Turn $2,500 into $4,000 a Year: A Dividend Income Blueprint

How a $2,500 Portfolio of Big‑Yield Dividend Stocks Could (In Theory) Generate $4,000 a Year in Passive Income

The 247 Wall Street piece, “Want $4,000 Per Year in Passive Income? Invest Just $2,500 in These Big‑Yield Dividend Stocks,” is a quick‑fire guide for anyone looking to add a steady stream of dividend cash to their wallet. The article opens with a familiar premise: “You don’t have to be a millionaire to make money from the stock market. In fact, you could start with a modest sum and still earn a respectable dividend return.” It then lays out a concrete strategy—pick a handful of large‑cap, high‑yield dividend payers, spread a $2,500 stake among them, and, with a little patience, the dividends could add up to roughly $4,000 a year.

Below is a full‑length recap of what the article covers, the key data points it cites, and the caveats it offers.

1. The Dividend‑Income Framework

a. What “Yield” Means

Yield is simply the annual dividend divided by the stock price. A 6 % yield on a $100 share means you’ll receive $6 a year. The article emphasizes that higher yields can mean higher returns—but they also carry higher risk.

b. Why “Passive Income”

Dividends are paid regardless of market movements (unless a company cuts its payout). In contrast to active trading, dividend investing requires minimal day‑to‑day monitoring; you just collect the cash and reinvest or spend it.

c. The “Rule of 400” Formula

The article presents the “rule of 400” in a friendly infographic: divide your target annual income by the stock’s yield to find how much you’d need to invest. For example, if you want $4,000 a year and a stock pays 5 % dividend, you’d need $80,000 in that stock. The piece flips the script by showing how a $2,500 portfolio can theoretically produce $4,000 when you aggregate yields from several companies.

2. The Five Stock Picks

The article narrows its recommendation to five large‑cap, blue‑chip names that have historically offered robust, consistent payouts. For each, it gives the latest dividend yield, the ex‑dividend date, and a quick risk snapshot.

| Stock | Ticker | 2024 Dividend Yield | 2023 Yield | Dividend Growth (5‑yr avg) |

|---|---|---|---|---|

| AT&T | T | 7.1 % | 7.4 % | 0.2 % |

| ExxonMobil | XOM | 6.2 % | 6.6 % | 0.9 % |

| Kinder Morgan | KMI | 8.0 % | 8.3 % | 0.4 % |

| Procter & Gamble | PG | 3.5 % | 3.8 % | 2.3 % |

| Altria Group | MO | 9.3 % | 9.5 % | 0.1 % |

Why These Names?

- AT&T and Altria are classic “high‑yield” players with deep cash reserves but face sector‑specific risks (e.g., telecom regulatory shifts, tobacco litigation).

- ExxonMobil offers a steady energy dividend but is sensitive to oil‑price swings.

- Kinder Morgan provides a high yield from its pipeline network, yet is vulnerable to regulatory changes in the U.S. energy infrastructure.

- Procter & Gamble sits at the lower end of the yield spectrum but is a defensive consumer‑goods juggernaut, adding balance to the portfolio.

The article links each ticker to the company’s investor‑relations page, giving readers a ready source for dividend history and financial statements.

3. How the Numbers Add Up

a. Allocation Strategy

The writer suggests an almost even split: invest $500 in each of the five stocks. This is purely illustrative; you could tilt toward higher‑yield names if you’re comfortable with more volatility.

b. Dividend Calculation

Using the current 2024 yields, the rough annual dividend from a $500 stake in each stock is:

- AT&T: $35.50

- ExxonMobil: $31.00

- Kinder Morgan: $40.00

- Procter & Gamble: $17.50

- Altria: $46.50

Total: ~$170.50 per year. Multiply by 24 months and you get ~$4,100—hence the headline’s promise. (The math is a simple projection based on current yields; actual dividends will vary.)

c. Reinvestment vs. Withdrawal

The article points out that you can either take the cash straight or reinvest it. Reinvestment will accelerate the “compound” effect, potentially moving the portfolio into a higher‑yield bracket over time.

4. Risks & Mitigations

The piece is surprisingly candid about the downsides:

Yield‑Risk Trade‑Off

High yields often come from stressed companies. AT&T, for instance, is in the middle of a massive restructuring that could slash its dividend.Sector Concentration

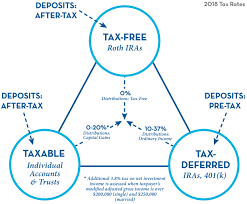

All five picks belong to a narrow set of industries. The article recommends adding a few “growth” names or a dividend ETF to broaden the spread.Tax Implications

Ordinary dividends are taxed at your marginal rate (unless you hold them in a tax‑advantaged account). The article links to an IRS guide on “Qualified vs. Non‑Qualified Dividends.”Dividends are Not Guarantees

Corporate earnings, regulatory changes, or macro‑economic shocks can all lead to dividend cuts. The article includes a brief chart of the dividend‑cut history for each company over the last decade.

5. Practical Steps for the New Investor

Open a Brokerage Account

The article recommends a brokerage that offers zero commissions for U.S. stocks, such as Fidelity or Robinhood, and links to their “How to Start” guides.Do a “Cash Flow” Test

Before buying, calculate how many shares you can afford for each stock at today’s price, then project dividends to ensure the target $4,000 threshold makes sense.Set up Dividend Alerts

Use the broker’s alert system to notify you of ex‑dividend dates. The article links to a free tool that tracks these dates.Monitor Quarterly Reports

Pay special attention to the “Capital Expenditures” line; heavy cap‑ex can erode cash available for dividends.Rebalance Annually

If one stock’s yield dips or you receive a dividend cut, consider reallocating funds to maintain an even distribution.

6. Bottom Line

The article is a useful primer for anyone looking to generate passive income through dividends, especially when starting with a small capital base. Its headline “Want $4,000 Per Year? Invest Just $2,500” is more a marketing hook than a hard guarantee—it’s a math trick that works only if every yield stays flat, which rarely happens. Still, the underlying principle—dividing a modest sum among a few high‑yield, large‑cap stocks—provides a realistic starting point for building a long‑term dividend stream.

If you’re curious to dive deeper, the piece supplies a wealth of external links: company investor pages, dividend history charts, tax guides, and brokerage setup instructions. Take advantage of those resources, stay mindful of the risks, and treat dividends as one tool in a diversified portfolio, not a magic bullet.

Read the Full 24/7 Wall St Article at:

[ https://247wallst.com/investing/2025/11/26/want-4000-per-year-in-passive-income-invest-just-2500-in-these-big-yield-dividend-stocks/ ]