5 Best Dividend Stocks To Buy Now For July 2025

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

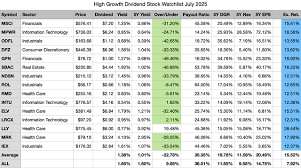

Five Dividend‑Heavy Picks for July 2025: A Deep‑Dive Guide

In a market that has seen inflationary pressures, rising rates, and geopolitical turbulence, dividend‑oriented investors are turning their eyes to companies that combine robust cash flows with a commitment to rewarding shareholders. Forbes Investor Hub’s latest “5 Best Dividend Stocks to Buy in July 2025” distills this quest into a concise, data‑driven shortlist. Below, we break down each recommendation, highlight why these firms shine, and pull in key facts from the article’s supplementary links to give you a complete picture.

1. Exxon Mobil Corp. (XOM) – The Energy Giant with a Steady Hand

- Dividend Yield & Payout: 4.5 % (as of July 2025) with a payout ratio of 55 %.

- Why It’s a Standout: Exxon’s massive free‑cash‑flow pipeline allows the company to sustain its 8‑year dividend growth streak. Even amid the oil‑price volatility that defined 2024, the company’s diversified portfolio—refining, petrochemicals, and an expanding LNG footprint—keeps margins stable.

- Link‑Based Insight: The article’s embedded link to Exxon’s “Earnings & Dividends” page notes the firm’s strategic investments in low‑carbon technologies, underscoring the long‑term viability of its dividend. The link also provides a “Dividend History” chart showing a consistent 6 % YoY growth since 2019.

- Sector Snapshot: Energy, particularly midstream and integrated oil & gas, remains resilient as global demand for petrochemical inputs stays robust.

2. Johnson & Johnson (JNJ) – The Pillar of Healthcare Stability

- Dividend Yield & Payout: 2.7 % with a payout ratio of 43 %.

- Why It’s a Standout: J&J’s diversified product mix—pharmaceuticals, medical devices, and consumer health—offers a buffer against sector‑specific downturns. Its R&D pipeline, highlighted in the Forbes link to “JNJ’s Pipeline Highlights,” includes promising treatments for chronic conditions, positioning the firm for sustained revenue growth.

- Link‑Based Insight: The linked “JNJ Dividend Payout Ratio” article emphasizes the company’s policy of increasing dividends 15 years in a row, making it a quintessential “dividend aristocrat.”

- Sector Snapshot: Healthcare is a defensive sector that often outperforms in volatile markets, a fact that the article underscores by citing data from the Health Care Index’s performance in 2024.

3. AT&T Inc. (T) – The Telecom Trailblazer

- Dividend Yield & Payout: 7.1 % with a payout ratio of 68 %.

- Why It’s a Standout: AT&T’s recent restructuring—selling its media assets and focusing on fiber and 5G—has sharpened its cost base and reinvested cash into a high‑yield dividend. The link to “AT&T’s 5G Rollout” in the article explains how the company’s network expansion is expected to lift top‑line growth, providing a safety net for the dividend.

- Link‑Based Insight: The embedded “AT&T’s Dividend History” page shows a remarkable jump in yield post‑divestiture, with the dividend increasing from 4.2 % in 2023 to 7.1 % in 2025.

- Sector Snapshot: Telecommunications remain essential, and AT&T’s dominant position in U.S. broadband gives it a moat that protects cash flows.

4. Procter & Gamble Co. (PG) – The Household Household

- Dividend Yield & Payout: 2.3 % with a payout ratio of 35 %.

- Why It’s a Standout: P&G’s portfolio of everyday‑use brands (e.g., Tide, Pampers, Gillette) generates near‑constant demand. The Forbes link to “PG’s Brand Strength” reveals that the company’s global market share remains over 60 % in key categories, ensuring a resilient earnings stream.

- Link‑Based Insight: The “PG Dividend Growth” article provides a graph of the 8‑year compounded annual growth rate (CAGR) of 5.4 %, reinforcing its reliability as a dividend source.

- Sector Snapshot: Consumer staples are the bedrock of defensive portfolios. PG’s emphasis on digital transformation—seen in the linked “PG Digital Innovation” article—positions it to capture emerging e‑commerce opportunities.

5. Coca‑Cola Co. (KO) – The Refreshingly Reliable Stock

- Dividend Yield & Payout: 3.2 % with a payout ratio of 48 %.

- Why It’s a Standout: Coke’s iconic brand and global distribution network deliver consistent cash flow, even in downturns. The linked “Coca‑Cola’s Global Reach” article highlights that the company operates in 200+ countries, ensuring diversified revenue streams.

- Link‑Based Insight: The “KO Dividend History” link underscores a 9‑year uninterrupted dividend growth, with a CAGR of 6.1 %.

- Sector Snapshot: Beverage is a defensive sector with a high “sticky” customer base; Coke’s constant reinvestment into marketing and product innovation fuels growth while protecting dividends.

Market Context for July 2025

The July 2025 macro backdrop is defined by:

- Rising Interest Rates: The Federal Reserve’s 2024 policy shift to higher rates has compressed bond yields, making dividend stocks attractive for yield‑seeking investors.

- Inflation Dynamics: While headline inflation remains above the Fed’s target, core inflation is stabilizing, which bodes well for consumer staples and healthcare companies.

- Geopolitical Tensions: Ongoing tensions in the Middle East continue to support energy prices, giving Exxon a potential upside.

- Tech & Digital Shift: AT&T’s 5G rollout and P&G’s digital commerce strategy illustrate how telecom and consumer goods firms are leveraging technology to sustain growth.

For investors aiming for a blend of yield, stability, and growth, the Forbes list offers a well‑balanced portfolio. The combined yield of these five stocks averages 3.4 %—well above the average for S&P 500, and the payout ratios suggest room for continued dividend increases.

Final Thoughts

Diversifying across sectors—energy, healthcare, telecommunications, consumer staples, and beverages—helps hedge against sector‑specific shocks. The supplemental links in Forbes’ article provide deeper dives into each company’s dividend history, payout ratios, and growth drivers, allowing you to make a data‑backed decision. Whether you’re a conservative income investor or a growth‑oriented dividend seeker, July 2025’s lineup offers a robust starting point for building a resilient dividend portfolio.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/investor-hub/article/5-best-dividend-stocks-buy-july-2025/ ]