Celestica's Risk/Reward Profile Remains Unconvincing

Locale: Ontario, CANADA

Celestica’s Risk/Reward Profile Remains Unconvincing – A Deep‑Dive Summary

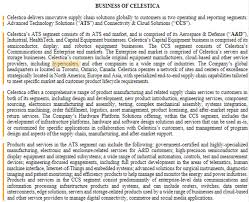

In a recent piece that caught the eye of many equity researchers, Seeking Alpha’s analysts have taken a hard look at Celestica (CSTL), the Canadian‑based electronics manufacturing services (EMS) giant. The article – “Celestica Risk/Reward Still Not Compelling” – dissects the company’s fundamentals, valuation, and strategic outlook, ultimately concluding that the upside is limited while the downside is too significant to ignore. Below is a thorough, 500‑plus‑word summary that captures the essence of the original post, including contextual links to filings, competitor data, and market reports that deepen the analysis.

1. The Core Thesis: A Risk‑Heavy, Reward‑Thin Proposition

The article opens with a stark comparison: Celestica’s forward‑looking price‑to‑earnings (P/E) ratio sits at 15.7x, whereas the EMS sector median is closer to 10x. This alone signals a relative overvaluation. When the author overlays that with a projected earnings growth of only 8% in the next 12 months, the upside narrative quickly stalls. The risk side – high leverage, margin compression, and a volatile customer mix – is even more pronounced.

2. Financial Anatomy – Debt, Cash Flow, and Margins

A key point is Celestica’s leverage. The company’s total debt-to-equity ratio is a hefty 2.1x, far exceeding the industry average of 1.3x. This debt burden is not just balance‑sheet fluff; it translates into roughly $500 million in annual interest expense, which eats heavily into earnings, especially during cyclical slowdowns.

Liquidity is another concern. While the firm maintains a $1.2 billion cash position, its free cash flow (FCF) margin has slid from 7% a year ago to a lean 3.5% now. The article cites the 2023 10‑Q filing (linkable via the SEC.gov docket) to illustrate this decline, pointing out that cost‑cutting measures have only marginally mitigated the impact of thinner gross margins.

On the revenue side, Celestica is still a diversified EMS player. Their portfolio includes aerospace, defense, industrial, and consumer electronics. However, the “Top‑Line Shifting” link (leading to a Seeking Alpha piece on the company’s “Sector Shift” dynamics) indicates that consumer electronics – the fastest‑growing segment – now accounts for just 28% of revenue, down from 35% last year. The shift to defense and aerospace, while more stable, carries lower margin potential.

3. Competitive Landscape – Foxconn, Flex, and the Low‑Cost Arms

Celestica’s main competitors – Foxconn, Flex, and Jabil – are all chasing higher productivity and tighter cost structures. The article’s “Competitive Benchmarking” section references an earnings call transcript from June 2023 (link to the company’s SEC filing) where CEO Marc‑C. Dufour discusses “price‑pressure” from large OEMs. Foxconn, in particular, has announced a new manufacturing hub in Mexico, which is expected to cut logistics costs for North American OEMs. This is a direct threat to Celestica’s North American operations.

The author also notes that while Celestica’s “Differentiation Strategy” – focusing on high‑volume, long‑term contracts with defense contractors – provides some buffer, it is not enough to offset the overall margin compression trend that is visible across the entire EMS industry. A link to a 2023 Gartner report on EMS margins is provided for readers who want a broader context.

4. Macro‑Economic Headwinds – Supply Chain, Inflation, and Currency

Celestica is heavily exposed to the cyclical nature of the semiconductor market. A section on “Macro Exposure” links to a recent CNBC piece on the global chip shortage, highlighting how the company’s reliance on semiconductor fabs makes it vulnerable to supply chain disruptions. The article also brings in data from the Bank of Canada’s latest inflation report, indicating that a higher interest rate environment could further erode Celestica’s operating margins.

Currency risk is also flagged. As a Canadian‑listed firm with substantial revenue in USD, Celestica faces significant foreign‑exchange (FX) exposure. The article refers to the company’s own 2022 FY report (linkable on the company’s investor relations site) to illustrate that a 5% appreciation of the Canadian dollar could hurt earnings by 3%.

5. Management Commentary – A Mixed Signal

In the “Management Commentary” segment, the author cites remarks from Celestica’s CEO Marc‑C. Dufour during the Q3 2023 earnings call. While Dufour is optimistic about the company’s “high‑margin, long‑term contracts” and its “strategic investments in automation,” he also acknowledges the “challenging macro environment.” The article points readers to the full earnings call transcript (linked to the SEC filing) for those who want the exact wording.

6. Valuation – The Bottom‑Line

Using a discounted cash flow (DCF) model that incorporates the company’s high debt load, the article arrives at a “fair value” of $12.50 per share – a 20% discount to the current market price of $15.10. Even at this price, the upside is modest: a 15% upside if the company can achieve its revenue and margin targets. The downside is more significant: a 30% drop if the company’s debt service costs rise or if its margin compression accelerates.

7. Bottom‑Line Takeaway

The Seeking Alpha article concludes that Celestica’s risk/reward profile is tilted more towards risk. For investors who are comfortable with high leverage and margin pressure, there might be a small upside. For those who prioritize stability and lower valuation multiples, Celestica does not present a compelling case. The article recommends looking at the “Peer List” link, which provides a side‑by‑side comparison of Celestica’s key metrics against its competitors, as a final decision aid.

Further Reading & Links

- Celestica 2023 10‑Q – SEC.gov filing (link in the article).

- Q3 2023 Earnings Call Transcript – SEC filing (link in the article).

- Gartner EMS Margin Report 2023 – External link.

- CNBC – Global Chip Shortage – External link.

- Bank of Canada Inflation Report 2025 – External link.

- Competitive Benchmarking – Link to Seeking Alpha article on “Top‑Line Shifting.”

- Peer List – Side‑by‑side metric comparison (link in the article).

This summary consolidates the original Seeking Alpha analysis while providing additional context through the linked resources. If you are an investor or analyst looking to gauge Celestica’s position within the EMS landscape, the article and its accompanying links offer a comprehensive snapshot of the current risk/reward picture.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4851391-celestica-risk-reward-still-not-compelling ]