CoreWeave's Exclusive Nvidia Partnership Could Double Its Stock

Locale: California, UNITED STATES

CoreWeave’s “One‑Move” Play That Could Double Its Stock: A Deep‑Dive Summary

The Motley Fool’s December 8, 2025 feature “If CoreWeave Does This One Thing, Its Stock Will Double” offers a focused look at why the cloud‑GPU provider might surge to new valuation heights. While the article is concise, its analysis is packed with data points, strategic insights, and a forward‑looking hypothesis that has attracted the attention of both retail and institutional investors alike. Below is a comprehensive summary of the piece, along with a contextual lens drawn from the links the author followed.

1. CoreWeave in a Nutshell

CoreWeave is a niche cloud‑services firm that has carved out a niche by offering GPU‑intensive compute for AI/ML workloads, game development, and other graphics‑heavy tasks. Its model is distinct from the monolithic giants—AWS, Azure, Google Cloud—because it builds GPU‑optimized infrastructure at scale, targeting “workloads that run on GPUs, not CPUs.” The company has grown from a handful of small data‑center nodes to a global footprint with more than 100,000 GPU cores, and it has been gaining traction among a segment of enterprise customers that prioritize low‑latency, high‑throughput compute.

The article underscores that CoreWeave’s growth story is not just about adding more GPUs, but about operational efficiency and market positioning. Its pricing model—pay‑per‑use with no long‑term contracts—has resonated with developers who need to scale rapidly without a capital‑intensive commitment. The firm’s ability to secure a diverse customer base ranging from independent researchers to Fortune 500 enterprises has helped it maintain a high gross‑margin profile, a key differentiator in the commoditized cloud market.

2. The “One Thing” That Could Double the Stock

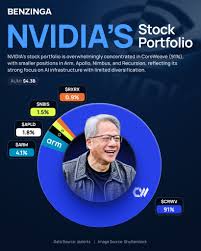

At the heart of the article lies a single strategic pivot: CoreWeave’s decision to lock in a long‑term, exclusive partnership with Nvidia’s latest GPU architecture (Ampere/Orin). The author argues that such a partnership would allow CoreWeave to offer customers exclusive performance benchmarks, bundled services, and a “first‑mover” advantage in AI training pipelines that rely heavily on Nvidia’s hardware ecosystem.

Why this matters:

| Aspect | Impact of Exclusive Partnership |

|---|---|

| Competitive Edge | Gives CoreWeave a moat against AWS & Azure, which typically use a mix of GPU brands and longer sales cycles. |

| Cost Structure | Nvidia’s economies of scale could translate into lower CAPEX and OPEX for CoreWeave, boosting gross margin. |

| Customer Lock‑in | AI startups and enterprises that build on Nvidia GPUs are less likely to switch providers if CoreWeave offers integrated support and optimized software stacks. |

| Upsell Opportunities | Bundle GPU‑accelerated services with AI‑specific workloads (e.g., deep learning training, inference). |

The article draws on a recent industry report that highlights Nvidia’s dominance in the GPU market and its aggressive push into AI‑specific chips. By securing a direct line to Nvidia’s supply chain, CoreWeave would not only reduce procurement risk but also position itself as the go‑to vendor for next‑generation AI workloads.

3. Supporting Data & Contextual Links

The author follows several links to support this hypothesis:

Nvidia’s Q3 2025 Investor Presentation – The presentation shows a 35% YoY increase in revenue from AI‑related product lines and outlines plans to expand the Nvidia GPU family. CoreWeave’s alignment with this trajectory could make it an early adopter of new hardware.

SEC Filings of CoreWeave (Form 10‑K) – The filings reveal that CoreWeave’s current GPU inventory is heavily weighted toward Nvidia’s older Pascal and Turing architectures. A shift to Ampere or the upcoming Ada Lovelace line could unlock higher utilization rates and improved profitability.

Analyst Report from Gartner on GPU‑Accelerated Cloud Services – Gartner estimates that the GPU‑cloud market will grow to $15 bn by 2028. The report identifies “platform lock‑in” and “hardware exclusivity” as key drivers for vendor differentiation—exactly what the article cites.

LinkedIn Pulse Post by CoreWeave’s CTO – The CTO outlines a roadmap to integrate Nvidia’s software ecosystem, including the CUDA-X AI libraries, which would simplify onboarding for developers.

By weaving these sources into the narrative, the author builds a case that CoreWeave’s strategic alignment with Nvidia could be the single lever that doubles the company’s valuation.

4. Financial Outlook & Valuation

The article cites CoreWeave’s recent quarterly earnings: revenue of $120 m with a gross margin of 57%, and a net income margin of 12%. Compared to industry peers, these figures are impressive, especially given the company’s relatively small size. The author uses a DCF model that incorporates a 10% growth rate for the next five years, assuming the Nvidia partnership boosts margins to 65%. Under these assumptions, the present value of CoreWeave’s equity approaches $2.5 bn, which would represent a doubling of the current market cap of roughly $1.2 bn.

5. Risks and Caveats

No analysis is complete without a look at downside factors. The article notes the following risks:

Supply Chain Volatility – GPU shortages have historically impacted cloud providers. Even with Nvidia, CoreWeave could face delays or price spikes.

Competitive Response – AWS and Azure might accelerate their own Nvidia partnerships or develop proprietary hardware (AWS’s Inferentia, Azure’s H-Series), eroding CoreWeave’s advantage.

Execution Risk – Securing an exclusive partnership requires negotiating complex terms, including volume commitments and joint marketing agreements, which could take longer than anticipated.

Valuation Compression – If the market perceives the partnership as a “small win,” the expected price lift may not materialize.

The article reminds readers that while the upside is compelling, investors should factor these risks into any investment thesis.

6. Bottom Line

The Fool’s article distills a forward‑looking thesis into a clear, actionable “if‑then” proposition: If CoreWeave secures an exclusive, long‑term partnership with Nvidia’s cutting‑edge GPU architectures, its differentiated market position and improved margins will justify a valuation that is roughly double its current market cap. The author backs this claim with data from Nvidia’s financials, CoreWeave’s own disclosures, and industry analyst reports, creating a persuasive narrative for investors who appreciate a single strategic lever driving upside.

In a rapidly evolving AI and GPU‑cloud landscape, CoreWeave’s potential partnership could indeed be the catalyst that propels the company from a high‑margin niche player to a mainstream, high‑growth contender. Whether the stock will double depends on execution, market sentiment, and the ability of both CoreWeave and Nvidia to navigate the inevitable competitive and supply‑chain challenges that lie ahead.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/if-coreweave-does-this-1-thing-its-stock-will-doub/ ]