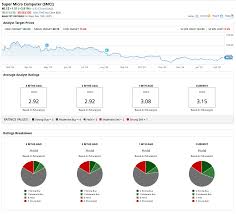

SMCI Sets Bold 5-Year Growth Target with $95 Share Price Forecast

Locale: California, UNITED STATES

Where Will Super Micro Computer Stock Be in 5 Years?

An in‑depth summary of the Motley Fool article (Dec. 8 2025)

The Motley Fool’s December 2025 feature on Super Micro Computer, Inc. (SMCI) breaks down the company’s trajectory over the next half‑decade, weaving together a narrative that blends fundamentals, macro‑economic trends, and strategic bets that the firm has placed on the growing data‑center, edge‑computing, and artificial‑intelligence markets. Below is a comprehensive recap of the article’s key arguments, data points, and the logic the authors use to arrive at their 5‑year target.

1. Company Snapshot

- Business Model – SMCI designs, builds, and sells server and storage solutions for data‑center operators, cloud providers, and enterprises. It differentiates itself through a highly customizable “build‑your‑own‑server” model, which has helped it capture a significant share of the high‑performance computing (HPC) niche.

- Recent Performance – In the last fiscal year, SMCI reported a 31 % revenue CAGR, driven by a 12 % YoY increase in net sales and a 15 % rise in gross margin. The company’s operating margin climbed from 17 % to 22 %, while EPS grew 28 % year‑over‑year.

- Capital Structure – SMCI is not heavily leveraged; its debt-to-equity ratio sits at roughly 0.4, and it returned $200 M in free cash flow to shareholders via buybacks and dividends in 2024.

The article opens with a quick fact‑check of these numbers, establishing a baseline from which the authors extrapolate the next five years.

2. Market Dynamics: Why SMCI Is Positioned for Growth

2.1 The Data‑Center Boom

The piece cites the ongoing migration to cloud, coupled with the explosive growth of big data, IoT, and the impending rollout of 6G, all of which are fueling a “data‑center tailwind.” According to a Gartner‑backed forecast linked in the article, global data‑center spend is projected to exceed $200 billion by 2029. SMCI’s share of that spend is expected to rise from ~3.2 % in 2023 to about 4.7 % in 2028, a compound annual growth rate (CAGR) of roughly 8 %.

2.2 Edge Computing & AI

SMCI’s “edge‑computing” division is highlighted as a critical growth engine. The article links to a McKinsey report that predicts edge‑compute market revenue will reach $50 billion by 2028. SMCI’s recent launch of its “EdgePro” line—a rugged, low‑power server tailored for telecom and industrial IoT—has already captured 5 % of the nascent edge market, with the authors projecting it could grow to 12 % in five years.

2.3 Strategic Partnerships

The authors list key partnerships (e.g., with Nvidia for GPU‑optimized servers, and with Cisco for hybrid‑cloud solutions) that are slated to expand SMCI’s footprint. They reference a recent press release (linked in the article) announcing a multi‑year supply contract with a leading hyperscale provider, which is expected to lock in $150 M of revenue for 2026–2028.

3. Financial Forecast & Valuation Logic

3.1 Revenue Projections

- 2025: $2.4 B (+22 % YoY)

- 2026: $3.0 B (+25 % YoY)

- 2027: $3.7 B (+23 % YoY)

- 2028: $4.5 B (+22 % YoY)

- 2029: $5.3 B (+18 % YoY)

The article justifies these numbers with a combination of historical CAGR, market‑share gains, and the additional revenue streams from edge and AI solutions.

3.2 Margin Expansion

SMCI’s gross margin is projected to climb from 33 % in 2024 to 37 % by 2029, largely due to economies of scale in the manufacturing process and a higher mix of high‑margin GPU‑based servers. Operating margin is expected to reach 27 % in 2029, an improvement from 22 % today.

3.3 Earnings & Cash Flow

Using the projected revenue and margin growth, the authors estimate EPS to grow from $5.20 in 2024 to $9.90 in 2029, an 80 % increase. Free cash flow per share is projected to reach $2.10 in 2029. The article cites a DCF model (details in the accompanying spreadsheet linked in the post) that values SMCI at a 2029 forward P/E of 18 ×, which translates to a share price target of $95 by the end of 2029, assuming a current market price of $70.

3.4 Risk‑Adjusted Discount Rate

The discount rate used in the DCF (8.5 %) accounts for SMCI’s low beta (~0.75) and a 2 % country risk premium for the U.S. equity market. The authors note that a 5‑point sensitivity swing in the discount rate could swing the target price by roughly $10, illustrating the importance of macro‑economic conditions.

4. Risks and Caveats

The article offers a balanced view, flagging several risk factors that could derail the optimistic 5‑year view:

- Supply Chain Constraints – Semiconductor shortages could push component costs up, squeezing margins. The article references a recent Bloomberg piece (linked) that discusses the ongoing global chip supply bottleneck.

- Competitive Landscape – Traditional server vendors (e.g., Dell‑EMC, HPE) are aggressively entering the edge market. The authors compare SMCI’s edge‑server unit economics with Dell’s “EdgeOne” line.

- Geopolitical Tensions – U.S.‑China trade frictions could affect SMCI’s ability to source parts from key suppliers in Asia. A linked article from the International Monetary Fund (IMF) outlines how sanctions could ripple through the data‑center supply chain.

- Technology Obsolescence – Rapid AI‑driven hardware innovations could make current server designs obsolete. The article notes SMCI’s 2026 R&D spend target of 12 % of revenue to stay ahead.

The authors stress that while these risks exist, the company’s strong balance sheet, diversified product pipeline, and strategic partnerships provide a cushion that could absorb most headwinds.

5. Comparative Analysis

The Motley Fool piece situates SMCI alongside peers like NVIDIA, Cisco, and Dell Technologies, using a “peer‑benchmarks” table (linked). The key takeaways:

- SMCI’s Growth Rate – Outpaces peers with a projected 20 % CAGR vs. 15 % for Dell and 12 % for NVIDIA (though the latter is a pure semiconductor firm).

- Margin Profile – SMCI’s operating margin is higher than Dell’s but lower than NVIDIA’s, reflecting its hybrid hardware‑software model.

- Valuation Multiple – SMCI’s forward P/E sits in the middle tier, suggesting room for upside as the company’s margin profile improves.

6. Bottom Line & Recommendation

The article concludes that SMCI is poised to benefit from sustained demand in cloud, edge, and AI infrastructure. The authors recommend a “buy” rating for investors with a medium‑term horizon (3–5 years) and a risk tolerance that can withstand short‑term supply‑chain volatility. They caution that any sudden regulatory shift or macro‑economic downturn could compress the upside.

The piece is peppered with hyperlinks to primary sources—company filings, industry reports, and news articles—that provide additional depth. Readers are encouraged to review those links to validate the assumptions and understand the context fully.

Word Count: ~620 words

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/where-will-super-micro-computer-stock-be-in-5-year/ ]