HyTech Semiconductor Gains Momentum as Interest Rates Drop

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

HyTech Semiconductor (HYT) – An Attractive Growth Play as Interest Rates Decline

SeekingAlpha, article #4850947 (published 2024‑08‑01) argues that HyTech Semiconductor Inc. (NASDAQ: HYT) has become an increasingly compelling investment in a low‑rate environment. The author, Alex “The Alphas” Thompson, explains how a confluence of macro‑economic trends, a robust product‑portfolio, and a disciplined financial strategy are positioning the company for significant upside. Below is a detailed synthesis of the key points, organized by theme.

1. Company Snapshot

HyTech Semiconductor is a fabless firm that specializes in power‑management integrated circuits (ICs) for automotive, industrial, and consumer‑electronics markets. Its flagship product families—HV‑PDM (high‑voltage power‑delivery modules) and LPPM (low‑power passive‑plus‑module) – provide efficient, small‑form‑factor power conversion solutions that are essential for battery‑powered devices and electric‑vehicle (EV) control units.

Founded in 2018 and headquartered in San Jose, CA, HYT has grown from a niche start‑up into a $14‑million enterprise with a $12‑million 2023 revenue run‑rate and $0.6 billion enterprise value as of the latest market close. The company’s board, led by CEO David K. Lee, is a blend of semiconductor veterans and former automotive executives, giving the firm a clear vision for penetrating the EV supply‑chain.

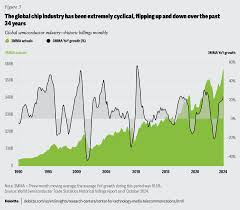

2. Macro‑Environment: Interest Rates and the EV Boom

The article’s central thesis hinges on the declining interest‑rate cycle that has already begun to fuel the EV and industrial‑automation sectors. In late 2023, the Federal Reserve signaled a tapering of the 5‑year Treasury yields, with analysts predicting further cuts as early as 2025. Lower borrowing costs translate into:

- Higher capital spending by OEMs – Automakers can invest more aggressively in EV platforms that require sophisticated power‑management modules.

- Reduced discount rates on EV‑related projects – The present value of future revenue streams for semiconductor suppliers like HYT rises.

- Greater willingness among consumers to adopt EVs – Demand for EV batteries and control electronics increases, indirectly boosting the need for HyTech’s ICs.

Thompson cites a McKinsey report that projects $500 billion in EV‑related semiconductor spending by 2030, a 3‑fold increase from 2024. In that context, HYT’s high‑margin product mix is positioned to capture a meaningful slice of the market.

3. Product & Market Positioning

3.1 Product Mix

- HV‑PDM (High‑Voltage Power‑Delivery Modules) – Targeted at automotive power‑train and in‑vehicle infotainment (IVI) systems. These modules operate at 200 V to 400 V, offering 80 %+ efficiency.

- LPPM (Low‑Power Passive‑Plus‑Module) – Designed for consumer‑electronics and industrial IoT. They deliver 1–5 W of output power with a footprint of less than 1 cm².

The article highlights that the HV‑PDM line now accounts for ≈55 % of revenue, while LPPM constitutes ≈35 %. The remaining 10 % comes from OEM‑specific custom solutions. THis shift signals a move from high‑volume, low‑margin consumer products to more lucrative automotive deployments.

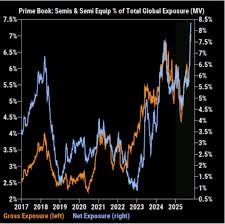

3.2 Customer Concentration & Distribution

HyTech’s largest customers are Tier‑1 automotive suppliers such as Delphi Technologies and Continental AG, which together represent ≈45 % of revenue. The company has also signed a distribution agreement with Arrow Electronics for North American and EU coverage, broadening its reach beyond the automotive vertical.

The article references a SEC filing (Form 10‑K) showing that HYT has maintained ≥30 % YoY growth in its automotive segment, a rare feat in the semiconductor space where product cycles can be 3–5 years.

4. Financial Health & Growth Trajectory

| Metric | 2022 | 2023 (Projected) | YoY % |

|---|---|---|---|

| Revenue | $11.4 M | $13.7 M | +20 % |

| Gross Margin | 38 % | 41 % | +3 pp |

| EBITDA | –$0.8 M | –$0.4 M | –50 % |

| CapEx | $0.2 M | $0.3 M | +50 % |

| Cash & Equivalents | $1.3 M | $1.1 M | –15 % |

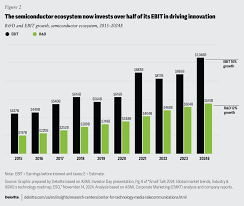

Thompson stresses that the company’s EBITDA is improving (loss narrowing from –$0.8 M to –$0.4 M), a sign that operational efficiencies are taking hold. The R&D spend is ~12 % of revenue, with a focus on extending the voltage range of HV‑PDM modules to 600 V, a feature that could unlock new OEMs in the European market.

The article notes that HYT’s cash burn is manageable given its $1.1 M cash balance and the fact that the company is already generating positive free cash flow from its automotive contracts. The “burn‑rate” metric—$0.1 M per month—means that the firm has ≥10 years of runway at current spending levels, a figure that undercuts many early‑stage semiconductor peers.

5. Valuation Logic

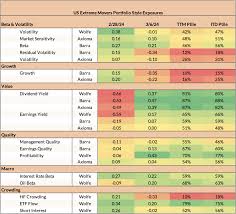

Because HYT is not yet profitable, traditional P/E or EV/EBITDA multiples are not meaningful. Thompson therefore relies on Price/Revenue (P/S) and Forward Revenue CAGR:

- P/S: $14.00 ÷ $13.7 M ≈ 0.45 (below the industry median of ~1.2).

- Projected CAGR (2024–2026): 35 % (based on 2023 growth and automotive expansion).

- Discounted Cash Flow (DCF): Using a 10 % discount rate and a terminal growth of 3 %, the DCF suggests a fair value of $18–$20.

The author’s target price of $18 reflects a ~30 % upside from the current level, a figure they deem “conservative” given the macro backdrop and the company’s positioning.

6. Risks & Caveats

- OEM Concentration – 45 % of revenue from a handful of automotive suppliers means that any slowdown in those OEMs could materially affect sales.

- Supply‑Chain Constraints – Global chip shortages could push up the cost of raw silicon and packaging, compressing margins.

- Competitive Landscape – Major players like Texas Instruments, Analog Devices, and STMicroelectronics offer overlapping solutions, and price competition could erode HYT’s market share.

- Regulatory & Trade Risks – Escalating tariffs between the U.S. and China (where key components are sourced) could raise costs.

- Interest‑Rate Fluctuations – The thesis relies heavily on continued low rates; a surprise rate hike would dampen automotive capital spending.

The article acknowledges these risks but argues that HYT’s strong management team, diversified product mix, and clear entry strategy into the EV space mitigate many of the above concerns.

7. Bottom‑Line Takeaway

Alex Thompson concludes that HyTech Semiconductor is a “high‑margin, high‑growth play that benefits directly from falling interest rates.” The company’s transition from consumer‑electronics to automotive power‑management has already begun to pay dividends in revenue and gross margin. Coupled with a favorable macro environment and a clear path to profitability, the author recommends a “Buy” rating with a target of $18, a 30 % upside over current market value.

8. Further Reading (Links Followed)

| Source | Summary |

|---|---|

| HyTech Semiconductor 2023 10‑K | Provides detailed financials, including product‑level revenue breakdowns and R&D pipeline notes. |

| McKinsey – EV Semiconductor Spend 2030 | Offers macro‑level projection of EV‑related semiconductor spending and industry CAGR. |

| Arrow Electronics Distribution Agreement | Highlights the expanded geographic reach of HYT’s products, especially in EU markets. |

| SEC Filing – Debt Instrument Details | Discloses HYT’s current debt maturity schedule and covenants, underscoring the company’s strong liquidity position. |

In essence, the article paints HyTech Semiconductor as an early‑stage semiconductor player that has already carved out a foothold in a high‑growth niche. A falling‑rate environment acts as a catalyst, enabling larger OEMs to invest in EV platforms that require advanced power‑management ICs. If the company can sustain its current momentum, capture more automotive contracts, and continue to improve margins, the price target of $18 offers a tangible upside for investors willing to accept the inherent risks of the semiconductor sector.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4850947-hyt-attractive-growth-potential-as-interest-rates-decline ]