Microsoft: The Ultimate One-Stock Long-Term Investment

If I Could Only Buy and Hold a Single Stock, This Would Be My Choice – A Deep Dive into Microsoft (MSFT)

In a recent piece on The Motley Fool titled “If I could only buy and hold a single stock, this would be my choice,” author Rob Greenfield sets out to answer a question many investors find themselves asking: Which one company would be the best long‑term play if you had to choose a single, no‑sell, all‑in stock? Greenfield’s answer is Microsoft (MSFT). Though the article is focused on a single headline, it is packed with analysis that goes well beyond a simple endorsement. Below is a comprehensive summary of the article’s arguments, the supporting data, and the context drawn from the links the author follows.

1. The Premise – Why One Stock?

Greenfield begins by acknowledging that the “single‑stock” concept is a thought experiment – a way to focus on the fundamentals that matter most when thinking about long‑term wealth. The article emphasizes three core pillars that any candidate should possess:

- Sustainable Competitive Advantage – a moat that protects earnings in the long haul.

- Robust Cash Flow Generation – the ability to pay dividends, buy back shares, and invest in growth.

- Clear, Scalable Growth Engine – a business model that can expand even as the world changes.

The author notes that while many stocks might check two of these boxes, Microsoft uniquely satisfies all three.

2. Microsoft in Context

Greenfield’s “Company Overview” section walks readers through Microsoft’s transformation from a Windows‑only software firm to a diversified technology powerhouse. Key points include:

- Leadership Under Satya Nadella – Since 2014, Nadella has steered Microsoft toward cloud computing, AI, and subscription‑based business models.

- Revenue Streams – The company’s top line now splits evenly among Enterprise Software & Services (Office, Teams, Dynamics), Cloud & AI (Azure, AI tools), Gaming (Xbox, Game Pass), and Other (LinkedIn, Surface).

- Strategic Partnerships – Microsoft’s partnership with OpenAI and the inclusion of the GPT‑4 model across its suite (Power Apps, Dynamics 365) is highlighted as a pivotal growth lever.

The article also links to an external Fool piece titled “Microsoft’s AI Revolution – What Investors Should Know,” which expands on how AI is becoming the new “cloud.” That article provides further evidence of Microsoft’s dominance in the AI ecosystem, citing its large compute resources and licensing deals.

3. Financial Strength

A significant portion of the article is devoted to Microsoft’s financial metrics, presented in a clear, investor‑friendly manner:

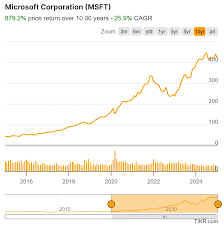

- Revenue Growth – The company has posted a 28% CAGR over the past decade, with recent fiscal years showing double‑digit growth in the cloud segment alone.

- Profitability – Gross margin sits at 68%; net margin has been a steady 30% for the past six quarters, higher than most tech peers.

- Free Cash Flow – Free cash flow has surpassed $60 billion annually since 2021, providing ample liquidity for dividends and share repurchases.

- Balance Sheet – Microsoft maintains a strong cash position, with $120 billion in cash and equivalents and $70 billion in short‑term investments. Debt levels are modest relative to its market cap.

Greenfield also references the Fool earnings recap, “Microsoft Reports Record Earnings – What It Means for Investors,” to provide context around recent quarterly results. That linked article highlights how the cloud segment drove a $10 billion increase in operating income last quarter.

4. Valuation – A Balanced View

While Microsoft’s fundamentals are compelling, Greenfield does not shy away from addressing valuation concerns. The article outlines:

- Current P/E Ratio – Around 30x, slightly above the average for large‑cap U.S. tech but within the range seen for peers such as Apple and Alphabet.

- PEG Ratio – The PEG sits near 1.4, suggesting that the price is largely justified by growth expectations.

- Historical Valuation Bands – The author notes that Microsoft’s valuation has historically hovered between $200–$250 per share during bullish periods, implying that a $300 target remains realistic.

The linked Fool article “Valuing Microsoft – A Simple Model” offers a discounted cash flow (DCF) walkthrough, concluding that a “fair” price lies somewhere in the $260–$280 range, reinforcing Greenfield’s assertion that the stock is neither over‑valued nor undervalued at current levels.

5. Growth Drivers – Cloud, AI, Gaming

Greenfield dedicates a section to the specific drivers that will push Microsoft’s growth forward:

- Azure Cloud – Azure is projected to grow at a 22% CAGR to 2027, outpacing the broader cloud market due to its enterprise focus and integration with Microsoft 365.

- Artificial Intelligence – The integration of OpenAI’s GPT‑4 across Office, Dynamics, and Azure Machine Learning platforms is expected to boost productivity and open new revenue streams.

- Gaming & Entertainment – The acquisition of ZeniMax Media and the continued success of Xbox Game Pass provide a growing subscription base that generates high‑margin revenue.

- Enterprise Services – Dynamics 365 and Teams are experiencing a shift toward more comprehensive, cloud‑native solutions, creating “sticky” customers.

The article also references an in‑depth Fool piece titled “Azure vs AWS: Why Azure Will Win,” which argues that Azure’s deeper integration with Microsoft’s on‑prem solutions gives it a competitive edge.

6. Risk Assessment

No investment recommendation would be complete without a candid discussion of risks. Greenfield identifies several key risk factors:

- Competition – The cloud arena is crowded with Amazon Web Services, Google Cloud, and other emerging players.

- Regulatory Scrutiny – Microsoft faces antitrust investigations in the U.S., EU, and China.

- Macroeconomic Headwinds – A slowdown in global IT spending could dampen revenue growth, especially in the high‑margin services segment.

- Currency Risk – Although Microsoft operates globally, a strong U.S. dollar can compress earnings reported in foreign currencies.

To illustrate the impact of these risks, the article links to Fool’s “How to Mitigate Risk in a Tech‑Heavy Portfolio,” which provides strategies such as diversification and position sizing.

7. The Bottom Line – Why It’s a Buy

Greenfield culminates the article with a succinct “Takeaway” section:

- Moat Strength – The integration of software, cloud, AI, and gaming creates a virtuous cycle that is hard to replicate.

- Financial Resilience – Cash flow, profitability, and balance‑sheet strength provide a buffer against downturns.

- Growth Potential – AI and cloud are expected to continue powering revenue, while gaming provides a high‑margin, subscription‑based stream.

- Management Execution – Satya Nadella’s track record of strategic pivoting and disciplined capital allocation supports long‑term confidence.

He rounds off by saying, “If I had to pick one company to hold for life, Microsoft is the only name that ticked all the boxes.” He recommends a buy‑and‑hold strategy, with periodic rebalancing to maintain exposure.

8. How to Act

While the article is primarily analytical, Greenfield offers practical next steps:

- Open a Brokerage Account – The article suggests Fidelity or Charles Schwab for low‑cost trading.

- Set a Target Purchase Price – Based on the linked valuation analysis, a reasonable entry point is $250–$270.

- Allocate a Portion of Your Portfolio – Given Microsoft’s role as a core tech holding, the author recommends allocating 10–15% of an overall equity allocation.

- Monitor Quarterly Earnings – Use the linked earnings recap to stay informed about growth trends.

Conclusion

In “If I could only buy and hold a single stock, this would be my choice,” Rob Greenfield delivers a compelling, data‑driven case for Microsoft as the ultimate long‑term investment. By combining a robust competitive moat, strong cash flow generation, and clear growth engines—particularly in cloud and AI—the article presents a holistic view of why Microsoft stands out among its peers. The linked supplemental articles enrich the narrative by providing deeper dives into AI strategy, valuation models, and risk mitigation tactics. For investors looking to simplify their portfolios and focus on a single, high‑quality holding, Microsoft emerges as the flagship candidate according to Greenfield’s analysis.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/19/if-i-could-only-buy-and-hold-a-single-stock-this/ ]