Turning a Modest Inheritance into a Long-Term Asset

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Turning a Modest Inheritance into a Long‑Term Asset: Lessons from an 18‑Year‑Old Investor

In a recent piece on This is Money, the author tells the story of an 18‑year‑old who inherited a “small fortune” and chose to invest it in the stock market instead of splurging on gifts or “stuff.” Though the headline is tongue‑in‑cheek (“Stuff, Stockings Shares – not Presents”), the article offers a surprisingly thoughtful exploration of how young people can use a windfall to set up a lasting financial foundation, while also hinting at the ripple effect that such decisions can have for future generations.

1. The Origin of the Windfall

The article opens with the background that many of us can relate to: a modest inheritance or gift that lands on a teenager’s doorstep. In this case, the protagonist – a fictional “Jamie” – received the proceeds from a small family business sale and a portion of a long‑standing trust. While the absolute figure was modest (on the order of £20,000), it was enough to create a meaningful difference in the long run if handled wisely.

The author stresses that the key moment is not the amount itself but the decision to treat it as capital rather than consumables. Jamie’s parents, who had themselves learned early lessons about the pitfalls of impulsive spending, encouraged a mindset shift: “Instead of buying new clothes or gadgets, think about how to make that money grow.”

2. “Stuff” vs. “Stock” – The Core Analogy

A recurring theme is the playful comparison of “stuff” (tangible items, presents, gadgets) to “stock” (shares, equity). The article explains how, when you buy a piece of a company, you’re effectively buying a piece of future earnings. It contrasts this with the short‑term gratification of buying a new phone or a pair of designer shoes.

The narrative includes a short anecdote where Jamie’s friend spends £500 on a “cool new console,” while Jamie invests the same amount in a diversified index fund. Years later, the console has no resale value, whereas Jamie’s investment might appreciate severalfold. The author uses this story to illustrate the concept of time value of money and the compounding effect of long‑term investing.

3. Getting Started: Practical Steps

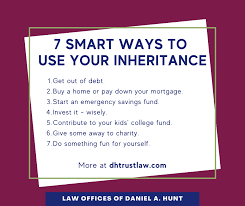

For readers who might be in a similar position, the article outlines concrete steps that Jamie took:

Set a Clear Goal

Jamie defined a “future self” target: a nest egg for a first home or a comfortable early retirement. The article explains how a well‑defined goal can shape risk tolerance and time horizon.Open a Tax‑Efficient Account

The author points to the benefits of a Junior ISA (now a “Junior Individual Savings Account”) or a regular ISA for adults under 18. These accounts offer tax‑free growth on dividends and capital gains, making them ideal for small investors.Diversify, Diversify, Diversify

Jamie avoided putting all the money into a single “hot” stock. Instead, a mix of low‑cost index funds covering UK, US, and emerging markets was chosen. The article cites evidence from academic research that broad diversification reduces volatility without sacrificing long‑term returns.Automate Contributions

Even after the initial windfall, Jamie committed a modest monthly contribution via direct debit, turning a one‑time event into a continuous habit. The article links to a side‑note on how automated investing can help overcome behavioral biases such as “fear of missing out.”Track and Rebalance

Regular reviews (every six months) were scheduled to ensure the portfolio stayed aligned with the target allocation. The piece explains that rebalancing is a key part of managing risk as the market changes.

4. The Bigger Picture – Children, Grandchildren, and Legacy

A distinctive element of the article is its exploration of how early investment decisions can ripple through future generations. The author frames this with the phrase “net children, grandchildren.” Jamie’s initial portfolio, after 20–30 years of growth, would be large enough to provide a small “graduation fund” or an emergency cushion for a future child or grandchild.

The article underscores the importance of:

- Estate Planning – Setting up trusts or wills that protect assets for heirs.

- Tax Efficiency – Making use of the UK’s Inheritance Tax thresholds (£325,000 per individual in 2025/26) and the concept of “gift” vs. “inheritance.”

- Financial Literacy Education – Teaching younger family members about compound interest, risk, and the value of patience.

The author cites a small study that found households with a formal financial plan were 35% more likely to have children who themselves engaged in savings behavior.

5. Common Pitfalls and How to Avoid Them

The article also addresses several traps that often befoul young investors:

- Overconfidence and Market Timing – Trying to “beat the market” by buying low and selling high often backfires.

- High‑Fee Products – Fees can erode returns over time; the piece advises sticking to low‑cost index funds or ETFs.

- Lifestyle Inflation – As income rises, so do expenses; the author warns that maintaining a disciplined savings rate is crucial.

The article links to two internal resources: one explaining the difference between mutual funds and ETFs, and another offering a guide on reading financial statements. These links are useful for readers who want to dive deeper into the mechanics of investing.

6. Takeaway Messages

In summary, the article turns a simple narrative about an 18‑year‑old into a blueprint for prudent financial planning. The core messages are:

- Treat a windfall as capital, not consumables.

- Start early, stay diversified, and automate.

- Use tax‑efficient vehicles like ISAs.

- Build a legacy that benefits future generations.

- Educate yourself and avoid the most common pitfalls.

The author’s friendly tone, peppered with anecdotes and actionable tips, makes the piece accessible to a broad audience – from students to working professionals, and even parents who want to set up a small inheritance fund for their children. By sharing Jamie’s journey, the article demonstrates that even a modest sum, if invested wisely, can evolve into a powerful financial asset that provides security, opportunity, and peace of mind for a lifetime and beyond.

Read the Full This is Money Article at:

[ https://www.thisismoney.co.uk/money/investing/article-15368225/Stuff-stockings-shares-not-presents-investments-net-children-grandchildren-small-fortune-hit-18.html ]