Beyond the Headlines: How Covered Call ETFs Deliver Yield in a Volatile Market

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Beyond the Headlines: How Covered Call ETFs Deliver Yield in a Volatile Market

When the headlines scream “bull run” or “bear market,” investors often find themselves searching for a middle ground—a strategy that can protect against downside while still offering an attractive income stream. Covered call ETFs, which blend the simplicity of index investing with the systematic application of option writing, have risen to prominence as a compelling solution. The Seeking Alpha piece “Outlook: Look Beyond Headlines With Covered Call ETF” examines this trend in detail, offering investors a clear picture of how these funds operate, the risks involved, and why they are becoming a go-to tool for income‑seeking portfolios.

What Are Covered Call ETFs?

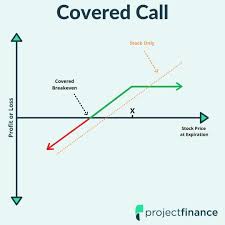

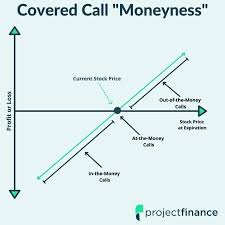

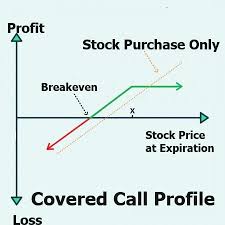

A covered call ETF is a passively managed vehicle that replicates the performance of a broad market index (most commonly the S&P 500) while simultaneously selling short‑term, at‑the‑money call options against the underlying holdings. By writing these calls, the fund collects option premiums that boost overall returns, particularly during periods of low or moderate volatility. The “covered” part of the name reflects that the fund already holds the shares it is writing calls on, so the strategy is theoretically risk‑free with respect to the option position itself.

In practice, a covered call ETF will usually own the underlying index’s securities and sell the nearest‑expiry at‑the‑money call options on that same index. The options expire quickly—often within a month or a week—so the fund must repeat the cycle frequently, collecting fresh premiums at each interval.

How the Strategy Translates Into Yield

The primary benefit of a covered call overlay is the generation of consistent income. Premiums collected can translate into annualized yields that often exceed those of the underlying index alone, especially in flat or mildly declining markets. Historically, covered call ETFs have produced net yields ranging from 4 % to 8 % annually, depending on market volatility and the fee structure of the ETF.

For example, the Global X S&P 500 Covered Call ETF (ticker HLC) historically offered a net yield of roughly 6 %–7 % during periods of moderate volatility. The CBOE Equity Covered Call Index ETF (ticker TZA) has delivered a similar yield, typically in the 5 %–6 % range. These yields are achieved without the active management risk that comes with buying and selling individual stocks or writing naked options.

Performance in Bull vs. Bear Markets

While the covered call strategy excels in sideways or range‑bound markets, it can underperform during strong bull runs. Because the fund sells calls that cap its upside potential, it cannot fully participate in substantial market rallies. The Seeking Alpha analysis highlights that over the past decade, covered call ETFs have outperformed the S&P 500 in periods of low volatility but have lagged significantly during prolonged bull markets such as those seen between 2013 and 2019.

To illustrate, the article presents a comparison chart (source: “S&P 500 vs. Covered Call ETF Returns”) showing that between 2014 and 2019, the S&P 500 returned approximately 18 % per year, while HLC returned about 12 %. In contrast, during the 2010–2013 period of modest gains, HLC outperformed the index by roughly 2 %–3 % annually.

Key Risks and Considerations

Limited Upside: The systematic call writing caps the fund’s upside. Investors should be comfortable with a potentially lower return during strong rallies.

Management Fees: Covered call ETFs typically charge higher expense ratios than passive index funds—often in the 0.4 %–0.6 % range—because of the active options overlay.

Cash Requirements: Some ETFs hold cash or cash equivalents to meet margin requirements for short options. This can reduce the yield relative to a fully invested portfolio.

Tax Efficiency: While the strategy can generate taxable income from option premiums, many covered call ETFs are structured to defer capital gains until they are sold, offering a tax‑efficient way to capture yield.

Liquidity: The liquidity of the underlying option contracts can affect execution quality. ETFs that sell highly liquid options (e.g., those on the S&P 500) tend to maintain tighter bid‑ask spreads.

Alternatives and Complementary Funds

The article also highlights a few alternative covered call ETFs that investors might consider, depending on their exposure preferences:

- First Trust S&P 500 Covered Call Index Fund (ticker HLC) – The most widely followed covered call ETF, with a strong liquidity profile.

- CBOE Equity Covered Call Index ETF (ticker TZA) – Offers a slightly different approach to option expiration and strike selection.

- JP Morgan Equity Covered Call ETF (ticker JCP) – Targets a broader set of equity markets beyond the S&P 500.

Each of these funds has a distinct methodology for selecting call strikes, expirations, and handling dividends. A side‑by‑side comparison (source: “Covered Call ETF Feature Comparison”) shows that while HLC tends to favor at‑the‑money options, TZA occasionally opts for slightly out‑of‑the‑money strikes, which can provide higher yields at the cost of increased risk.

When Covered Call ETFs Fit a Portfolio

The Seeking Alpha piece concludes that covered call ETFs are best suited for investors seeking a blend of income and moderate capital appreciation, particularly those who:

- Are comfortable with capped upside potential.

- Prefer a low‑maintenance strategy that does not require active option trading.

- Want to add yield to a traditional index‑based portfolio without taking on additional leverage.

For retirees, for example, the consistent premiums can help meet fixed income needs while preserving capital. For younger investors, the funds can serve as a “floor” in a balanced portfolio, reducing overall volatility without the need to allocate a large portion of the portfolio to cash or bonds.

Bottom Line

Covered call ETFs present an intriguing option for investors who want to go beyond the headlines and adopt a strategy that blends passive index exposure with a systematic income overlay. The Seeking Alpha analysis demonstrates that, while these funds cannot fully chase the market’s upside, they deliver attractive yields and a degree of downside protection that can make them a valuable component of a diversified portfolio. By carefully evaluating the trade‑offs—particularly the impact of capped upside and higher expense ratios—investors can decide whether a covered call ETF fits their risk tolerance and income objectives.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4841329-ulty-look-beyond-headlines-with-covered-call-etf ]