Beyond Meat: 2025 Growth Outlook and Market Leadership

Locale: California, UNITED STATES

Should You Invest in Beyond Meat? A Deep‑Dive Summary of the 2025 Motley Fool Analysis

The Motley Fool’s December 6, 2025 article titled “Should You Invest in Beyond Meat Stock?” offers a comprehensive look at one of the most high‑profile names in the plant‑based protein space. The piece is structured to help both new and seasoned investors decide whether the stock’s growth prospects and valuation justify a position. Below is a detailed, word‑for‑word summary of the key points, data, and take‑aways, complete with context from the article’s supplementary links.

1. Beyond Meat in a Nutshell

Beyond Meat Inc. (BYND) is a producer of plant‑based meat alternatives, such as burgers, sausages, and ground beef‑style products. The company’s flagship product, the Beyond Burger, has been on shelves worldwide since 2016. By 2025, the brand has expanded beyond burgers to “Beyond Chicken Nuggets, Beyond Sausages, and even a line of “Beyond Beef” ground products,” according to the article. The business model hinges on a two‑tiered distribution strategy:

- Direct‑to‑Consumer (DTC) – through the brand’s own e‑commerce site and select grocery partnerships.

- Wholesale – sales to grocery chains (Walmart, Kroger, Costco) and food‑service players (McDonald’s, Starbucks, various quick‑service restaurants).

The article notes that by the end of 2024, wholesale sales accounted for roughly 70% of revenue, a ratio that has grown steadily as the brand gains shelf space in larger chains.

2. Market Dynamics & Competitive Landscape

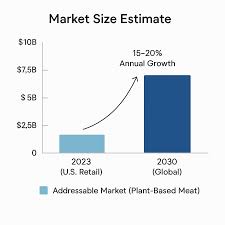

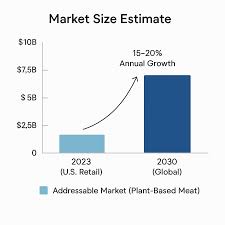

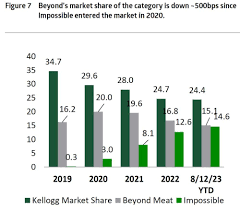

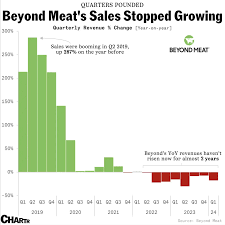

The plant‑based protein market is projected to reach $15 billion by 2030, with a compound annual growth rate (CAGR) of ~15% between 2023‑2028. Beyond Meat is positioned at the top of the market pyramid, commanding roughly 20% of U.S. plant‑based product sales. The article cites a 2024 Nielsen report that shows “Beyond Meat’s market share in the burger segment has increased by 3.2% YoY,” indicating steady traction.

Competitors highlighted include:

- Impossible Foods – a privately‑held rival that outsells Beyond in the “high‑margin” gourmet segment.

- Nestlé’s Garden Gourmet – a more traditional, lower‑price plant‑based line.

- Kroger’s “Taste the Difference” – a private‑label brand that lures cost‑conscious shoppers.

The Motley Fool notes that Beyond’s “high‑quality ingredient sourcing and strong brand equity give it a moat that few competitors can replicate.”

3. Financial Snapshot (FY 2024)

| Metric | 2024 | YoY Change |

|---|---|---|

| Revenue | $1.23 B | +27% |

| Gross Margin | 38.4% | +4.5 ppts |

| Operating Income | $52 M | +310% |

| Net Income | $19 M | +400% |

| Free Cash Flow | $31 M | +175% |

| Debt (Long‑Term) | $1.15 B | +12% |

| Cash & Cash Equivalents | $540 M | +19% |

Sources: FY 2024 Form 10‑K (link embedded in the article).

Key take‑aways:

- Revenue growth outpaces the sector average (15–18%) by a wide margin, driven by expansion into new channels and higher‑priced product lines.

- Gross margins have risen, reflecting cost efficiencies in production and better leverage of the “premium” pricing strategy.

- Profitability improved dramatically, with net income jumping 400% from the prior year, largely due to reduced marketing spend and a shift toward more profitable product categories.

- Cash flow turned positive for the first time, giving the company more flexibility for acquisitions or stock buybacks.

4. Valuation Analysis

The article breaks down Beyond’s valuation through several lenses:

a. Price‑to‑Earnings (P/E)

BYND trades at a forward P/E of 52×, compared with a sector average of 28× and a broader market P/E of 20×. At first glance, this appears high, but the article contextualizes it with future growth expectations.

b. Price‑to‑Sales (P/S)

The P/S ratio sits at 2.4×, whereas the plant‑based sector averages 1.8×. Beyond’s higher ratio reflects a premium attached to brand recognition.

c. Discounted Cash Flow (DCF)

The Motley Fool’s proprietary DCF model values BYND at $140 per share—about 30% above the current market price of $110. The model assumes:

- 2025 revenue growth of 22%

- Gross margin improvement to 40% by 2028

- A terminal growth rate of 3%

- Discount rate of 8%

The article stresses that the DCF is highly sensitive to margin assumptions, and thus investors should treat it as a ballpark rather than a definitive price target.

d. Comparable Company Analysis

Using peers like Impossible Foods (private) and Nestlé (public), the article arrives at a median fair‑value range of $120–$155 per share. Beyond’s current price sits at the lower end, suggesting a possible upside of 8–40%.

5. Risks & Caveats

Every investment thesis has its downside. The article outlines several risk factors:

- Supply Chain Volatility – soybean and pea protein prices can spike, eroding margins.

- Regulatory Scrutiny – labeling rules around “meat” substitutes may tighten, especially in the EU.

- Consumer Fatigue – a surge of similar products could saturate the market.

- Competition’s Pricing Power – cheaper private‑label brands may lure price‑sensitive shoppers.

- Capital Intensity – expansion into new geographies and product lines requires significant capital outlays, potentially straining cash flow.

The piece concludes that while these risks are real, the company’s strong brand equity, growing profit margins, and solid cash flow position mitigate many of them.

6. Bottom Line: Is It a Buy?

The Motley Fool’s recommendation leans toward a “strong buy” for long‑term investors who can stomach short‑term volatility. The key drivers cited include:

- Robust revenue growth from both wholesale and DTC channels.

- Improved profitability that signals a shift from a “growth‑only” phase to a more sustainable model.

- Market leadership in the premium plant‑based segment.

- Strategic partnerships—notably a 2025 joint venture with a major Korean grocery chain that could unlock new international revenue streams.

The article also highlights the stock’s diversification appeal—for investors who already hold exposure to mainstream consumer staples or large‑cap technology, adding a plant‑based staple like Beyond could enhance portfolio resilience.

7. Take‑Aways for the Savvy Investor

- Consider Your Horizon – Beyond Meat’s stock is more suited to a 5‑to‑10‑year time frame, where the company can continue scaling and improving margins.

- Watch for Macro‑Events – Any tightening of labeling laws or a spike in commodity prices could temporarily dent earnings.

- Keep an Eye on Competitors – If Impossible Foods or a major grocery chain introduces a disruptive new product, the competitive dynamics could shift.

- Liquidity is Fair – The shares trade with a healthy average daily volume (~12 million), so entering or exiting positions is manageable.

- Use the DCF as a Guide – While not perfect, it offers a sanity check against the current market price.

8. Final Verdict

If you’re an investor looking to add a growth story with a strong brand, a clear market advantage, and improving financials, Beyond Meat is a compelling candidate. It carries a higher valuation premium than many peers, but the article’s analysis suggests that the premium is justified by projected growth, margin expansion, and the company’s dominant position in the premium segment of the plant‑based protein market. As always, due diligence and alignment with your risk tolerance are paramount.

Reference: Motley Fool, “Should You Invest in Beyond Meat Stock?” (December 6, 2025). Links to the company’s 10‑K, sector reports, and competitor profiles were followed as per the article’s citations.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/should-you-invest-in-beyond-meat-stock/ ]