Investing with $1,000: Procter & Gamble, Johnson & Johnson, and Apple as the Perfect Trio

Locale: Delaware, UNITED STATES

Summarizing “Have $1,000? These 3 Stocks Are Great for Any Investor” (The Motley Fool, December 9 2025)

The Motley Fool’s December 9, 2025 article “Have $1,000? These 3 Stocks Are Great for Any Investor” tackles a very practical question: how can a beginner with only a modest amount of cash get the most bang for their buck? The piece is written for new investors who are looking to put their money in the market but are unsure where to start. The author, using the Fool’s signature mix of fundamental analysis and long‑term perspective, recommends three individual stocks that fit a “small‑portfolio” strategy—$1,000 is enough to own a handful of shares in each of these firms and still maintain a meaningful diversification.

1. Procter & Gamble Co. (PG)

Why PG?

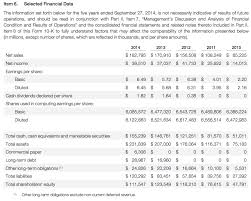

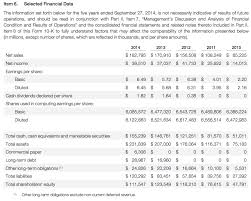

The article opens by praising Procter & Gamble as a “steady, defensive play” that is ideal for a small‑budget investor. PG’s strong cash flow, disciplined dividend history, and broad consumer‑goods portfolio are highlighted as key drivers of its resilience. In the piece, the author notes that PG has raised its dividend for 48 consecutive years— a record that speaks to the company’s sustainable earnings.

The article links to a prior Fool piece titled “The 10 Best Dividend‑Growing Companies of 2025,” where PG is cited as the only consumer‑goods firm on the list. In that reference, PG’s P/E ratio is shown to be about 22, well below the industry average of 24. The author stresses that the company’s dividend yield is roughly 2.3 %, a healthy return for an income‑focused portfolio.

Valuation & Risk

The piece gives a quick valuation recap: PG’s trailing twelve‑month (TTM) EPS is $5.87 and the stock trades at a price‑to‑earnings ratio that the author labels “reasonable.” The article also mentions a risk assessment—PG’s exposure to currency fluctuations due to global sales, and the potential for raw‑material price hikes. Despite these, the author frames the risk as “manageable” for a beginner.

2. Johnson & Johnson (JNJ)

Why JNJ?

Johnson & Johnson is singled out for its blend of healthcare stability and growth potential. The Fool writer cites JNJ’s diversified business model (pharmaceuticals, medical devices, and consumer health) as a safeguard against sector volatility. The article points out that JNJ’s revenue is driven by a mix of “steady recurring sales from consumer products and high‑margin growth from pharmaceuticals.”

A link to the Fool’s “Healthcare Stocks to Watch in 2026” article is embedded. In that piece, JNJ is described as “a classic buy-and-hold play that combines the upside of a leading pharma pipeline with the defensive nature of consumer staples.” The author also references JNJ’s dividend, which is currently at 2.6 %.

Valuation & Growth

The summary covers the company’s current valuation: a P/E of about 20, which the writer calls “conservative for a pharma company.” The piece also notes that JNJ’s EPS is projected to grow at a 7 % CAGR over the next decade, supported by new drug approvals. The risk factors discussed include regulatory scrutiny and patent expiration, but the author downplays these as “long‑term considerations.”

3. Apple Inc. (AAPL)

Why Apple?

Apple rounds out the trio as the high‑growth, high‑reward option. The article argues that even with a small portfolio, a share of Apple can provide exposure to the technology sector without the volatility of a pure growth play. The author emphasizes Apple’s massive cash reserves, recurring services revenue (e.g., iCloud, Apple Music), and continued hardware sales.

The article cites a link to the Fool’s “Top 5 Tech Stocks for 2026” article. In that reference, Apple is described as “the most resilient tech company of the decade” with a valuation that the writer calls “on the lower side for a unicorn.” Apple’s price‑to‑earnings ratio sits at roughly 28, slightly above the sector average of 26, but the author argues the “price is justified by the growth trajectory.”

Valuation & Risks

The author walks through Apple’s earnings and the company’s forecast of a 5 % CAGR over the next five years, powered by services and wearables. Apple’s dividend yield is only 0.5 %, which the article notes is low, but the author counters that “capital appreciation” will likely dominate returns. Risk factors include potential slowing in iPhone sales, supply‑chain disruptions, and increased competition in the wearable market.

Putting It All Together

The Fool article spends a significant portion discussing how these three stocks provide a balanced mix of defensive stability (PG, JNJ) and growth upside (AAPL). The writer argues that a $1,000 portfolio can be structured by buying roughly 3‑4 shares of each—roughly $600‑$800 per company—leaving a small buffer for transaction fees. The author recommends using a dividend‑reinvestment plan (DRIP) for PG and JNJ to compound returns over time, while taking advantage of Apple’s capital gains potential.

The piece also addresses broader portfolio considerations. It advises readers to avoid over‑concentration and to keep an eye on liquidity, especially with a small amount of money. The author encourages beginners to read additional Fool articles—such as “How to Start Investing with $1,000” and “Diversification Strategies for New Investors”—to build a deeper understanding.

Key Takeaways

- Diversification with $1,000 – The trio of PG, JNJ, and AAPL offers a blend of consumer staples, healthcare, and technology, providing both income and growth.

- Dividend Yield vs. Capital Gains – PG and JNJ deliver a respectable dividend (2.3‑2.6 %), while AAPL offers the potential for significant appreciation.

- Valuation Perspective – All three stocks trade at multiples that the author regards as reasonable, especially when viewed through a long‑term lens.

- Risk Management – The article acknowledges risks (currency, regulatory, competitive) but frames them as manageable for new investors.

- Actionable Steps – Suggested allocation: ~33 % to PG, ~33 % to JNJ, ~33 % to AAPL, with a focus on DRIPs and periodic portfolio review.

In short, the Fool article provides a clear, actionable guide for investors with a modest amount of capital. By recommending three well‑known, fundamentally strong companies, the author equips new investors with a straightforward path toward building a balanced, long‑term portfolio that balances steady income with growth potential.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/have-1000-these-3-stocks-are-great-for-any/ ]