AI Surge Mirrors Dot-Com Bubble: Investor Red Flags Emerge

Locale: California, UNITED STATES

Is the AI Boom Becoming a Bubble? A Comprehensive Investor’s Guide

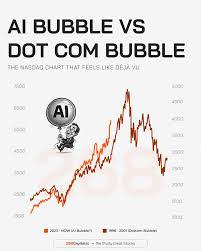

The artificial‑intelligence (AI) wave has swept markets in 2024–2025 with a vigor reminiscent of the dot‑com frenzy of the late 1990s. Stock prices for key AI‑centric names have surged, venture capital pours billions into start‑ups, and mainstream media touts the technology as the next “industry of the future.” Yet beneath the hype, the question has emerged: Is the AI boom turning into a bubble? The Motley Fool’s December 7, 2025 article “Is the AI boom becoming a bubble? Here’s what investors need to know” tackles this dilemma head‑on, breaking down the evidence for and against a bubble, and offering practical advice for investors navigating the terrain.

1. The Anatomy of the Current AI Surge

1.1. Valuations in the Spotlight

- High Forward P/E Ratios: AI‑heavy stocks such as NVIDIA, Alphabet, and Meta trade at forward price‑to‑earnings multiples exceeding 50x, well above the long‑term average for the broader market (~16x).

- Revenue Growth Expectations: Forecasts often project compound annual growth rates (CAGR) for AI companies in the 40–70% range over the next five years.

- Margin Expansion Assumptions: Many analysts assume rapid scale‑up will erode cost‑to‑serve and lift gross margins from ~60% to >70% in a few years.

1.2. Market Size and Growth Projections

- AI Market Forecasts: Gartner and IDC estimate that AI services and infrastructure will reach $1.3 trillion by 2030, a growth rate of roughly 30% CAGR.

- Enterprise Adoption: The article cites research showing that 85% of Fortune 500 firms now integrate some form of machine learning or NLP into core operations, underscoring demand.

2. Arguments That the AI Boom Is a Bubble

2.1. Historical Comparisons

- Dot‑Com Parallels: The article points out that tech valuations in the early 2000s were similarly inflated, driven by over‑optimistic expectations of revenue generation from internet services.

- Rapid Price Corrections: Several AI names have already seen price corrections of 20–30% in the past 12 months, a sign of market re‑balancing.

2.2. Over‑Optimistic Growth Metrics

- Saturation of Core Segments: In cloud‑based AI services, the competitive moat is eroding as hardware cost declines and new entrants (e.g., ARM‑based AI chips) enter the market.

- Data Scarcity Concerns: Many AI models rely on proprietary data sets that are costly and hard to replicate, limiting scalability for rivals.

2.3. Regulatory and Ethical Risks

- Privacy Legislation: Upcoming EU GDPR‑like rules for AI may impose heavy compliance costs.

- AI Safety Backlash: High‑profile incidents involving biased or unsafe models could lead to tighter regulation and consumer wariness.

2.4. Macro‑Economic Headwinds

- Interest Rate Hikes: The Fed’s aggressive tightening reduces the present value of long‑term growth prospects, pressurizing valuations.

- Supply‑Chain Bottlenecks: The semiconductor crunch and geopolitical tensions affect the supply of high‑performance GPUs critical to AI work.

3. Counter‑Arguments: Why the AI Boom Might Persist

3.1. Substantial Fundamentals

- Profitability Trajectory: Companies like NVIDIA already generate operating profits exceeding $10 billion, with revenue growth outpacing the broader tech sector.

- Capital Efficiency: High free‑cash‑flow yield of 10–12% for AI leaders suggests sustainability beyond hype.

3.2. Breadth of Application

- Sector Coverage: AI isn’t limited to consumer electronics; it’s transforming logistics, healthcare, finance, and autonomous vehicles.

- Cross‑Industry Synergy: AI adoption in manufacturing (Industry 4.0) and agriculture is expected to unlock new revenue streams.

3.3. Competitive Dynamics

- First‑Mover Advantage: Companies that develop proprietary hardware (e.g., NVIDIA’s CUDA platform) lock in a developer ecosystem that is hard to replicate.

- Network Effects: Larger AI ecosystems benefit from data aggregation, creating a virtuous cycle of performance improvement and user acquisition.

4. Investor Takeaways & Strategies

| Risk | What to Watch | Mitigation Tactics |

|---|---|---|

| Valuation Overstretch | P/E > 60x, high EV/Revenue multiples | Focus on firms with strong cash flow, consider buying at a discount to historical multiples. |

| Regulatory Shock | Data privacy, AI safety laws | Diversify across regions; favor companies with strong compliance frameworks. |

| Technological Obsolescence | Rapid hardware evolution | Invest in firms with R&D pipelines and patents; avoid sole reliance on a single chip supplier. |

| Macroeconomic Shocks | Rising rates, inflation | Hedge with high‑quality dividend stocks; allocate a portion to defensive AI themes (healthcare). |

| Competitive Entry | New entrants lowering margins | Look for companies with defensible ecosystems or superior cost structures. |

Long‑Term Playbook

- Blend Growth and Value: Allocate a balanced portion to high‑growth AI specialists and a defensive slice to more mature, diversified technology conglomerates.

- Consider ETFs: Broad‑based AI ETFs (e.g., ARK AI ETF, Global X Robotics & Artificial Intelligence ETF) can provide diversified exposure with a lower concentration risk.

- Watch Emerging Sub‑Sectors: AI in cybersecurity, precision agriculture, and quantum computing are still nascent; early exposure could pay off.

5. Bottom Line

The article concludes that while the AI sector bears many hallmarks of a bubble—excessive valuations, hype‑driven momentum, and regulatory uncertainties—there are also compelling fundamentals and a growing range of applications that could justify a sustained rally. As with any emerging technology, the risks are real, but so are the rewards for investors who adopt a disciplined, fundamentals‑first approach. The key is to stay informed, maintain a diversified portfolio, and keep an eye on both the promise and the pitfalls that AI presents in the coming decade.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/is-the-ai-boom-becoming-a-bubble-heres-what-invest/ ]