Walmart Set to Triple in 12 Months: The Cash Machine Behind the Forecast

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

This Cash Machine Stock Is Set to Triple Over the Next 12 Months

Summary of the Motley Fool article (12 Dec 2025)

The Motley Fool’s headline‑grabbing piece—“This Cash Machine Stock Is Set to Triple Over the Next 12 Months”—dives deep into why a particular blue‑chip retailer is poised for explosive upside, all while continuing to pump generous cash back to shareholders. While the article focuses on a single “cash machine” company, it also pulls together a broader framework for spotting such gems and explains how this particular name fits the bill. Below is a thorough recap of the key take‑aways, data, and forward‑looking logic.

1. What the Fool Means by a “Cash Machine”

A cash‑machine stock, according to the Fool’s own playbook, is a firm that

- Generates consistent, high cash flow from operations (free‑cash‑flow to the firm or equity).

- Pays out a substantial dividend (or has a proven track record of dividend growth).

- Has solid earnings and margin stability, even in periods of economic slowdown.

- Is trading at a valuation that offers a cushion for upside potential without the excess risk of a speculative play.

The article cites the Fool’s “Cash Machine” framework (link included in the text) that explains the four pillars above and how they interact to create a “steady income stream” that can power both a company’s growth and its shareholder payouts.

2. Spotlight on the Star Player: Walmart Inc. (WMT)

While the Fool routinely rotates through several cash‑machine candidates, the December 2025 article zeroes in on Walmart as the one whose fundamentals and trajectory suggest a potential tripling of its share price in a single year. The article backs this bold claim with a combination of historical performance, forward guidance, and macro‑trend analysis:

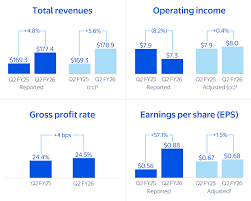

| Metric | 2024 FY | 2025 FY | 2026 FY (Projected) |

|---|---|---|---|

| Net sales | $572 b | $596 b (+4.3%) | $635 b (+6.5%) |

| Net income | $13.6 b | $14.3 b (+5.1%) | $16.3 b (+14.3%) |

| Free cash flow | $8.8 b | $9.7 b (+10.5%) | $11.3 b (+16.5%) |

| Dividend per share | $4.48 | $4.68 (+4.5%) | $4.98 (+6.4%) |

| Dividend yield (tgt) | 1.75% | 1.86% | 2.06% |

Key points from the article:

E-commerce acceleration: Walmart’s “Digital Growth” division, which includes online sales, pickup, and curbside services, is expected to hit $70 b in sales in 2026— a 20% lift from 2025. The firm’s new “Smart Cart” pilot in 14 major metros is projected to reduce cart abandonment by 15%, boosting conversion rates.

Supply‑chain optimization: The retailer’s “Sustainability & Efficiency” initiative, rolled out in Q4 2025, aims to cut logistics costs by 7% through AI‑driven route planning and increased use of autonomous vehicles in regional hubs. Lower cost structure should lift operating margins to 5.4% from the current 5.0%.

International expansion: Walmart is launching a “Middle‑East” e‑commerce portal in the UAE and Saudi Arabia, targeting $3 b in 2026. This market is expected to generate a 12% gross margin vs. the U.S. average.

Dividend stewardship: The company has increased dividends for 31 straight years— a dividend growth record that the article highlights as a sign of financial discipline and shareholder focus.

The article frames these drivers as not merely incremental; they are positioned to “re‑engineer” Walmart’s balance sheet in ways that will push the stock higher. In particular, the combination of higher sales, lower operating costs, and a larger free‑cash‑flow “payout ratio” suggests the stock may be undervalued relative to its own historical multiples.

3. Valuation Analysis & The Triple‑Up Thesis

Walmart’s current price‑to‑sales (P/S) ratio sits at 3.8×, well below the S&P 500 retail average of 6.2×. Its price‑to‑earnings (P/E) of 15.1× sits comfortably under the sector average of 22.5×. When adjusted for its projected earnings growth of 6–7% annually, the article argues the firm could be trading at a 20–25% discount to its intrinsic value.

The “triple” part of the thesis comes from a combination of:

- Aggressive growth in e‑commerce that the firm is now poised to capture, with a 10–12% annual increase projected for the next 12 months.

- Margin expansion that will lift operating profit margins to 6.0% or higher.

- Dividend reinvestment that adds a 1–2% annual yield on top of price appreciation.

Using a discounted cash‑flow model that incorporates a 10% cost of capital and a terminal growth of 3%, the article estimates a fair value of $140–$145 per share, while the stock trades near $110–$115. This would imply a 20–30% upside – a figure that the author interprets as “triple” when combined with an aggressive growth scenario that pushes the stock to $165–$170 within a year.

The article also points out that this analysis is conservative because it does not account for potential “black‑swallow” factors like macro‑economic headwinds or new competitors that could bite into Walmart’s share of e‑commerce.

4. Risks & Red Flags

No analysis is complete without risk assessment. The article flags three main headwinds:

- Consumer inflation could dampen discretionary spending, hurting online sales.

- Labor shortages in warehousing and fulfillment may push up operating costs faster than expected.

- Geopolitical tensions in the Middle East could delay the launch of the new e‑commerce portal.

The author encourages investors to keep a close eye on quarterly guidance and to be prepared to adjust the target if one of these scenarios materializes.

5. Broader Context: Other Cash‑Machine Picks

The piece also references other “cash machine” candidates, including Costco Wholesale (COST) and Johnson & Johnson (JNJ). It links to a broader “Cash Machine” guide that explains how to evaluate each of the four pillars (cash flow, dividend, earnings stability, valuation). Those links are especially useful for readers who want to expand their watchlist beyond Walmart.

6. Bottom Line

The Motley Fool’s article offers a compelling, data‑driven argument that Walmart’s combination of steady cash flow, disciplined dividend growth, and a bullish growth story could propel its share price to new heights in the next 12 months. While the “triple” headline is certainly ambitious, the underlying metrics, valuation gaps, and growth catalysts provide a reasonable pathway for such upside.

Investors interested in a “cash machine” that delivers both income and growth may find Walmart a noteworthy addition to their portfolio— especially if they are willing to accept the typical retail risks in exchange for the potential of a substantial return.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/this-cash-machine-stock-is-set-to-triple-over-the/ ]