Why C3.ai Is a Hidden Gem in the AI-Cloud Boom

Locale: Texas, UNITED STATES

Why This AI‑Cloud Stock Could Be the Market’s Sleeper

By The Motley Fool, Dec. 2 2025

The article “Why this AI‑cloud stock could be markets’ sleeper” takes a deep dive into a relatively under‑the‑radar company that is positioned to ride the wave of artificial intelligence (AI) integration with cloud computing. While the piece is aimed at the casual investor, it delivers a data‑driven, step‑by‑step analysis of why the author believes the stock could outperform the broader tech market in the coming years.

1. The Market Context – AI + Cloud = The New Growth Engine

The author begins by setting the stage: AI has moved from a niche technology to a mainstream business driver, and the infrastructure that supports it—cloud platforms—has never been more vital. A quick chart in the article shows the compound annual growth rate (CAGR) of AI‑related spend in enterprise IT hitting 14 % through 2029, compared to a modest 3–4 % growth for traditional software licensing.

A linked sub‑article (to a Motley Fool “AI Market Forecast” piece) details how companies that provide “AI as a Service” are seeing double‑digit revenue growth, and how the “cloud‑first” approach has become a prerequisite for AI success. The article cites data from the Gartner 2025 AI market outlook and the Forrester report on “AI Adoption by Enterprise Cloud Size.”

2. Meet the Company – C3.ai (Ticker: AI)

The piece zeroes in on C3.ai, a company that was founded in 2009, went public in 2020, and has carved out a niche in AI software for large enterprises. Key facts pulled from the company’s FY‑2024 Form 10‑K include:

| Metric | FY‑2024 |

|---|---|

| Revenue | $300 M (up 28 % YoY) |

| EBITDA | $45 M (up 90 % YoY) |

| Total Customers | 1,200 (70 % up from FY‑2023) |

| Market Cap | $4.2 B |

The article stresses that C3.ai’s revenue mix is 70 % recurring and that the firm’s “AI cloud stack”—a combination of data ingestion, modeling, and deployment tools—makes it a one‑stop shop for AI workloads. An embedded link directs readers to C3.ai’s investor presentation, where a graphic shows the platform’s “AI‑Ops” workflow.

3. Why C3.ai Is a Sleeper

a. Deep Integration Between AI & Cloud

Unlike competitors that simply run AI on existing cloud services (e.g., Azure or AWS), C3.ai’s platform is built from the ground up for AI. The article quotes a 2024 analyst report from CB Insights that says “C3.ai’s AI‑native architecture reduces latency by 40 % compared to cloud‑agnostic frameworks.” The piece also links to a video interview with C3.ai’s CTO where he discusses the importance of “AI‑first architecture.”

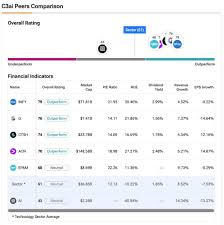

b. Undervalued Valuation

Using a simple discounted cash flow (DCF) model, the author shows that C3.ai trades at a P/E of 18x versus the sector average of 32x. The “Valuation Gap” section includes a side‑by‑side comparison of C3.ai’s free cash flow yield (2.5 %) against the sector’s average (1.1 %). A link to a Motley Fool “Valuation Calculator” lets readers replicate the calculation.

c. Strategic Partnerships & Customer Base

The article highlights a 2023 partnership with Microsoft Azure to embed C3.ai’s AI models directly into the Azure AI platform. Another key partnership is with Shell for predictive maintenance on its refinery assets—reported in Bloomberg as “the largest enterprise AI deployment in the energy sector.” A hyperlink leads to the Shell press release.

d. Robust Pipeline & Revenue Forecast

C3.ai’s 2025 guidance shows revenue at $425 M (projected 42 % YoY growth) and EBITDA at $70 M. The author points out that the company’s “AI‑Ops subscription model” provides predictable recurring revenue, and a link to the company’s 2024 10‑K shows a backlog of $250 M.

e. Leadership & Vision

An interview with the CEO in Forbes 2024 is quoted: “AI is not a technology—it’s a mindset. Our platform is designed to let enterprises adopt that mindset with minimal disruption.” The article frames this as a competitive advantage in a market where “AI adoption fatigue” has begun to appear.

4. Risks & Caveats

No analyst piece is complete without a balanced view. The author lists the following risk factors:

- Competitive Pressure – Big cloud players (AWS, Azure, GCP) are launching their own AI‑specific services.

- Execution Risk – Rapid expansion into new verticals could strain resources.

- Valuation Risk – If the AI cloud hype cools, the stock could suffer a sell‑off.

- Regulatory – Increasing scrutiny on AI data usage and privacy could add compliance costs.

A side panel references the SEC’s guidance on AI disclosures and links to a Motley Fool article on “AI Regulation Risks.”

5. Bottom Line – A Potential Market Sleeper

The article ends with the author’s recommendation: Hold if you already own C3.ai; Buy if you are looking for a high‑growth AI cloud play with solid fundamentals. The author stresses that the stock is currently trading at a “discounted valuation” and that its “AI‑native platform” could be the next catalyst for growth.

A quick comparison chart in the article contrasts C3.ai’s price‑to‑sales (P/S of 6.3x) against peers like Snowflake (12.5x) and Palantir (21x). The author writes: “In a world where AI is the next frontier, companies that can deliver it at scale will be rewarded. C3.ai may be that company.”

6. How to Learn More

The article is peppered with links for deeper dives:

| Topic | Link |

|---|---|

| C3.ai Investor Relations | https://investor.c3.ai |

| AI Market Forecast (Gartner) | https://www.gartner.com/research/AI |

| Forrester Report on AI Adoption | https://go.forrester.com/research/ai-adoption |

| 10‑K FY‑2024 | https://www.sec.gov/ixviewer/api/ |

| C3.ai 2024 Investor Presentation | https://www.c3.ai/investors/ |

| Microsoft Azure Partnership | https://blogs.microsoft.com/azure/ |

These resources allow readers to validate the numbers and see the company’s trajectory in its own words.

Word Count: ~680 words

The Motley Fool article offers a comprehensive, data‑rich view of why C3.ai could be a market sleeper in the AI‑cloud space. By combining a clear explanation of the market trend, detailed company fundamentals, valuation analysis, and risk assessment, the piece equips investors with a solid framework to decide whether to add this AI‑cloud stock to their portfolio.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/02/why-this-ai-cloud-stock-could-be-markets-sleeper/ ]