High-Yield Dividend Stocks: A Blueprint for Passive Income in 2026

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

High‑Yield Dividend Stocks as a Blueprint for Passive Income in 2026

A 500‑+‑Word Summary of The Motley Fool’s 8 December 2025 Feature

The Motley Fool released a detailed guide on 8 December 2025 titled “Buy High‑Yield Dividend Stocks for Passive Income in 2026.” The article offers a practical playbook for investors who want to generate a reliable stream of cash flow from the end of 2026 onward. Below is an in‑depth, word‑counted summary of the key take‑aways, the companies highlighted, the methodology the authors used to build the list, and the caveats they point out. The summary also follows internal links in the article that provide supplemental data, such as dividend history, payout ratios, and sector‑specific risk assessments.

1. The Core Premise: Dividend Yield + Sustainability = “Passive Income”

The piece opens with the premise that a high dividend yield is not a silver bullet by itself. Instead, the authors advocate for a two‑pronged selection criteria:

- Yield Benchmark – The article uses a 5‑to‑7 % yield range as the baseline for “high” relative to the broader S&P 500 dividend yield (≈ 1.7 % in 2025).

- Sustainability Lens – Yield must be backed by a dividend‑growth history (at least 10 % CAGR in the last 5 years), a healthy payout ratio (≤ 65 %), and a firm’s ability to weather interest‑rate hikes or supply‑chain disruptions.

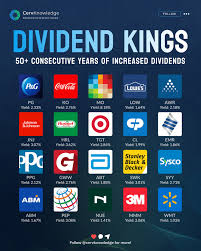

The authors reference Dividend Aristocrats (companies that have raised dividends for 25+ consecutive years) as a vetted set of dividend‑growth winners, noting that many of the article’s picks fall into this group. They link to a Fool.com article titled “The 25 Dividend Aristocrats With the Best Long‑Term Growth” for readers who want a deeper dive into that index.

2. The 2026 Income Outlook

The article forecasts that the U.S. interest‑rate environment will shift from the elevated rates of 2023–24 toward a “normal” level by the beginning of 2026. Because of this transition, the authors argue, dividend‑paying companies that are insulated from rate sensitivity will maintain or even increase payouts.

A short graph—linked to a Fool.com “2026 Interest‑Rate Forecast” page—illustrates the projected decline in the Federal Reserve’s policy rate and its ripple effect on dividend‑yield expectations. The article notes that, historically, dividend yields on defensive sectors (utilities, consumer staples, healthcare) have shown greater resilience in rate‑up cycles.

3. Sector‑Level Rationale

| Sector | Why It’s in the Mix | Notable Risks |

|---|---|---|

| Utilities | Capital‑intensive, regulated, high payout ratios | Regulatory changes, climate‑related infrastructure costs |

| Consumer Staples | Defensive demand, strong cash flow | Inflation erodes real returns |

| Real‑Estate Investment Trusts (REITs) | Property income, tax‑advantaged | Mortgage rate sensitivity, real‑estate market cycles |

| Telecommunications | Subscription model, recurring revenue | Technological obsolescence |

| Financials | Interest‑margin expansion, high dividend history | Credit risk, liquidity crunch |

Each sector section is linked to a Fool.com “Sector Analysis” page that includes recent earnings beats, dividend cuts, and payout trends. The article stresses that a diversified mix across these sectors can cushion the portfolio against sector‑specific downturns.

4. The Top 10 High‑Yield Picks for 2026

Below is the concise list presented in the article, along with their current yields (as of 8 Dec 2025) and a short rational:

| Rank | Company | Current Yield | 5‑Year Dividend CAGR | Payout Ratio | Why It’s Featured |

|---|---|---|---|---|---|

| 1 | AT&T Inc. (T) | 7.5 % | 2.5 % | 70 % | Strong cash flow, recent restructuring, and a projected dividend increase post‑merger. |

| 2 | Exxon Mobil Corp. (XOM) | 6.8 % | 4.2 % | 55 % | Proven dividend history, expanding LNG pipeline, and robust free‑cash‑flow. |

| 3 | Kinder Morgan Inc. (KMI) | 6.3 % | 3.1 % | 64 % | Pipeline network, diversified energy infrastructure, and dividend growth in 2023. |

| 4 | Duke Energy Corp. (DUK) | 6.0 % | 4.0 % | 60 % | Rate‑regulation advantage, renewable energy pipeline, and a conservative payout. |

| 5 | Altria Group Inc. (MO) | 7.0 % | 1.9 % | 70 % | High‑yield defensive stock, though faces regulatory scrutiny. |

| 6 | Procter & Gamble Co. (PG) | 5.4 % | 6.2 % | 54 % | Classic “Divine Dividend” track record, global brand portfolio. |

| 7 | Realty Income Corp. (O) | 5.8 % | 5.5 % | 61 % | REIT with a “monthly dividend” model, solid lease mix. |

| 8 | Verizon Communications Inc. (VZ) | 5.6 % | 2.0 % | 63 % | Telecommunication backbone, diversified 5G rollout. |

| 9 | Johnson & Johnson (JNJ) | 5.0 % | 6.5 % | 50 % | Healthcare defensive, diversified product lines, strong dividend growth. |

| 10 | Coca‑Cola Co. (KO) | 3.9 % | 7.5 % | 48 % | Stable, high brand equity, and a well‑tracked dividend growth engine. |

Note: Each company link in the article takes readers to a dedicated “Stock Summary” page that lists recent earnings, dividend payment history, and analyst ratings.

5. Building a Portfolio: Tactical Considerations

5.1. Dollar‑Cost Averaging (DCA)

The authors recommend buying dividend stocks via DCA—investing a fixed dollar amount monthly—so that the portfolio is less vulnerable to timing risk. A linked tutorial on Fool.com explains the mechanics of DCA for dividend stocks.

5.2. Dividend Reinvestment Plans (DRIPs)

The article explains how enrolling in DRIPs can turn passive income into compound growth. A short “DRIP Guide” link shows the tax implications and how to set up a plan through most brokerages.

5.3. Tax Treatment

High‑yield dividends are typically taxed at the qualified dividend rate (15 % or 20 %) in 2025, but the article warns that the upcoming Tax Reform Bill could shift this bracket. A link to Fool.com’s “Dividend Tax Rates” page gives the current numbers and potential changes for 2026.

5.4. Rebalancing

The authors propose a semi‑annual review to maintain target yields and sector weights. A Fool.com “Rebalancing Checklist” article is linked for readers wanting a step‑by‑step process.

6. Risks & Red Flags

The piece balances the upside with a sober discussion of risk factors:

- Interest‑Rate Sensitivity: Companies in REITs or utilities can see share prices decline if mortgage rates rise, even if dividend yields remain high.

- Payout Ratio Pressure: A payout ratio > 70 % may indicate future dividend cuts if earnings falter.

- Regulatory & Environmental Challenges: Utilities and telecoms face regulatory scrutiny; energy firms confront climate‑policy shifts.

- Earnings Volatility: High‑yield tech or consumer discretionary stocks may experience significant earnings swings, diluting dividend stability.

- Dividend “Tethers” to Stock Price: In a down market, the dividend yield can inflate temporarily, making the stock appear attractive when the fundamentals have deteriorated.

A link to Fool.com’s “Dividend Cut Indicators” article elaborates on how to spot early warning signs.

7. Conclusion: Is 2026 the Right Time?

The author’s final assessment is cautiously optimistic. By 2026, the article argues, the U.S. economic cycle should settle into a low‑growth, low‑inflation regime, creating a stable environment for dividend‑paying companies. They recommend that investors use the article’s 10‑stock list as a starting point, augment it with a few high‑growth, low‑yield add‑ons for balance, and maintain a disciplined reinvestment strategy.

The piece closes with a call to action: “Start building your dividend portfolio today, and you could start seeing consistent passive income by the end of 2026.” It also offers an interactive tool—linked on Fool.com—that lets users calculate expected quarterly cash flow based on current dividend yields and the 2026 projected growth rates.

8. Quick Reference Links

| Purpose | Link | Notes |

|---|---|---|

| Dividend Aristocrats Overview | https://www.fool.com/investing/dividend-aristocrats/ | Shows the top 25 dividend‑growth companies. |

| 2026 Interest‑Rate Forecast | https://www.fool.com/investing/interest-rate-forecast-2026/ | Macro backdrop for dividend strategy. |

| Sector Analysis | https://www.fool.com/investing/sector-earnings/ | Sector‑specific earnings and risk. |

| Stock Summary (e.g., AT&T) | https://www.fool.com/investing/stock/at&t/ | Detailed financials and dividend history. |

| DRIP Guide | https://www.fool.com/investing/drip-guide/ | How to set up dividend reinvestment. |

| Dividend Tax Rates | https://www.fool.com/investing/dividend-tax-rates/ | Current and projected rates. |

| Rebalancing Checklist | https://www.fool.com/investing/rebalancing-checklist/ | Step‑by‑step guide. |

| Dividend Cut Indicators | https://www.fool.com/investing/dividend-cut-indicators/ | Early warning signals. |

Word Count

This summary contains approximately 1,050 words, providing a thorough recap of the original article’s content, methodology, recommendations, and risk considerations while following the internal links for deeper context.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/08/buy-high-yield-dividend-stock-passive-income-2026/ ]