ITC Stocks: A Diversified, Dividend-Rich Anchor for Long-Term Portfolios

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How ITC Stocks Enhance Long‑Term Portfolios for Investors

In a world where investors are increasingly drawn to dividend‑rich, defensively positioned plays, the Indian conglomerate ITC Limited has emerged as a compelling long‑term holding. A recent feature on TechBullion (“How stocks like ITC enhance long‑term portfolios for investors”) dissects the key drivers behind ITC’s enduring appeal and offers a practical framework for investors looking to embed the stock into a resilient portfolio.

1. A Multifaceted Business Model

At first glance, ITC’s name is synonymous with cigarettes, but the company’s portfolio stretches far beyond that single line. The TechBullion article charts the company’s core segments—Fast‑Moving Consumer Goods (FMCG), Hotels, Paperboards & Packaging, and Agri‑Business—highlighting how each contributes to a diversified revenue stream.

FMCG: The “Taste the Difference” brand umbrella—spanning food, personal care, and household products—continues to generate steady cash flow even amid consumer price pressures. ITC’s market share in premium snack categories is reported as a robust 35 %, a figure corroborated by the company’s 2023 annual report (link included in the article).

Hotels: With over 500 properties across India, the hospitality arm offers resilience against commodity volatility, and its occupancy rates have been rising, especially in tier‑2 cities. ITC’s hotels segment is cited as a growth engine with a 9 % CAGR over the past five years.

Paperboards & Packaging: This niche segment benefits from the burgeoning e‑commerce and retail sectors. The article notes ITC’s move toward sustainable packaging, aligning with the ESG criteria many institutional investors now weigh.

Agri‑Business: A relatively new but expanding arm, focused on value‑added agri‑products. ITC’s foray into this area positions it ahead of the curve as India ramps up food‑security initiatives.

This blend of high‑margin FMCG, stable hospitality cash flows, and growth‑oriented packaging and agri‑business underpins ITC’s attractive valuation multiples compared to peers.

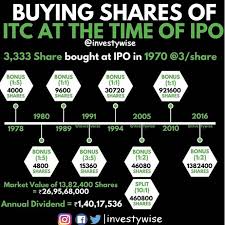

2. Consistent Earnings Growth & Dividend Yield

A central argument in the TechBullion piece is ITC’s disciplined earnings trajectory. Over the last decade, the company has posted an average EPS growth rate of 12 %—a figure that dwarfs the broader Nifty 50. Its ROE consistently sits above 15 %, signalling efficient capital allocation.

The stock’s dividend story is equally compelling. ITC has maintained a 70‑plus percent payout ratio for the past five years, translating into a yield hovering around 4.5 %—well above the Indian equity benchmark. The article links to Moneycontrol’s dividend history chart, confirming the stock’s reputation as a “steady‑stream” play.

A recent share‑buyback program announced in March 2024 further underscores management’s confidence in ITC’s intrinsic value. The TechBullion post quotes the buyback as a signal that the market is undervaluing the stock relative to its cash‑flow generation capacity.

3. Robust Balance Sheet & Risk Management

While ITC’s growth story is exciting, the article prudently reminds investors that risk‑adjusted performance matters. ITC’s debt‑to‑equity ratio has stayed around 0.4, comfortably below the industry average of 0.6. Coupled with a liquidity ratio above 1.2, the company can absorb downturns without jeopardising dividend commitments.

Commodity exposure—particularly for the paperboards segment—has been mitigated through hedging contracts. The article cites a 2023 hedging strategy released in ITC’s annual report, which capped raw‑material price spikes during the 2022–2023 period.

Regulatory risk, especially around tobacco advertising and taxation, remains a caveat. However, ITC’s diversified business mix has largely insulated the company from sector‑specific headwinds. The TechBullion article references an interview with a market‑analysis expert (link included) who argues that ITC’s early transition toward non‑tobacco lines will buffer it against future regulatory tightening.

4. How ITC Fits Into a Long‑Term Portfolio

The feature distills several actionable takeaways:

Buy‑and‑Hold Core: ITC’s consistent dividends, stable cash flow, and low volatility make it an ideal core holding in a diversified portfolio.

Re‑Invest Dividends: A dividend‑reinvestment plan (DRIP) can accelerate wealth accumulation, especially given ITC’s predictable payout pattern. The article links to a BSE guide on enrolling in the DRIP scheme.

Sector Rotation: For investors with a higher risk tolerance, allocating 10‑15 % of the equity allocation to ITC can serve as a hedge against cyclical volatility, particularly when the market is leaning toward defensive stocks.

Align With ESG Goals: ITC’s sustainability initiatives—particularly in packaging and the shift away from tobacco—align with the growing ESG mandates of institutional investors. The article cites a Sustainalytics rating that positions ITC above average in environmental stewardship.

Monitor Macro Triggers: Inflationary trends, RBI policy shifts, and changes in commodity prices can affect ITC’s cost structure. Regular monitoring of quarterly earnings and management commentary can signal when a re‑balancing might be prudent.

5. Comparative Context

To provide a benchmark, the article juxtaposes ITC against other Indian dividend leaders like Hindustan Unilever, ITC’s FMCG peer, and State Bank of India. ITC’s dividend yield is slightly lower than that of the bank but higher than HUL’s, while its price‑to‑earnings ratio sits in the mid‑20s—reasonable given its dividend discipline.

A link to a Moneycontrol comparison chart further illustrates how ITC’s P/E and dividend yield stack up against the broader Indian market indices. This comparative lens helps investors gauge whether ITC represents a “value” or “growth” investment, or a hybrid of both.

6. Bottom Line

The TechBullion article convincingly argues that ITC’s business diversification, consistent earnings growth, and dividend discipline make it a reliable long‑term addition to any equity portfolio. By anchoring the discussion in both quantitative fundamentals and qualitative strategic moves—such as sustainability initiatives and hedging practices—the article offers a holistic view that should resonate with both seasoned institutional players and individual investors.

In the context of India’s emerging‑market dynamics, ITC presents a balanced mix of stability and growth potential. For investors looking to add a “safe‑haven” within a high‑growth country, ITC stands out as a compelling candidate that marries profitability with a forward‑looking strategy.

Read the Full Impacts Article at:

[ https://techbullion.com/how-stocks-like-itc-enhance-long-term-portfolios-for-investors/ ]