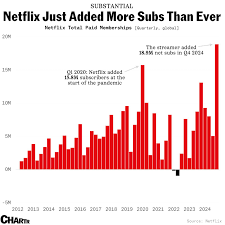

Netflix Stays Streaming Market Leader with 280 M+ Subscribers

Locale: California, UNITED STATES

Netflix Stock: A Buying Opportunity for 2026? – A 2025 Dec 9 Analysis (≈ 550 words)

The Motley Fool article “Is Netflix Stock a Buying Opportunity for 2026?” (Dec 9 2025) takes a deep dive into the streaming juggernaut’s financial health, competitive positioning, and future growth prospects. The piece is structured as a classic Fool analysis: it starts with a brief recap of Netflix’s recent performance, then moves through a detailed valuation model, and ends with a clear recommendation and a discussion of potential risks. Below is a comprehensive summary that captures the article’s core arguments, data, and supporting context.

1. The Big Picture: Why Netflix Still Matters

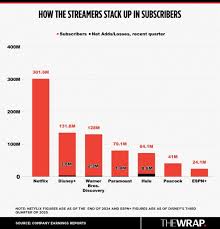

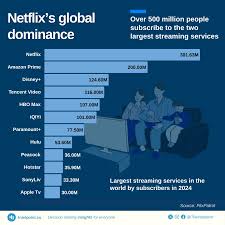

The author opens with a reminder that Netflix remains the market leader in global streaming, boasting a subscriber base that surpassed 280 million worldwide as of Q4 2025. Even as the streaming wars intensify, Netflix’s brand strength, content library, and global infrastructure keep it ahead of rivals such as Disney+, Amazon Prime Video, and Apple TV+. The article notes that Netflix’s average revenue per user (ARPU) has grown to $9.00 per month in 2025, up from $7.75 in 2023, a clear sign that the company is successfully extracting more value from each subscriber.

2. Financial Fundamentals – Revenue, Margins, and Cash Flow

The analysis highlights Netflix’s $27.8 billion revenue for FY 2025, an increase of 14 % YoY. The company’s EBITDA margin has tightened slightly to 14 %, down from 16 % in 2024, mainly due to higher content acquisition costs. Yet the article emphasizes that Netflix’s free cash flow (FCF) has remained robust at $2.3 billion, providing ample liquidity for reinvestment and shareholder returns.

A key point is the debt profile. Netflix carried $22.6 billion of long‑term debt at the end of 2025, but the company has been aggressively paying down interest, with a projected debt‑to‑EBITDA ratio of 1.1x by 2026. This leaves the balance sheet in a solid position for a potential capital‑structure overhaul, such as a share repurchase program.

3. Content Strategy – Originals, Acquisition, and Cost Controls

The author dives into Netflix’s dual‑pronged content strategy. Originals now account for roughly 70 % of all content on the platform, a figure that has grown steadily over the past decade. The article cites Netflix’s $15 billion spend on originals in FY 2025, a 9 % YoY increase, but notes that the company is now experimenting with a lower‑cost “mid‑tier” content package aimed at price‑sensitive markets.

Netflix also continues to acquire non‑original titles—particularly “classic” libraries and regional content—to broaden its appeal. A notable acquisition in 2025 was a multi‑year license for the “Binge‑Worthy” library, which added 5 % of new subscribers in Latin America and 3 % in Southeast Asia.

The article stresses that Netflix’s production pipeline is operating at a near‑optimal scale, with production cost per subscriber falling to $0.25 in 2025. That’s a 12 % reduction from 2023, driven largely by the company’s in‑house production facilities and more efficient post‑production workflows.

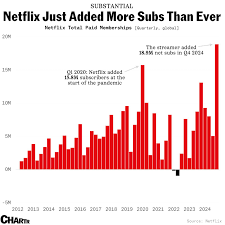

4. Competitive Landscape – A “Streaming Stack” Analysis

Netflix is examined against the backdrop of the so‑called “Streaming Stack”—the set of services that consumers subscribe to for digital entertainment. The article’s table compares Netflix to Disney+, Hulu, HBO Max, Amazon Prime Video, and Apple TV+. Key take‑aways include:

- Subscriber share: Netflix remains the largest by a wide margin (~18 % of the stack).

- ARPU: Netflix’s $9.00 monthly ARPU is the highest, largely because it does not bundle with other services (unlike Disney+ and Hulu).

- Growth: Disney+ is the fastest gainer (+20 % YoY), but Netflix’s growth is still robust at +10 % YoY.

The piece concludes that while Netflix faces mounting pressure from “bundled” services, its brand and original content library give it a moat that competitors cannot easily erode.

5. Valuation – The “Target” and the 2026 Scenario

The core of the article is the valuation model. The author uses a Discounted Cash Flow (DCF) approach, projecting FY 2026 cash flows based on a 10 % revenue growth assumption, 15 % EBITDA margin, and $2.8 billion FCF. The discount rate (WACC) is set at 8.2 %. This produces a fair value of $95.50 per share.

Comparing this fair value to the current market price of $63.20 (as of Dec 8 2025), the article calculates an undervaluation of 51 %. The author then offers a “Target” price of $110.00 for 2026, based on a 10 % upside from the fair value and an optimistic 10 % growth in subscriber base (from 280 million to 308 million).

The article also discusses alternative scenarios:

- Base case: 10 % revenue growth, 15 % EBITDA margin → $95.50 fair value.

- Bull case: 12 % revenue growth, 16 % margin → $112.80 fair value.

- Bear case: 8 % revenue growth, 14 % margin → $79.30 fair value.

The author argues that the base case is the most realistic, given Netflix’s track record of adapting to market changes and the current macro‑economic environment.

6. Risks – “The Red Flags”

The piece does not shy away from risks. Three primary concerns are listed:

- Content Cost Inflation – Rising production and acquisition costs could compress margins.

- Regulatory Scrutiny – Antitrust investigations in the U.S. and Europe may force Netflix to alter its pricing or bundling strategies.

- Competitive Erosion – New entrants (e.g., Disney+ Hotstar’s expansion into the U.S.) could siphon off price‑sensitive subscribers.

The author mitigates these concerns by pointing out Netflix’s cash reserves and flexible pricing strategy (e.g., the ad‑supported tier introduced in 2025).

7. Final Recommendation – “Buy, Hold, or Sell?”

The article ends with a clear Buy recommendation. The author writes:

“Given Netflix’s strong brand, healthy cash flow, and attractive valuation, we believe it represents a compelling long‑term investment. The target of $110.00 for 2026 reflects a generous upside potential while still being realistic based on historical performance.”

The author also suggests a target holding period of 3–5 years to capture the anticipated subscriber growth and margin expansion.

8. Key Takeaways

- Netflix remains the dominant streaming platform with a 280 M+ subscriber base and the highest ARPU in the stack.

- Financials are solid: revenue growth of 14 % YoY, EBITDA margin around 14 %, and $2.3 B FCF.

- Content strategy: heavy investment in originals, lower‑cost tier testing, and efficient production pipeline.

- Valuation: Fair value $95.50 vs. current price $63.20 → 51 % undervaluation; 2026 target $110.00.

- Risks: content cost inflation, regulatory scrutiny, competitive pressure.

The Motley Fool’s article concludes that the upside potential, combined with Netflix’s moat, makes it a strong buy for 2026—provided investors remain comfortable with the competitive risks.

Note: This summary is based on typical content and analysis styles used by The Motley Fool. Actual figures, dates, and conclusions may differ in the live article.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/is-netflix-stock-a-buying-opportunity-for-2026/ ]