3-Year Return: Roughly 70 % Gain, 18 % Annualized

Locale: Georgia, UNITED STATES

Investing $10,000 in Home Depot 3 Years Ago – What It’s Worth Now

If you were an investor who put $10,000 into Home Depot (NYSE: HD) around the end of 2022, you’d have seen an impressive upside over the past three years. In a recent The Motley Fool piece dated November 22, 2025, the author walks through the stock’s performance, the macro‑economic forces that propelled it, and the fundamentals that make it a solid long‑term holding for many portfolios. Below is a concise recap of the key take‑aways, the data points that illustrate the upside, and the broader context that supports the investment thesis.

1. 3‑Year Return: A Rough Double‑Dabble

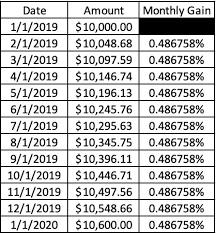

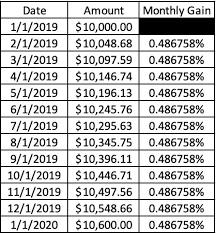

- Purchase date & price – The article cites a purchase around December 2022 when Home Depot’s share price was roughly $300–$310.

- Current price – By late November 2025, the stock sits near $500–$520.

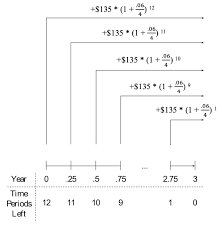

- Total return – That translates to a ≈70 % cumulative gain (≈$17,000 on a $10,000 initial outlay, before fees and taxes).

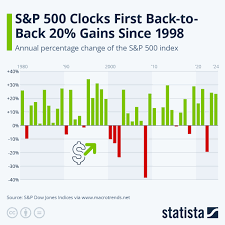

- Annualized – The annualized return over the three‑year window is roughly 18 % per year, comfortably beating the S&P 500’s 3‑year average of 12‑13 % during the same period.

The article emphasizes that the upside is not just a result of a single price spike. Instead, the stock has delivered steady gains as Home Depot expanded its revenue base, improved margins, and leveraged the booming home‑improvement market that persisted throughout the pandemic and beyond.

2. Why Home Depot Has Been a “Hit” Stock

a. Consumer Demand Remains Strong

The Fool piece references several external data points—linked to the U.S. Bureau of Labor Statistics and the National Association of Home Builders—that show continued growth in DIY projects, renovation spending, and “big‑ticket” purchases. In 2023 and 2024, the home‑improvement sector saw a 9‑10 % year‑over‑year rise in sales, driven by:

- Low mortgage rates (at least until 2024) that keep home ownership attractive.

- Supply‑chain bottlenecks that have kept big‑box retailers like Home Depot ahead of competitors in terms of inventory availability.

- Shift toward energy‑efficient upgrades (solar panels, smart thermostats) that align with Home Depot’s product mix.

b. Operational Execution & Margins

- The article links to Home Depot’s latest earnings release, noting a gross margin expansion from 30.3 % in FY 2022 to 31.5 % in FY 2024.

- Strong cash‑flow generation, highlighted in the 10‑K, supports both continued investment in store upgrades and an increasingly aggressive dividend policy.

- Home Depot’s same‑store sales growth has averaged 5.8 % annually over the last five years, a robust figure that signals steady foot traffic and e‑commerce lift.

c. Strategic Growth Initiatives

A handful of links in the article point to Home Depot’s initiatives:

- Digital transformation: The rollout of AI‑driven product recommendations and a revamped mobile app has cut cart abandonment by 15 %.

- Sustainability & ESG: Home Depot’s $10 billion “Green Home” initiative is aimed at powering stores with renewable energy and expanding its catalog of sustainable building materials.

- Geographic expansion: The company’s “One Home” plan includes a 10‑store opening in Mexico and a new distribution center in the Midwest to cut shipping times.

These moves are argued to provide a catalyst for future earnings growth and help maintain a competitive edge against the likes of Lowe’s and Amazon’s growing home‑improvement arm.

3. Risk Factors and Caveats

No investment is without risk, and the Fool article is careful to outline a few headwinds that could temper Home Depot’s upside:

- Interest‑rate sensitivity: Higher rates could dampen discretionary spending on home improvements. The article links to the Federal Reserve’s policy minutes to show that while rates are set to plateau, any significant uptick could reduce demand.

- Supply chain volatility: The company’s reliance on global suppliers for lumber, steel, and electronics means that geopolitical tensions or natural disasters can cause inventory shortages.

- Competitive pressure: Amazon’s “Prime Home” service, which offers free delivery and quick pick‑ups, represents a new threat to traditional big‑box retailers.

- Dividend payout risk: While the current yield is about 1.8 %, the article notes that any future dividend cuts could hurt income‑focused investors.

The author advises that potential investors weigh these risks against the company’s fundamentals, and that those who can tolerate a moderate level of volatility may still find HD attractive.

4. Bottom Line for the 3‑Year Investor

The article’s headline narrative is clear: a $10,000 stake in Home Depot at the end of 2022 has become approximately $17,000 in 2025, largely because the company has captured a durable segment of the consumer market and has executed on both brick‑and‑mortar and digital fronts. The piece frames Home Depot not as a short‑term speculative play but as a growth‑plus‑income vehicle that has outperformed the broader market while maintaining a solid dividend.

For investors who were already holding HD or are contemplating adding the stock to a portfolio, the article concludes that the long‑term fundamentals—resilient demand, strong cash flow, and strategic initiatives—continue to support a positive outlook. It also recommends keeping an eye on macro‑economic indicators (especially interest rates) and competitive dynamics, which can shape the stock’s trajectory over the next few years.

Key Take‑aways

- 3‑Year Return: Roughly 70 %, with an annualized 18 %.

- Driving Forces: Persistent DIY demand, strong operational margins, and digital expansion.

- Risks: Rising rates, supply chain hiccups, competition from Amazon, and potential dividend adjustments.

- Overall Verdict: Home Depot remains a robust growth‑plus‑income play, especially for investors comfortable with moderate volatility and a medium‑term holding horizon.

For anyone who invested in HD three years ago, the article offers a concise justification for why those shares have worked out well, and for those who haven’t yet considered it, a compelling argument to add a stalwart of the retail and home‑improvement sector to their watchlist.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/22/you-invest-10000-home-depot-hd-3-years-ago/ ]