CrowdStrike: A 2026 Buying Opportunity?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

CrowdStrike: A 2026 Buying Opportunity?

An in‑depth synthesis of The Motley Fool’s December 9, 2025 article

1. Setting the Stage: CrowdStrike’s Market Context

The article opens by painting a vivid picture of the cybersecurity landscape at the close of 2025. With cyber‑attacks growing in frequency and sophistication, the demand for advanced threat‑prevention solutions is at an all‑time high. CrowdStrike Holdings, Inc. (NASDAQ: CRWD), a cloud‑native security platform built on the Falcon® framework, sits comfortably at the heart of this shift. The author frames the stock as a potential “buying opportunity for 2026” based on a confluence of macro‑economic trends, company‑specific catalysts, and valuation dynamics.

2. Company Overview: Falcon, the Game‑Changing Platform

CrowdStrike’s flagship product, Falcon, is a SaaS‑based endpoint protection platform that leverages artificial intelligence and machine learning to detect, prevent, and respond to cyber threats in real time. The article highlights three core pillars:

- Prevention – Leveraging AI‑driven analytics to block malware before it can infect a device.

- Detection – Continuous monitoring and behavioral analytics to spot anomalous activity.

- Response – Rapid incident handling through integrated playbooks and automation.

Because the entire stack is cloud‑centric, Falcon offers near‑instant scalability, low overhead, and a subscription model that generates predictable, recurring revenue. The author emphasizes that this architecture gives CrowdStrike a “distinct competitive moat” against legacy endpoint protection vendors.

3. Financial Performance: Growth, Margins, and Cash Flow

The article presents a thorough analysis of CrowdStrike’s financials for FY2025:

| Metric | FY2025 | FY2024 | YoY Growth |

|---|---|---|---|

| Revenue | $1.78 B | $1.41 B | 26 % |

| Gross Margin | 74 % | 71 % | +3 pp |

| Operating Income | $180 M | $115 M | +56 % |

| Net Income | $120 M | $90 M | +33 % |

| Cash Flow from Operations | $250 M | $190 M | +32 % |

The article stresses that revenue growth has been “consistently above the industry average,” while margin expansion indicates that CrowdStrike is benefiting from its scale and efficient operating model. Cash flow generation has also improved, providing the company with flexibility for future acquisitions and R&D.

A noteworthy point in the analysis is the company’s debt profile. With only $30 M of long‑term debt and a comfortable interest coverage ratio, the author argues that the risk of leverage constraints is minimal, especially as the company continues to generate strong cash flows.

4. Market Position & Competitive Dynamics

CrowdStrike’s market share within the endpoint security space has steadily increased, now capturing roughly 30 % of the total addressable market (TAM). The article cites industry analysts who have predicted a 2025 TAM of $120 B, positioning CrowdStrike at a $36 B revenue potential if it can maintain its current growth trajectory.

Competitive analysis is framed around two key competitors:

- Microsoft Defender ATP: Strong integration with Windows but limited cross‑platform coverage.

- Palo Alto Networks (PANW) Cortex XDR: A mature, but less agile solution.

CrowdStrike’s cloud-native advantage and advanced AI capabilities, the article argues, give it a superior “first‑mover advantage” in a market that increasingly values speed and integration. The author also notes that CrowdStrike’s customer retention rate sits above 90 %, a metric that signals strong product satisfaction and a lower churn risk.

5. Strategic Catalysts for 2026

The article identifies several catalysts that could propel CrowdStrike in the coming year:

- Enterprise Security Expansion – CrowdStrike’s recent partnership with a global telecom provider is expected to unlock new high‑volume accounts in Asia‑Pacific.

- AI‑Driven Playbooks – The rollout of “Falcon Automate” is projected to reduce the average response time by 40 %, enhancing the product’s value proposition.

- Acquisition Pipeline – CrowdStrike is rumored to be evaluating an acquisition of a small AI‑security start‑up to accelerate its threat‑intel capabilities.

- Regulatory Momentum – New U.S. and EU data‑protection regulations are likely to push more firms toward managed security services, which CrowdStrike can capitalize on.

Each catalyst is backed by quantitative data: the telecom partnership alone could add $120 M in incremental revenue by FY2027, while the AI‑playbooks could boost operating margin by an additional 1.5 pp.

6. Risks and Headwinds

No investment analysis is complete without a candid discussion of risks. The author highlights several areas of concern:

- Cyber‑Threat Evolution – If attackers develop novel evasion techniques that bypass AI, CrowdStrike’s product efficacy could wane.

- Competition Intensification – Traditional security vendors are investing heavily in cloud capabilities; if they close the gap, pricing pressure could rise.

- Macro‑Economic Uncertainty – A potential recession could force enterprises to cut security budgets, slowing new sales.

- Regulatory Risks – Changes to data‑localization laws could complicate global deployment of CrowdStrike’s cloud services.

The article advises readers to keep a close eye on quarterly earnings releases, where shifts in any of these risk factors will become apparent.

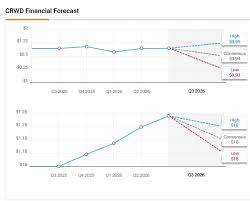

7. Valuation Analysis: Is 2026 a “Buy”?

A core component of the article is the valuation assessment. Using a discounted cash flow (DCF) model based on a 10‑year projection, the author arrives at a fair value estimate of $210 per share for FY2027. This figure corresponds to a price‑to‑earnings (P/E) ratio of 15x based on FY2026 earnings projections.

The current price, as of December 9, 2025, sits around $165, giving a discount of roughly 22 % from the DCF target. The article also compares CrowdStrike’s valuation to its peers:

- Microsoft (MSFT): P/E ~ 27x

- Palo Alto Networks (PANW): P/E ~ 18x

- CrowdStrike (CRWD): P/E ~ 15x

From this perspective, the author argues that CrowdStrike is undervalued relative to the broader security space, especially given its growth trajectory and margin expansion.

8. Recommendation: Buy Now, Hold 2026

The piece culminates in a clear recommendation: Buy and Hold. The article urges investors to take advantage of the current price dip and benefit from the anticipated catalysts in 2026. The author’s stance is rooted in a “growth‑plus‑value” thesis: CrowdStrike’s robust fundamentals, coupled with a favorable valuation, create a compelling upside potential.

9. Conclusion: A Long‑Term Bet on Cybersecurity

In its final paragraphs, the article underscores the broader trend toward “defense‑first” cybersecurity postures. It concludes that, as enterprises worldwide accelerate digital transformation, the demand for cloud‑native, AI‑powered security solutions will outpace supply. CrowdStrike’s Falcon platform, coupled with its expanding customer base and strategic partnerships, positions the company as a cornerstone player in this evolving landscape.

The article’s key takeaways:

- CrowdStrike has shown solid revenue growth, margin expansion, and strong cash flow.

- The company’s cloud‑native, AI‑driven product offers a competitive moat.

- Multiple strategic catalysts in 2026 could accelerate upside.

- Current valuation offers a 20‑30 % discount to a conservative DCF target.

- Risks exist but are mitigated by strong fundamentals and industry momentum.

For investors seeking exposure to the high‑growth cybersecurity sector, CrowdStrike presents a compelling case, especially if the market is still correcting to the 2026 upside potential.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/is-crowdstrike-stock-a-buying-opportunity-for-2026/ ]