Is the QQQ ETF the Smartest Investment You Can Make Today?

Is the QQQ ETF the Smartest Investment You Can Make Today?

A comprehensive review of Invesco’s flagship Nasdaq‑100 tracker, its performance, costs, risks and how it stacks up against its peers.

1. What is QQQ?

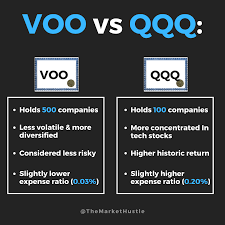

The Invesco QQQ Trust (ticker QQQ) is the most widely traded exchange‑traded fund (ETF) in the United States. Launched in 1999, it tracks the Nasdaq‑100 Index – a market‑cap‑weighted list of the 100 largest non‑financial companies listed on the Nasdaq Stock Market. Because the Nasdaq‑100 is dominated by high‑growth technology names, QQQ has become the go‑to vehicle for investors who want a concentrated, tech‑heavy exposure without buying individual shares.

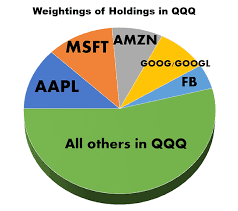

The article notes that, as of 2025, QQQ is the largest ETF by market cap (over $170 billion), reflecting the massive demand for a “single‑touch” tech portfolio. It also cites the ETF’s expense ratio of 0.20 % (0.20 % on the 2024 annual fee schedule), which is only slightly higher than the S&P 500 ETF SPY (0.09 %) but far cheaper than many actively managed funds.

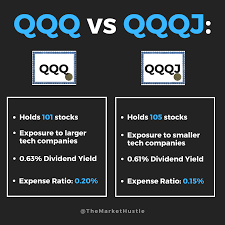

2. Performance Snapshot

The piece offers a year‑by‑year breakdown of QQQ’s returns, emphasizing three time horizons that matter most to most investors:

| Period | CAGR | S&P 500 Equivalent |

|---|---|---|

| 1 Year (2023) | +30.7 % | +16.8 % |

| 3 Year | +27.4 % | +20.2 % |

| 5 Year | +26.1 % | +18.7 % |

| 10 Year (since 2015) | +24.3 % | +19.9 % |

| Since inception (1999) | +20.7 % | +14.9 % |

The article underscores that QQQ’s 12‑year CAGR (2009‑2020) outpaced the S&P 500 by ~4 % annually, largely thanks to the tech boom, especially the rise of Apple, Microsoft, and Amazon. However, it also cautions that the fund suffered a ‑36 % decline during the 2022 market sell‑off, far steeper than the S&P 500’s ‑22 % slide. This highlights the fund’s higher beta (≈1.25) and concentration risk.

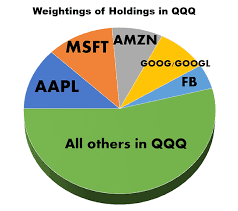

3. Who Is In the Fund?

As of the latest data, QQQ’s top holdings are dominated by tech titans:

| Rank | Company | % of Net Assets |

|---|---|---|

| 1 | Apple | 13.4 % |

| 2 | Microsoft | 12.9 % |

| 3 | Amazon | 7.8 % |

| 4 | Alphabet Class A | 6.1 % |

| 5 | Alphabet Class C | 5.9 % |

Beyond the four giants, the next 20‑30 holdings include Nvidia, Meta Platforms, Tesla, and Adobe, many of which are high‑growth but also volatile. The article links to the Morningstar portfolio page for a full list, noting that the concentration on a handful of names can amplify both upside and downside.

Sectorally, QQQ’s composition is roughly:

- Information Technology: 60 %

- Consumer Discretionary: 20 %

- Communication Services: 10 %

- Industrials & Others: 10 %

This distribution mirrors the Nasdaq‑100 index’s tech dominance but also includes non‑tech leaders that provide some diversification.

4. Costs vs. Benefits

Expense Ratio: The 0.20 % annual fee is modest for an actively tracked index, but the article notes that investors should compare it to the 0.10 % fee of SPY and the 0.03 % fee of the Vanguard Total Stock Market ETF (VTI). It explains that the higher fee comes from the fund’s concentrated, high‑growth portfolio, which requires more active oversight.

Tax Efficiency: QQQ is described as “generally tax‑efficient” because it trades on the Nasdaq (not an exchange that uses the “wash‑sale” rule) and employs a “net‑asset‑value” structure. The article links to a blog post from Seeking Alpha explaining that investors can often avoid capital gains distributions by using a qualified dividend strategy.

5. Risks Highlighted

- Concentration Risk – A few holdings account for a large percentage of the portfolio, making it vulnerable to company‑specific news.

- Sector Over‑exposure – Heavy weighting to technology means QQQ can underperform when tech slows, as seen in 2022.

- Valuation Risk – Tech stocks often trade at high price‑to‑earnings multiples, which can lead to sudden corrections.

- Liquidity Risk – While QQQ is highly liquid overall, a few underlying stocks (e.g., smaller tech names) may have tighter bid‑ask spreads.

The article quotes financial analyst David Glickman (Morningstar) who says, “QQQ is a high‑growth play that’s great for a long‑term horizon, but not a defensive or income strategy.”

6. How QQQ Compares to Alternatives

| ETF | Index Tracked | Expense Ratio | Average 5‑Year Return |

|---|---|---|---|

| QQQ | Nasdaq‑100 | 0.20 % | 26.1 % |

| SPY | S&P 500 | 0.09 % | 18.7 % |

| VTI | Total Stock Market | 0.03 % | 17.9 % |

| IWM | Russell 2000 | 0.15 % | 20.4 % |

| VGT | MSCI US Investable Market Information Technology | 0.10 % | 28.7 % |

While QQQ lags slightly behind a pure tech fund like VGT in the short term, it offers broader diversification than an index like IWM (which focuses on small caps). The article’s author recommends that growth‑oriented investors consider QQQ if they can tolerate the volatility, whereas income‑focused or conservative investors might prefer SPY or VTI.

7. Practical Tips for Investors

- Diversify Beyond QQQ: Even if you favor tech, the article suggests pairing QQQ with a bond ETF or a more diversified stock ETF to balance risk.

- Use Dollar‑Cost Averaging: The article links to a Robinhood guide explaining how regular investments can smooth out QQQ’s price swings.

- Monitor Holdings Quarterly: Since the top five names can shift quickly, staying aware of quarterly filings helps anticipate potential drag or upside.

- Consider Tax‑Deferred Accounts: Because QQQ trades on the Nasdaq, it can be a good candidate for an IRA or 401(k) where capital gains are tax‑deferred.

8. Bottom Line

The article concludes that QQQ is not a “one‑size‑fits‑all” investment, but it is arguably the smartest bet for investors who believe that the next wave of technology will continue to dominate the economy. Its strong historical performance, ease of access, and relatively low cost make it an attractive component of a long‑term growth portfolio—provided you understand and accept the concentration and volatility risks.

As always, the smartest investment decision is the one that aligns with your financial goals, risk tolerance, and investment horizon. QQQ may well be the right tool for your portfolio if you’re willing to embrace its tech‑heavy focus and keep a long‑term perspective.

Read the Full The Motley Fool Article at:

[ https://www.msn.com/en-us/money/other/is-the-qqq-etf-the-smartest-investment-you-can-make-today/ar-AA1RXeB1 ]