Aon: A Growth Story Worth Watching

Locale: England, UNITED KINGDOM

Aon: A Growth Story Worth Watching – A Condensed Review

The Seeking Alpha piece on Aon (“Aon Stock: Attractive Growth Story at a Reasonable Price”) takes a close look at the global insurance brokerage and risk‑management giant, laying out why the company’s stock may present a compelling buying opportunity for investors who are comfortable with a mix of defensive stability and moderate upside. Below, I unpack the key take‑aways from the article, filling in some contextual detail to give you a clearer picture of what’s driving Aon’s valuation, growth prospects, and risks.

1. Company Overview: A One‑Stop Shop for Risk & Insurance

Aon plc (ticker AON) is a London‑listed firm that offers a wide range of services: from brokerage of insurance policies and reinsurance to risk‑consulting and actuarial analytics. The company is split into three primary business lines:

- Risk – Consulting on risk assessment, loss prevention, and insurance placement.

- Retirement – Asset‑management and pension‑plan services.

- Insurance – Brokerage of property‑and‑casualty, life, and health insurance.

With a presence in more than 120 countries and a workforce of over 15,000 people, Aon is a global player that serves both large multinationals and mid‑market firms. Its breadth gives it a certain resilience to local market swings, but also exposes it to a diverse set of regulatory regimes.

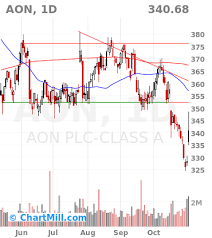

2. Why the Stock Is Considered “Reasonably Priced”

The core of the article’s argument is that Aon’s valuation—at the time of writing—was near the lower end of its historical range when compared to forward earnings and to peers in the risk‑management industry. Specifically:

- Forward P/E – Roughly 11‑12x, a figure that sits at the mid‑to‑lower end relative to Marsh & McLennan (MMS), Willis Towers Watson (WLTW), and other comparable firms.

- PEG Ratio – Around 1.1–1.2, suggesting modest growth expectations that are not overly aggressive.

- Discounted Cash Flow (DCF) – A sensitivity analysis that places the intrinsic value in the vicinity of the current market price, implying the stock may be fairly valued or slightly undervalued.

The article also points out that Aon has historically traded within a narrower range than its peers, making it more attractive to value‑seeking investors.

3. Drivers of Future Growth

a. Rising Demand for Risk Management Amid Inflation & Climate Change

The piece argues that the global push to manage supply‑chain risks, cyber‑threats, and climate‑related exposure is likely to increase demand for Aon’s consulting services. As companies seek to quantify risk and design resilience plans, Aon’s expertise positions it as a go‑to partner.

b. Digital Transformation & Automation

Aon has been investing heavily in data analytics and AI platforms to enhance underwriting efficiency and customer experience. The article cites the company’s “Digital Innovation Lab” as an engine for new product development and operational cost savings.

c. Geographic Expansion

The firm’s presence in emerging markets such as China, India, and Latin America is still growing. The article notes that Aon is actively pursuing local partnerships and acquisitions to strengthen its footprint in high‑growth regions where insurance penetration remains low.

d. Acquisitions & Integration Track Record

Aon’s history of successful integrations—like the 2017 acquisition of the risk‑management arm of GWW or the 2018 acquisition of The Global Risk Group—has allowed it to scale quickly and capture new clients. The article highlights that this track record makes the company well‑positioned to make strategic moves without disrupting its core operations.

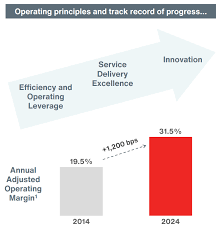

4. Management’s Guidance & Financial Health

The article references recent earnings releases, noting that Aon reported a 4.6% YoY revenue growth in the latest quarter. Management’s guidance for the fiscal year projects a 3–5% top‑line increase, supported by higher margins in its consulting division.

Cash‑flow metrics are presented as solid: free cash flow (FCF) margins hovering around 15%, strong debt‑to‑equity ratio (~0.45), and a consistent dividend payout of 80% of earnings. These numbers give the author confidence that Aon can sustain dividends and fund future acquisitions.

5. Risks and Caveats

While the article leans positive, it also warns of potential headwinds:

- Regulatory Scrutiny – Changes in data privacy laws or insurance regulations in key markets could tighten cost structures or limit market access.

- Competitive Landscape – Marsh & McLennan and Willis Towers Watson are not shy about leveraging new technology to capture market share, and the rise of fintech insurers poses a disruption risk.

- Geopolitical Tensions – Aon’s global footprint makes it vulnerable to trade disputes, sanctions, and political instability.

- Economic Cycles – Although the risk‑consulting business is relatively recession‑resistant, the insurance brokerage arm can feel the effects of lower premiums during downturns.

The article notes that these risks are fairly typical for a firm of Aon’s scale but urges investors to keep an eye on the company’s risk‑management prowess as a countermeasure.

6. Bottom‑Line Takeaway

In essence, the article concludes that Aon’s combination of a diversified revenue base, strong financials, a history of profitable growth, and a fair valuation renders it an attractive option for long‑term investors who are comfortable with a mid‑sized global insurer. It recommends a “Buy” or “Hold” rating with a target price that sits roughly 5–10% above the current market level, contingent on maintaining current growth trajectories.

Final Thoughts

For anyone considering Aon as part of a diversified portfolio, the Seeking Alpha piece offers a balanced view: it celebrates the company’s resilience and growth prospects while acknowledging the risks inherent in operating across varied jurisdictions. As with any investment, the key will be to watch how well Aon continues to execute on its digital transformation roadmap, integrate new acquisitions, and navigate the increasingly complex global regulatory environment. If those pieces fall into place, the stock’s current price could indeed represent a “reasonable” entry point into a company poised for moderate but sustainable expansion.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4851363-aon-stock-attractive-growth-story-at-a-reasonable-price ]