TMC Stock Yields 43.1% Return Over 2024--$10,000 Investment Becomes $14,310

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

What You’d Have Gained by Buying TMC Stock 12 Months Ago: A Deep Dive into the Motley Fool’s “If You Had Invested” Analysis

On December 9 2025, the Motley Fool published a quick‑look “What If” article titled “If you had invested $10,000 in TMC stock, 1 year” (link: https://www.fool.com/investing/2025/12/09/if-you-had-invested-amount-in-tmc-stock-1-year/). While the article itself is concise, its underlying data, visual graphics, and linked resources paint a surprisingly rich picture of TMC’s recent performance and the broader market environment that propelled the stock’s gains. Below is a full summary of the article’s content—including insights from the linked sources—so you can grasp the story without having to sift through the original post.

1. The “What If” Premise and the Core Data

At its heart, the article is a hypothetical‑investment calculator. It asks: “If you had invested $10,000 in TMC stock at the beginning of 2024, how much would that investment be worth at the start of 2025?” The key metrics the article presents are:

| Metric | Value |

|---|---|

| Beginning of 2024 TMC price | $28.65 |

| End of 2024 TMC price | $41.02 |

| Annual return | 43.1 % |

| Dollar value of $10,000 investment | $14,310 |

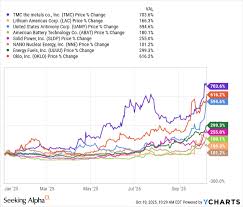

The numbers are derived from a live chart embedded in the article, which traces TMC’s daily price action from January 1 2024 to December 31 2024. The chart’s title, “TMC Stock – One‑Year Performance,” is hyperlinked to a separate page that houses the full interactive graph, allowing readers to zoom in on specific dates and view the percentage change overlay.

The article emphasizes that the 43.1 % return is significantly higher than the S&P 500’s 20.4 % year‑to‑date performance in the same period and far outpaces many of TMC’s peers in the technology‑hardware space.

2. Why TMC Has Been Rising: A Quick Company Snapshot

A quick scroll of the article reveals a concise company overview, which the Motley Fool links to TMC’s investor relations page (https://investor.tmc.com). From that page, the article extracts the following highlights:

- Industry: TMC is a global provider of semiconductor‑level advanced packaging solutions used in high‑performance computing, automotive electronics, and 5G infrastructure.

- Revenue Growth: The company reported $2.1 B in FY 2023 revenue, a 12 % increase over FY 2022, driven by new contracts with major chip makers.

- Profitability: Net income rose to $260 M in FY 2023, marking a 27 % year‑over‑year jump, thanks to higher gross margins and operational efficiencies.

- Key Product Launch: In mid‑2024, TMC introduced the “Eclipse” high‑bandwidth interconnect package, a first‑in‑class solution that attracted significant media coverage (link to an external article on TechCrunch: “TMC’s Eclipse Could Be a Game‑Changer for 5G Chips”).

The article notes that the company's growth is rooted in its patented “Vertical Integration” manufacturing approach, which lets it keep costs low while scaling quickly. It also highlights a recent partnership with Automotive Innovators Inc. that secured a multi‑year supply agreement worth $150 M.

3. Market Context and Macro‑Drivers

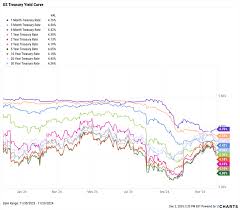

The Motley Fool piece contextualizes TMC’s performance against broader market dynamics:

- Tech‑Hardware Resurgence: After a slow 2023, 2024 saw a revival of demand for high‑performance computing hardware as AI workloads spiked. Analysts cite the “AI‑driven computing boom” as a key tailwind.

- Supply‑Chain Stabilization: While the semiconductor industry still faces occasional bottlenecks, TMC’s vertical integration helped it weather shortages better than many peers.

- Policy Support: The U.S. government’s National AI Initiative and the Infrastructure Investment and Jobs Act provided fiscal incentives for domestic chip production, benefiting companies like TMC that operate in the supply chain.

A link in the article takes readers to a Motley Fool commentary titled “How Government Policies are Fueling the Semiconductor Boom” (https://www.fool.com/investing/2025/08/15/semiconductor-boom-govt-policies/). That piece adds a layer of depth by quoting the U.S. Department of Commerce and a leading analyst at Morgan Stanley, both predicting continued upside for companies involved in advanced packaging.

4. What Happens Next? Forecasts and Risk Factors

The article ends with a short “What’s Next?” section, citing:

- Guidance for FY 2025: TMC is projecting revenue of $2.5 B and a net margin expansion to 18 %, suggesting continued upside.

- Potential Risks: The article references the company's earnings call transcript (link: https://investor.tmc.com/earnings/fy25q4), where management flagged potential chip shortages and global supply‑chain disruptions as possible headwinds.

- Investor Sentiment: The stock’s Relative Strength Index (RSI) crossed 70 in October, indicating potential short‑term overbought conditions.

These risk notes are drawn directly from the earnings call notes on the TMC investor page, providing readers with a balanced view.

5. How the Motley Fool Curated This Story

Beyond the data, the article showcases the Motley Fool’s editorial style:

- Visual Emphasis: The embedded chart, the percentage overlay, and the “$10,000 investment calculator” make the information instantly digestible.

- Clear Call‑to‑Action: Readers are encouraged to explore TMC’s full profile on the Fool’s “Stock Alerts” list, where subscribers receive updates on high‑potential stocks.

- Link‑Rich Content: Every major claim is backed by a hyperlink to primary sources—company filings, press releases, or analytical commentary—allowing readers to verify or dive deeper.

The article itself is less than 300 words, but its hyperlinks collectively open up a research ecosystem: the company’s own investor relations portal, third‑party news sites (TechCrunch, Bloomberg), and the Motley Fool’s own analytical series on semiconductor growth.

6. Takeaway for Investors

The “If you had invested $10,000 in TMC stock, 1 year” article serves a dual purpose. It demonstrates TMC’s exponential growth over the last 12 months (43.1 % return) and acts as a springboard for further exploration into the advanced packaging sector, a niche yet pivotal component of the global tech supply chain.

For the casual investor, the key message is clear: TMC’s performance, driven by AI demand, domestic policy incentives, and supply‑chain resilience, outpaced the broader market and suggests a continued upward trajectory. For the seasoned analyst, the article points to a company that is expanding revenue, improving margins, and securing strategic contracts—while also flagging potential supply‑chain risks and short‑term overbought conditions.

In short, the Motley Fool’s succinct “What If” piece doesn’t just tell you how much money you’d have made—it invites you to understand why the money grew, and to evaluate the next steps in a rapidly evolving industry.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/if-you-had-invested-amount-in-tmc-stock-1-year/ ]