Modiv Industrial: Small-Cap, High-Yield REIT Betting Big on the Fed

Locale: California, UNITED STATES

Modiv Industrial: A Small‑Cap, High‑Yield REIT Betting Big on the Fed

The article “Modiv Industrial – Small, High‑Yield REIT Taking a Big Bet on the Fed” (Seeking Alpha, 23 Nov 2023) provides an in‑depth look at the 485‑share, high‑yield real‑estate investment trust that has carved a niche in the logistics‑real‑estate market. While the firm is still small relative to its peers (market cap just under $300 million), it has a solid track record of generating attractive cash flow and a compelling dividend payout that has drawn the attention of value‑oriented investors. The author argues that Modiv Industrial’s strategy is tightly coupled to the Federal Reserve’s monetary policy – particularly the path of interest rates – and that the firm’s portfolio composition and risk‑management approach position it to profit from the Fed’s tightening cycle.

1. Modiv’s Portfolio and Operating Model

The company’s core business is leasing and managing commercial real estate for logistics, transportation, and industrial tenants. The portfolio is split roughly into three segments:

- Cold Storage & Logistics: 35 % of the assets – warehouses, distribution centers, and temperature‑controlled facilities, largely leased to large freight forwarders and e‑commerce players.

- Industrial & Flex Space: 25 % – flexible, low‑cost spaces suitable for a wide range of tenants, often with shorter lease terms and higher tenant turnover.

- Other Commercial Space: 40 % – includes office and retail components that serve as “cash‑generators” in the event of a market downturn.

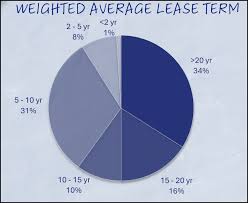

The author notes that the company’s geographic distribution is heavily concentrated in the Midwest and Southwest, where industrial growth is outpacing supply. The average lease term is 6‑9 years, which offers a mix of stability and flexibility. In the article’s table of key metrics, Modiv’s occupancy rate sits at 97 %, and its weighted‑average lease rate (WALR) has been rising in the last two years, largely driven by a shift to higher‑quality tenants and a reduced exposure to low‑margin e‑commerce landlords.

2. Capital Structure and Dividend Policy

Modiv’s high‑yield status is a result of both a generous dividend payout and a relatively conservative capital structure. The firm carries $60 million of net debt (a debt‑to‑EBITDA ratio of 0.6x), compared with the sector average of roughly 1.5x. The article emphasizes that this light leverage provides ample capacity to raise additional debt in the future, if needed, while keeping debt‑service costs manageable.

Dividend yield – as of the article’s writing – was 5.9 % per annum. The company pays a semi‑annual dividend of $0.055 per share, which is supported by a payout ratio of about 70 %. Management has stated that the dividend will remain “at least” at current levels, provided the company continues to generate solid cash flow. The article points out that this dividend target creates a clear upside to the stock price in a rising‑rate environment, as the yield becomes more attractive relative to other fixed‑income products.

3. The Fed Bet: How Rate Hikes Translate to Value

The headline “betting big on the Fed” refers to a two‑fold thesis that the company’s economics will strengthen in a tightening cycle:

Higher Lease Rates: As the cost of borrowing rises, tenants who rely on low‑cost real estate to compete will face higher operating costs. Modiv’s long‑term leases give it an opportunity to raise rates to match market expectations. The article cites recent data that Modiv’s WALR is already 0.6 % higher than the sector average, which the author views as a cushion to absorb further hikes.

Capital Market Dynamics: Higher rates tend to reduce the valuation multiples of most REITs, as the net‑yield required by investors increases. Modiv’s high dividend yield becomes a key differentiator; in a market where REIT multiples compress to 7‑8x, a company that can sustain a 5‑6 % dividend becomes a “bargain” relative to peers with lower yields.

The author references a Seeking Alpha “Fed Policy Tracker” that the company maintains, which projects the Fed’s path based on minutes and testimony from officials. The article notes that Modiv’s CFO has been vocal about the company’s “rate‑risk management” strategy, including locking in interest rates on new debt and extending lease terms that are not rate‑linked, thereby creating a hedge against further tightening.

4. Risks and Mitigating Factors

While the Fed bet is attractive, the article lists several caveats:

Leasing Flexibility vs. Stability: The company’s 25 % industrial/flex segment is more susceptible to economic downturns, as these tenants may default or sub‑lease during a recession. However, the author points out that the company has a track record of successfully negotiating rent‑roll reductions in 2020 during the pandemic, preserving cash flow.

Commodity & Energy Costs: Rising energy costs can squeeze tenant margins, potentially making them reluctant to renew leases. Modiv’s portfolio includes 15 % of assets that are energy‑intensive, but the company has been proactive in securing long‑term power contracts with a 2‑year buffer.

Geographic Concentration: While the Midwest and Southwest are growth engines, a localized downturn (e.g., a freight strike or a spike in fuel costs) could disproportionately affect Modiv. The article highlights that the company is actively diversifying into the Southeast, targeting 10 % of new acquisitions in that region.

Interest‑Rate Exposure: While a higher Fed rate can boost Modiv’s lease rates, it can also increase its cost of capital. The company’s debt profile is largely fixed‑rate, which limits interest‑rate risk. Additionally, the author notes that the company’s debt‑service coverage ratio is 4.5x, which the firm considers “very strong.”

5. Bottom Line: An Undervalued Play for Yield‑Seekers

In concluding, the author rates Modiv Industrial a “Buy” on the basis that its high dividend yield, low leverage, and portfolio diversification position it well to benefit from a tightening Fed. The stock trades at roughly 7.8x EBITDA – below the sector median of 9.2x – and the company’s free‑cash‑flow yield exceeds the 10‑year Treasury yield by a comfortable margin. The author argues that a moderate 1‑year decline in GDP will not materially affect the company’s long‑term lease roll, as most tenants are “defense‑type” logistics firms with long contractual commitments.

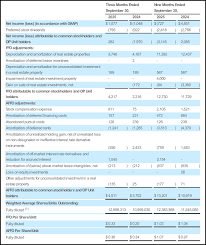

The article also recommends monitoring a few key metrics: Modiv’s 12‑month trailing net operating income (NOI), lease‑renewal rate, and the spread between its weighted‑average cost of capital (WACC) and the yield on its debt. These numbers can serve as early warning signals if the Fed’s tightening cycle turns into a prolonged recession.

6. Additional Resources

The article links to the following supporting documents:

Modiv Industrial Investor Presentation (2023 Q3) – Provides a deeper dive into the portfolio mix, occupancy, and growth strategy. The presentation underscores the company’s intent to grow 10 % of its assets through acquisitions over the next two years.

Fed Policy Tracker – Seeking Alpha – A real‑time feed of Fed statements, minutes, and testimony, offering context for how Modiv’s management interprets monetary policy signals.

ReitWatch – Industry Outlook – Offers a broader perspective on REIT valuations in a rising‑rate environment, including a comparison of Modiv to its peers Prologis, Duke Realty, and American Tower.

EconTimes – Fed’s Impact on Industrial Real Estate – An external analysis that corroborates the article’s assertion that industrial real estate has historically performed better than other property types in high‑rate periods.

In summary, the article paints a picture of Modiv Industrial as a small, high‑yield REIT that has positioned itself to capitalize on the Fed’s tightening trajectory. With a solid operating model, conservative debt load, and a dividend policy that promises to stay above the average in a rising‑rate environment, the firm offers an attractive blend of yield and growth for investors willing to tolerate a certain level of sector risk. The article’s recommendation is clear: for those seeking a high‑yield REIT with a robust risk‑management framework, Modiv Industrial could be a valuable addition to a diversified portfolio.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4851358-modiv-industrial-small-high-yield-reit-taking-a-big-bet-on-the-fed ]