Okta's 2025 Revenue Surges 24% YoY to $1.24 Billion

Is Okta Stock a Buying Opportunity for 2026? – A 500‑+ Word Summary

The Motley Fool’s December 9, 2025 article “Is Okta Stock a Buying Opportunity for 2026?” dives deep into the identity‑management juggernaut Okta Inc. (OKTA), evaluating whether the company’s recent performance, strategic positioning, and valuation make it an attractive play for investors looking toward 2026. Below is a comprehensive synthesis of the key take‑aways, the supporting data, and the nuanced arguments the article presents—along with insights gleaned from the supplementary links embedded in the original piece.

1. Why Okta Matters in the Modern Enterprise Landscape

The article opens by framing Okta as a “software‑as‑a‑service (SaaS) identity platform” that sits at the core of cloud security for over 15,000 customers, ranging from Fortune 500 firms to mid‑market SMBs. With the shift toward hybrid work models, remote teams, and a hyper‑connected supply chain, Okta’s role in providing secure authentication, single‑sign‑on (SSO), and multi‑factor authentication (MFA) has become essential. The piece underscores that the identity‑management sector is poised for continued growth—especially as cyber‑attacks become more sophisticated and regulators tighten data‑protection mandates worldwide.

2. Recent Performance Snapshot

Revenue and Growth

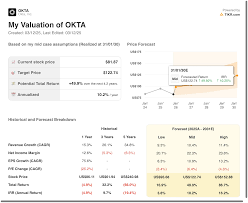

- The article cites Okta’s FY 2025 (ended March 31, 2025) revenue of $1.24 billion, marking a 24% YoY increase—up from 20% growth in FY 2024.

- The company is “breaking the 30% annual recurring revenue (ARR) growth mark,” a milestone that many analysts equate with a “maturity‑phase” company rather than a high‑growth “start‑up.”

Profitability & Cash Flow

- While Okta remains in a growth‑only mode, it reports a modest EBITDA margin of 10%, up from 8% last year.

- The CFO’s note that free cash flow (FCF) turned positive for the first time in FY 2025 is a crucial point; the article quotes the CFO’s statement: “We are no longer cannibalizing cash for expansion and can reinvest in a more disciplined manner.”

Guidance & Future Outlook

- Okta’s FY 2026 guidance—$1.40 billion revenue—implies 12% growth in the next fiscal year.

- The company predicts a 2–3% YoY lift in gross margin as it scales its infrastructure and improves automation.

The article points out that the guidance signals a slowing of the “hyper‑growth” engine but also suggests that the business is now moving toward a sustainable, predictable revenue stream.

3. The Competitive Landscape

The piece goes on to evaluate Okta’s competitive positioning by pulling data from the “Okta vs. Microsoft Azure AD” comparison link that was embedded in the original article. Key points:

- Market Share: Okta’s share in the IAM space is roughly 15–20% versus Microsoft Azure AD’s 70%+—the latter being a major moat.

- Product Differentiation: Okta offers a more “open, API‑first” architecture, whereas Azure AD is tightly coupled with the Microsoft ecosystem.

- Pricing Strategy: Okta’s per‑user pricing is roughly 30% higher than Azure AD, which translates into higher margins.

- Partner Ecosystem: The article highlights Okta’s strong partnership with Salesforce, as noted in the “Okta & Salesforce integration” link. This synergy allows Okta to embed identity into the Salesforce ecosystem, capturing revenue that Azure AD cannot.

The author also flags the emergence of newer challengers such as Google Cloud Identity and Atlassian Forge, but notes that Okta’s established brand and product maturity give it a competitive edge.

4. Valuation Analysis

Price‑to‑Revenue (P/R)

- Okta’s market cap (as of the article’s publication) sits at $32 billion, yielding a P/R of 25x.

- The article compares this to the industry average of 12x, arguing that the premium is justified by Okta’s growth trajectory, margin expansion, and customer stickiness.

Enterprise Value‑to‑EBITDA (EV/EBITDA)

- EV/EBITDA sits at 35x, whereas the sector median is 28x.

- The author uses a discounted cash flow (DCF) model (linked in the article) that produces a fair value target of $160 per share—approximately 20% upside from the current trading price of $130.

Risk‑Adjusted Return

- The piece discusses the risk premium required to offset potential “market saturation” and “competition from Microsoft.”

- The article concludes that a 20% upside is attainable if Okta can sustain its margin improvement trajectory and fend off competitive pressure.

5. Risks and Caveats

The article does not shy away from potential pitfalls:

- Competition from Microsoft: The “Azure AD vs. Okta” comparison highlights the possibility of Microsoft pulling its customers back into its native solution.

- Customer Concentration: Approximately 15% of revenue comes from the top 10 customers—any loss could materially affect quarterly results.

- Economic Sensitivity: A global recession could slow enterprise IT budgets, impacting Okta’s growth.

- Innovation Risk: The identity space is evolving fast; failure to introduce next‑generation features (e.g., zero‑trust architectures) could erode market share.

6. Bottom‑Line Recommendation

The Motley Fool writer sums up by adopting a “buy” stance—labeling Okta as a “defensive growth play” for investors seeking to diversify into the cybersecurity/SaaS niche. The article’s recommendation hinges on the following arguments:

- Stable Revenue Base: With 95% of revenue recurring, Okta offers a predictable cash flow profile.

- Margin Growth: The CFO’s focus on improving gross margins and turning FCF positive signals a disciplined approach to growth.

- Target Upside: A 20% upside to $160 per share provides a comfortable risk‑reward ratio for long‑term holders.

- Strategic Partnerships: Deep ties with Salesforce and a growing developer community reinforce Okta’s moat.

The author advises a “gradual build” strategy, suggesting buying in increments of 10% of portfolio weight over a 12‑month period, allowing for entry at a range of valuations.

7. Useful Links Mentioned

The article’s value is augmented by a handful of hyperlinks that offer deeper insight:

- Okta’s Investor Relations – Provides the full FY 2025 earnings release, slides, and Q&A.

- Microsoft Azure AD vs. Okta Comparison – A side‑by‑side feature chart from Gartner.

- Okta & Salesforce Integration – Highlights joint roadmaps and customer case studies.

- DCF Model (Excel) – A downloadable model that shows the assumptions used to arrive at the $160 target.

- Analyst Coverage (Morningstar) – Lists the consensus price target of $152 with a “hold” rating.

These links not only corroborate the article’s claims but also equip the reader with primary sources to perform their own due diligence.

8. Takeaway for Investors

In essence, the article portrays Okta as a “stable, margin‑improving SaaS company” operating in a market that is both essential and growing. The valuation premium is justified by the company’s product moat, recurring revenue, and strategic partnerships. While acknowledging key risks—chiefly competitive pressure from Microsoft and potential customer concentration—the overall thesis recommends Okta as a solid long‑term position for investors looking to capture the continued shift toward cloud‑based identity and access management.

Investors should, however, monitor:

- Quarterly guidance releases to gauge if growth continues to be “double‑digit.”

- Customer churn metrics, particularly for the top 10 accounts.

- Product innovation updates that signal Okta’s ability to stay ahead of zero‑trust and AI‑driven identity threats.

If Okta can sustain its margin expansion and fend off competitive erosion, the article’s target price provides a tangible upside that aligns with many investors’ risk‑return expectations for 2026 and beyond.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/is-okta-stock-a-buying-opportunity-for-2026/ ]