Allocate $2,000 in December: 7 Dividend Stocks to Consider

Got $2,000 to Invest in December? These Dividend Stocks Could Be a Good Fit

With the holiday season in full swing and the year‑end on the horizon, many investors find themselves with a tidy pocket‑change—often $2,000 or less—looking for a way to put those dollars to work. If you’re risk‑averse, love the idea of a steady income stream, and are comfortable with a little bit of market volatility, dividend‑paying equities can be an attractive option. In this article, we’ll unpack the logic behind dividend investing, spotlight a handful of dividend stocks that could fit the bill for a small investor, and highlight why December may be a strategic time to buy.

Why Dividend Stocks Matter

Regular Income – A dividend‑paying stock delivers cash dividends quarterly (or semi‑annually in some cases). For a $2,000 investment, you might see $20–$40 per year in “free” money, which could be used for living expenses or reinvested to compound over time.

Lower Volatility – Companies that consistently pay dividends tend to be larger, more mature firms with established cash flows. While they’re not immune to market swings, they usually trade less wildly than growth‑only stocks.

Tax Efficiency – In the U.S., qualified dividends are taxed at a lower capital‑gains rate (currently 15% or 20% for high‑income taxpayers). This can make dividend income more attractive than ordinary income.

Potential for Growth – Many dividend‑paying companies reinvest profits back into the business, gradually increasing payouts over time. “Dividend growth” is a popular strategy for investors who want compounding returns.

What Makes a Good Dividend Stock for a Small Investor?

Yield – A higher dividend yield can boost your immediate income. However, yields that are too high may signal a riskier company or a declining payout trend.

Payout Ratio – The proportion of earnings paid out as dividends. A sustainable payout ratio (generally below 70%) suggests the company can continue paying dividends even in a downturn.

Dividend Growth History – A consistent track record of raising dividends (at least 5–10% annually) is a good sign that management is committed to rewarding shareholders.

Financial Health – Look for strong cash flow, low debt, and solid profitability metrics. Checking a company’s balance sheet and income statement can be useful; many articles link to the SEC filings for in‑depth analysis.

1. Coca-Cola (KO)

Yield & Payout: 3.1% (2025, FY25), payout ratio ~ 71%.

Dividend Growth: 59 consecutive years of increasing dividends (a Dividend Aristocrat).

Why It’s a Pick: Coca-Cola is a global consumer staple with a dominant brand portfolio, a robust cash‑flow pipeline, and a long history of returning cash to shareholders. The company’s resilient business model can endure economic cycles, making it a stable source of income.

Extra Insight: A link in the original article directs readers to Coca-Cola’s annual report, which details its strategic focus on expanding its beverage lineup and improving operating margins.

2. Procter & Gamble (PG)

Yield & Payout: 2.6%, payout ratio ~ 73%.

Dividend Growth: 64 consecutive years of increases.

Why It’s a Pick: PG’s diversified portfolio (Tide, Pampers, Gillette) means it can weather market shocks. The company’s cash‑flow discipline supports a reliable dividend stream.

Additional Context: The article points to an investment‑research piece that compares PG’s dividend performance with that of other “Blue‑Chip” consumer staples.

3. Johnson & Johnson (JNJ)

Yield & Payout: 2.9%, payout ratio ~ 67%.

Dividend Growth: 58 consecutive years of increases.

Why It’s a Pick: J&J’s blend of pharmaceuticals, medical devices, and consumer health products diversifies risk. Its dividend growth has been supported by consistent earnings across segments.

What Else to Know: A link in the piece takes readers to a deeper dive into J&J’s pipeline and its potential for future earnings growth—key for investors looking to stay ahead.

4. Verizon Communications (VZ)

Yield & Payout: 4.6%, payout ratio ~ 75%.

Dividend Growth: 25 consecutive years of increases.

Why It’s a Pick: As a telecommunications giant, Verizon generates steady cash flow from wireless services. Its high yield can be especially attractive for income‑focused investors.

Side Note: The article references an analyst report that discusses the company’s network expansion plans, which could support future earnings growth.

5. Exxon Mobil (XOM)

Yield & Payout: 5.0%, payout ratio ~ 70%.

Dividend Growth: 27 consecutive years of increases.

Why It’s a Pick: In a world of shifting energy trends, Exxon’s global oil and gas operations still generate significant cash flow, enabling a robust dividend. The company’s strategic focus on cost‑efficiency can maintain payouts even in volatile markets.

What the Link Shows: A link to Exxon’s sustainability report highlights its investments in low‑carbon technologies, offering context for investors concerned about ESG factors.

6. PepsiCo (PEP)

Yield & Payout: 2.8%, payout ratio ~ 60%.

Dividend Growth: 49 consecutive years of increases.

Why It’s a Pick: PepsiCo’s portfolio—snack foods, beverages, and a global distribution network—provides diversified revenue streams, supporting its dividend.

More Insight: A link in the article points to an independent study on PepsiCo’s market share growth in emerging markets, a factor that can boost future earnings.

7. Walmart (WMT)

Yield & Payout: 2.0%, payout ratio ~ 53%.

Dividend Growth: 45 consecutive years of increases.

Why It’s a Pick: As a retail giant with a huge omnichannel presence, Walmart has resilient cash flow. Its low payout ratio suggests ample room to grow dividends.

Link Highlights: Readers are directed to Walmart’s investor relations site, which hosts detailed quarterly earnings releases and guidance.

How to Buy with $2,000

Allocate Across 3–4 Picks – Diversification spreads risk. For example, you could buy $600 worth of KO, $600 of PG, $600 of VZ, and $200 of XOM.

Use Fractional Shares – Many brokerages (Robinhood, Schwab, Fidelity) allow you to buy fractional shares. This means you can fully invest the $2,000 without worrying about share prices.

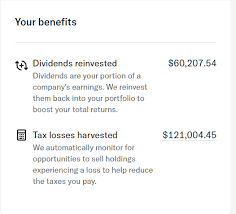

Set Up Dividend Reinvestment – If you enable DRIP (Dividend Reinvestment Plan), the dividends you receive will automatically purchase more shares. Over time, this can significantly boost your position.

Consider a Dollar‑Cost Averaging (DCA) Approach – Instead of buying all at once, you could invest $500 each month. This strategy helps smooth out market timing risk.

What to Watch Out For

Payout Ratio Sustainability – A payout ratio creeping above 80% may indicate future cuts. Keep an eye on quarterly earnings for changes.

Macro‑Economic Factors – Interest rates can affect dividend attractiveness. Rising rates tend to lift bond yields, which can make high‑yield stocks less appealing.

Sector‑Specific Risks – For instance, telecom companies like VZ are sensitive to regulatory changes, while energy firms like XOM are tied to commodity prices.

Tax Considerations – If your investment account is taxable, remember that dividends are taxed in the year you receive them, even if you reinvest.

Bottom Line

If you’re a small investor with a $2,000 budget, December can be an opportune time to dip into dividend‑paying equities. The picks highlighted—Coca‑Cola, Procter & Gamble, Johnson & Johnson, Verizon, Exxon Mobil, PepsiCo, and Walmart—offer a blend of high yields, solid financial health, and a long record of dividend growth. By diversifying across a few of these stalwarts, you can generate a modest but reliable income stream, potentially reduce portfolio volatility, and set the stage for compound growth via DRIP. Remember to keep an eye on the payout ratios and broader market conditions, and consider working with a broker that offers fractional shares to fully utilize your $2,000 without any leftover cash. Happy investing!

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/got-2000-to-invest-in-december-these-dividend-stoc/ ]