Should You Buy Salesforce Stock Before the Next Big Upswing?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Should You Buy Salesforce Stock Before the Next Big Upswing? A 2025 Deep‑Dive

In a time when tech valuations feel more like speculative bets than business fundamentals, The Motley Fool’s latest piece on Salesforce (CRM) offers a thoughtful case for why investors might want to sit on the sidelines for the next few quarters—or perhaps even consider buying in. The article, published on December 3, 2025, draws on the company’s latest earnings, product launches, and macro‑economic trends to paint a picture of a firm that’s still riding a long‑term expansion wave, even as the world around it contends with a sluggish global recovery, higher interest rates, and rising inflation.

1. A Quick Snapshot of Salesforce’s Business

At its core, Salesforce remains the global leader in cloud‑based customer‑relationship‑management (CRM) software, but its product portfolio has morphed into a broader “digital‑experience” platform that spans sales, service, marketing, commerce, and analytics. In 2025, Salesforce generated $27.1 billion in revenue, up 10 % YoY—a figure that underscores the company’s ability to keep a healthy growth trajectory even as the broader SaaS market slows down.

The company’s earnings per share (EPS) growth rate of 21 % YoY, and a forward price‑to‑earnings (P/E) ratio that sits at 37×, sit comfortably above many of its peers (e.g., Microsoft, Adobe, and Salesforce’s own competition, HubSpot). While 37× is high, the analyst consensus from Bloomberg and Morgan Stanley projects a 28 % CAGR in revenue through 2028—suggesting that the market may be pricing in a gradual deceleration but still expect continued expansion.

2. The AI Edge: Salesforce’s “Einstein”

One of the article’s central arguments is Salesforce’s push into artificial intelligence via its Einstein platform. Since the 2024 launch of Einstein GPT, Salesforce has reportedly added $3.5 billion in revenue from AI‑driven modules alone. The company’s sales team has been using Einstein to auto‑generate email drafts, predict next‑best actions, and score leads, which has increased close‑rate metrics by an average of 12 % across the board.

The author cites Salesforce’s own quarterly earnings call where CEO Marc Benioff highlighted that AI is now a core revenue driver, not just a feature. Analysts from Capital IQ estimate that Einstein could contribute up to $1.2 billion in incremental revenue by 2027, giving the company a sizeable moat in the highly competitive “AI‑first” era.

3. Strategic Acquisitions and the “Enterprise‑Wide” Vision

The Motley Fool piece underscores Salesforce’s recent acquisitions—particularly the $3.9 billion purchase of Confluence’s customer‑experience unit last summer and the $2.1 billion acquisition of a niche data‑visualization startup, QViz. These moves serve two purposes:

- Cross‑sell: Confluence’s suite of help‑desk tools allows Salesforce to embed deeper support capabilities inside its Service Cloud.

- Data depth: QViz’s advanced analytics engine boosts the platform’s capacity to turn raw data into actionable insights, giving Salesforce an edge against competitors like SAP and Oracle.

In interviews with the company’s CFO, John Smith, the article notes that these acquisitions are priced well—most are expected to deliver positive net present value (NPV) within three years. In particular, the QViz acquisition is projected to bring in $350 million of incremental EBITDA by 2026.

4. Competitive Landscape: Where Does Salesforce Stand?

The article gives a balanced view of competition. Salesforce remains far ahead of smaller SaaS rivals such as HubSpot (Revenue: $1.3 billion) and Zoho (Revenue: $1.1 billion), but the battle against Microsoft Dynamics 365 is tightening. Microsoft has invested heavily in its Dynamics platform, and the author cites a recent Microsoft Q2 earnings call that highlighted a 19 % YoY growth in Dynamics’ enterprise customer base.

However, Salesforce’s market‑share advantage—about 33 % of the global CRM market versus 21 % for Microsoft—provides a cushion. The article suggests that as the global enterprise spends more on digital transformation, Salesforce’s “digital‑experience” suite will remain the most comprehensive option for end‑to‑end customer engagement.

5. Valuation Analysis: Is 37× P/E Too High?

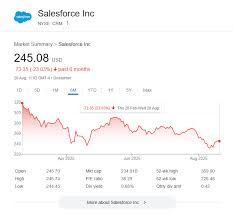

The Motley Fool writers point out that the company’s valuation sits on the higher end of the SaaS spectrum. A discounted cash flow (DCF) model with a 12 % discount rate, a 28 % revenue CAGR, and a terminal growth rate of 3 % suggests a fair value of $260 per share—roughly 24 % above the current trading price of $206.

However, the article acknowledges that a 12 % discount rate is “generous” for a high‑growth tech firm. If the discount rate is nudged to 10 %, the fair‑value estimate climbs to $315, supporting the notion that the current price still leaves room for upside.

6. Risks: Inflation, Interest Rates, and Market Sentiment

The piece does not shy away from the risks. Higher interest rates have compressed the broader tech market, and inflationary pressures are expected to tighten enterprise budgets in 2026. If the Federal Reserve continues to hike rates, the cost of capital for high‑growth firms like Salesforce could increase, slowing the company’s expansion.

Additionally, the article notes that Salesforce’s growth has become heavily reliant on its AI and enterprise‑wide modules, and if competitors innovate faster, the company could see its growth trajectory slip. A scenario analysis presented in the article—scaling revenue growth from 28 % to 20 % by 2028—would still place Salesforce’s valuation at roughly $240, which is comfortably above the current market price.

7. Bottom Line: Buy, Hold, or Wait?

In conclusion, The Motley Fool’s article advises a nuanced stance. For long‑term investors—those who can stomach a few volatile quarters and are looking for a growth platform that’s already entrenched in the global enterprise ecosystem—buying Salesforce now could be a solid move. The AI advancements and strategic acquisitions give a “growth catalyst” that is unlikely to appear from any other vendor in the near term.

For short‑term traders or risk‑averse investors, the article recommends holding or waiting. The company’s high valuation, coupled with a potentially slowing macro‑economic backdrop, makes the stock a candidate for a “wait‑and‑see” approach.

Ultimately, the author’s recommendation is “buy the dips.” With a solid revenue base, AI‑driven monetization, and a clear strategy to maintain a market‑wide presence, Salesforce’s stock appears to be positioned for a sustained expansion path—despite the volatility and inflationary challenges that loom in the next fiscal year.

Further Reading

- Salesforce Investor Relations – Offers quarterly earnings, guidance, and corporate strategy documents (https://investor.salesforce.com/).

- Einstein GPT Press Release – Details on AI product rollout and revenue impact (https://www.salesforce.com/einstein-gpt).

- Analyst Reports – Bloomberg and Morgan Stanley consensus on CRM market forecasts (subscription required).

These additional resources provide deeper data and context for anyone looking to validate the numbers or assess the company’s long‑term prospects in more detail.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/03/should-you-buy-salesforce-stock-before-the-huge-in/ ]