom giants, independent carriers) provide a “lock‑in” of revenue for decades.

Key Metrics:

- Dividend Yield: 5.3 % (2025).

- Payout Ratio: 89 % – high, but REITs are required to distribute 90 %+ of taxable income.

- Net Operating Income (NOI) Growth: 6.5 % YoY in 2025.

- Debt‑to‑Equity: 1.1 – manageable given the strong cash flows.

Risk Factors Discussed:

Regulatory changes around 5G rollouts and potential over‑capacity in certain markets. Yet, AMT’s diversified geography helps cushion local regulatory risks.

Follow‑Up Links:

The article references a Motley Fool piece on “Why REITs Are a Dividend Investment’s Best Friend” and a 2025 earnings presentation where AMT’s CEO outlines future acquisition plans.

3. Johnson & Johnson (JNJ)

Why JNJ?

A diversified healthcare conglomerate with a triple‑dividend‑aristocrat track record. The company’s product mix—pharmaceuticals, medical devices, and consumer health—offers multiple revenue streams, each with strong pricing power and global demand.

Key Metrics:

- Dividend Yield: 2.6 % (2025).

- Payout Ratio: 53 % – balanced between growth and income.

- Free‑Cash‑Flow Yield: 4.0 % – robust enough to sustain dividend hikes.

- R&D Spend: 10.5 % of sales – reinforcing long‑term growth prospects.

Risk Factors Discussed:

Potential legal exposure from product liability and patent expirations. The article notes that JNJ’s diverse portfolio and deep cash reserves help manage such uncertainties.

Follow‑Up Links:

Readers are linked to a Motley Fool article on “Healthcare Dividend Stocks: The Low‑Risk, High‑Reward Option” and an analyst report summarizing JNJ’s pipeline of upcoming drug approvals.

How to Deploy These Stocks

The article advises that while each of the three stocks has its own merits, a balanced approach can mitigate sector‑specific risks. The author suggests a 40/30/30 split: 40 % in PG, 30 % in AMT, and 30 % in JNJ, but stresses that the exact allocation should be adjusted based on an individual’s risk tolerance, income needs, and overall portfolio size.

Reinvestment Strategy:

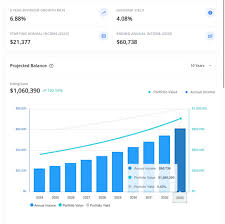

Reinvesting dividends through a Dividend Reinvestment Plan (DRIP) can accelerate growth. The author links to a Motley Fool guide on setting up DRIPs for each of the three companies.

Tax Considerations:

Qualified dividends benefit from lower tax rates. For investors in high‑tax brackets, placing these stocks in a tax‑advantaged account (e.g., an IRA) can preserve more of the yield.

Bottom Line

“The 3 No‑Brainer Dividend Stocks to Buy Right Now” argues that these three names—PG, AMT, and JNJ—combine the classic attributes of a dividend investment: high, sustainable yield, low payout ratio, and a history of dividend growth. Together, they offer a defensive, income‑generating portfolio that can withstand the next recessionary cycle, all while continuing to grow over time.

Takeaway for Investors:

If you’re looking for a “set‑and‑forget” portfolio that produces consistent income and has built‑in resilience, these three stocks warrant serious consideration. They’re not just “good buys”; the article claims they’re “no‑brainers.” As always, perform your own due diligence, but you’ll find that the data backing this recommendation is as solid as the companies’ own balance sheets.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/3-no-brainer-dividend-stocks-to-buy-right-now/ ]