Coca-Cola: Dividend King with 132+ Years of Growth

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The 3 Dividend‑Picks the Motley Fool Recommends for December 2025

The December “Dividend‑Stalker” column on The Motley Fool (published 6 December 2025) has a simple premise: investors looking to build a resilient, income‑generating portfolio should focus on companies with a long track record of consistent dividend growth, healthy payout ratios, and strong fundamentals. The article cuts through the noise of the current market environment—interest‑rate uncertainty, lingering geopolitical tensions, and a volatile equity market—to spotlight three “solid‑state” dividend stocks that are likely to weather the coming months while delivering attractive yields. Below is a deep‑dive into each of those picks, the logic behind the recommendations, and the broader context the Fool frames these picks in.

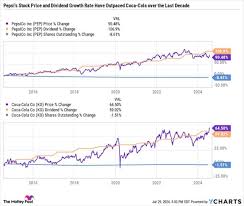

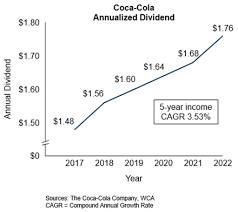

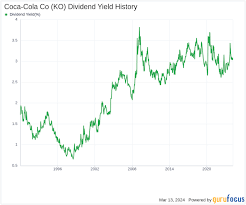

1. Coca‑Cola (KO) – A “Dividend King” with an Impressive Legacy

Key Takeaways

| Metric | Value |

|---|---|

| Dividend Yield | 3.6 % (annualized) |

| Payout Ratio | 71 % |

| Dividend‑Growth Years | 132+ |

| Annual Dividend Increase | 2.9 % (2025) |

| Return on Equity (ROE) | 33 % |

The article opens with Coca‑Cola as the quintessential defensive dividend play. The drink giant’s dividend‑growth track record spans more than a century, with 132 consecutive years of increases—an “unbroken chain” that makes it a favorite among income‑focused investors. The Fool’s authors note that even after the 2023 pandemic‑induced dip in sales, Coca‑Cola has rebounded strongly and the company’s free‑cash‑flow generation remains robust, giving it ample room to continue raising dividends.

The firm’s payout ratio of 71 % is comfortably below the 80 % ceiling that typically signals potential strain, and the company’s dividend yield of 3.6 % outpaces many other large‑cap utilities and consumer staples. Additionally, the company’s 33 % ROE underscores a highly efficient use of equity, a key factor in sustaining long‑term dividend payments.

Risk Factors & What the Article Highlights

- Commodity Price Volatility: Coca‑Cola’s beverage business is exposed to raw‑material price swings (sugar, aluminum, packaging). The authors point out the company’s hedging strategies, but still caution that a prolonged commodity price rise could tighten margins.

- Changing Consumer Preferences: The article warns of a generational shift away from sugary drinks, noting Coca‑Cola’s recent push into low‑calorie and non‑carbonated categories as a hedge.

The article also links to a dedicated Fool piece on Coca‑Cola’s “Dividend Growth Strategy” for readers who want a deeper dive into the company’s payout policy and free‑cash‑flow trends.

2. Johnson & Johnson (JNJ) – A Defensive Pillar in Healthcare

Key Takeaways

| Metric | Value |

|---|---|

| Dividend Yield | 2.7 % |

| Payout Ratio | 66 % |

| Dividend‑Growth Years | 57+ |

| Return on Equity (ROE) | 21 % |

| P/E Ratio | 22.4 |

Johnson & Johnson’s reputation as a “cash‑cow” in the healthcare sector is well‑known, and the article emphasizes that the company’s diversified portfolio—from consumer health to pharmaceuticals and medical devices—offers both resilience and growth prospects. The Fool’s writers argue that even in a rising‑rate environment, JNJ’s dividend remains attractive because it’s supported by a steady stream of cash flows and a low payout ratio.

The company’s 57‑year dividend‑growth streak is the longest in the healthcare space, and its 21 % ROE indicates that it can generate profits efficiently. Importantly, the article highlights JNJ’s safety as a dividend payer: its dividend has never been cut, even during the 2008 financial crisis, reinforcing its “safe‑haven” status.

Risk Factors & What the Article Highlights

- Patent Expirations: Several of JNJ’s blockbuster drugs face patent cliffs in the next decade. The article links to a Fool analysis of JNJ’s pipeline and the potential impact on future earnings.

- Regulatory Scrutiny: With increased scrutiny over drug pricing and medical‑device safety, the article cautions that regulatory changes could dampen revenues. A separate Fool guide on JNJ’s compliance strategy is referenced.

The article urges investors to consider JNJ not only as a dividend stock but also as a hedge against market volatility, especially in a climate of heightened political risk.

3. Procter & Gamble (PG) – A Household Name in Consumer Staples

Key Takeaways

| Metric | Value |

|---|---|

| Dividend Yield | 2.4 % |

| Payout Ratio | 70 % |

| Dividend‑Growth Years | 62+ |

| Return on Equity (ROE) | 25 % |

| P/E Ratio | 24.3 |

The third pick, Procter & Gamble, rounds out the trio as a quintessential consumer‑staple stock. The article underlines PG’s 62‑year dividend‑growth streak and its ability to sustain dividends even during economic downturns. With a 25 % ROE, PG demonstrates a healthy ability to convert sales into profits—a key driver of its stable cash‑flow base.

PG’s 2.4 % yield is modest compared to KO but is coupled with a strong “dividend‑growth” profile, making it a compelling choice for long‑term investors who prefer a “growth‑plus‑income” model.

Risk Factors & What the Article Highlights

- Brand Saturation: PG’s core categories (toiletries, household cleaners) are heavily saturated, potentially compressing margins. The article links to a Fool piece on PG’s strategic acquisitions and brand diversification to offset saturation risk.

- Currency Volatility: Operating in more than 70 countries, PG is exposed to foreign‑exchange fluctuations. The article notes the company’s hedging practices and the impact of a stronger dollar on international earnings.

The authors also recommend reading their in‑depth Fool analysis on PG’s “Value‑Added Brand Strategy” to better understand how the company plans to maintain profitability in a low‑growth environment.

Why December? Market Context & Timing

The article frames its December timing around a few key market dynamics:

Interest‑Rate Outlook: The Federal Reserve’s rate‑cut cycle has stalled, and rates are projected to remain elevated through 2026. Dividend stocks that offer a higher yield relative to bond rates can become more attractive to income seekers. The article compares the three picks’ yields against the 10‑year Treasury yield (currently ~4.2 %) to illustrate the relative advantage.

Tax Considerations: With the U.S. tax code’s dividend‑tax rates potentially shifting in 2026, the authors suggest that now may be the last window to lock in a “tax‑efficient” dividend return. They discuss how qualified dividends are taxed at 15 % (or 20 % for high‑income earners) versus ordinary income rates.

Corporate Earnings Forecasts: The article notes that earnings guidance for all three companies shows modest growth, with a 3–4 % EPS expansion in 2026. These forecasts support continued dividend growth and reassure investors that the companies can sustain their payouts.

Takeaway

The Motley Fool’s December column paints a clear picture: Coca‑Cola, Johnson & Johnson, and Procter & Gamble represent three of the most resilient dividend payers in the market today. Their combination of long‑term dividend growth, healthy payout ratios, strong ROE, and diversified business models make them well‑positioned to provide income and stability amid a landscape of uncertain rates and geopolitical risk. While each company carries its own set of risks—from commodity price swings and patent expirations to regulatory scrutiny and brand saturation—the article offers a balanced view, linking to additional research to help investors assess how each fit within their own risk tolerance and income needs.

For anyone looking to shore up a portfolio with dependable dividends in the coming year, the article’s trio is an excellent starting point. As always, the Fool recommends readers to read the full analysis, consider their personal financial goals, and consult a financial advisor if needed before making any investment decisions.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/3-top-dividend-stocks-to-buy-in-december/ ]