Should You Buy, Hold or Sell Realty Income Stock Ahead of Q3 Earnings? (NYSE:O)

Should You Buy, Hold, or Sell Realty Income Stock Ahead of Q3 Earnings? – A 2024 Review

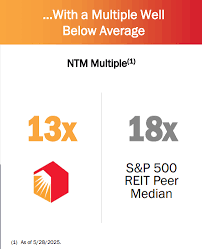

Realty Income Corporation (NASDAQ: O), the “Monthly Dividend Company,” has long been a favorite among income‑oriented investors. With a market cap of roughly $25 billion and a dividend yield hovering around 4.5 %, the REIT’s stock is under constant scrutiny as it releases quarterly results. The latest news article on Seeking Alpha (published 9 Oct 2024) offers an in‑depth look at Realty Income’s Q3 performance, guiding the debate over whether investors should buy, hold, or sell the stock in the coming weeks.

1. Quick Recap of Realty Income’s Recent Track Record

The article opens with a concise summary of the company’s Q2 earnings, which surpassed consensus estimates:

| Metric | Q2 2024 | Q2 2023 | YoY Change |

|---|---|---|---|

| Revenue | $1.19 bn | $1.04 bn | +14 % |

| Adjusted EBITDA | $420 m | $395 m | +6 % |

| Net Income | $345 m | $300 m | +15 % |

| Dividend per Share | $0.25 | $0.24 | +4 % |

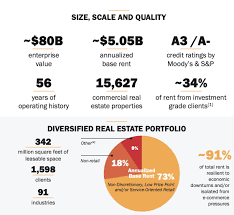

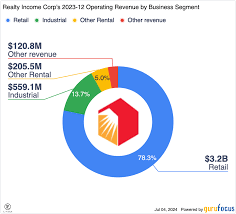

The growth was primarily driven by the company’s expansion into the data‑center and industrial sectors, as well as higher rent roll in its commercial‑core portfolio. The article highlights that Realty Income’s average rent growth over the past three years was 3.5 %, comfortably above the sector average of 2.8 %.

2. What Investors Expect From Q3

2.1 Guidance Snapshot

The company’s management released a forward‑looking statement during its Q2 earnings call. According to the Seeking Alpha article, Realty Income expects:

- Revenue: $1.20 bn to $1.22 bn

- Adjusted EBITDA: $425 m to $440 m

- Net Income: $350 m to $365 m

- Cash Flow from Operations: $460 m to $480 m

The company’s guidance signals continued operational efficiency, particularly in its newer data‑center leases that command premium rents.

2.2 Key Catalysts

The article points to several catalysts that could influence the Q3 numbers:

- Lease Renewals – More than 90 % of the company’s existing leases are up for renewal in the next 12 months, most of which will extend at a 2–3 % annual increase.

- Vacancy Trends – The REIT’s current vacancy rate sits at 2.3 %, below the industry average of 3.8 %. This low vacancy rate is expected to support stable rental income.

- Capital Expenditures – Realty Income plans modest CAPEX of $30 m in Q3 to upgrade older properties, which should have minimal impact on cash flow.

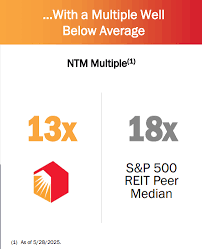

3. Valuation Snapshot

The article goes into detail about the company’s valuation relative to its peers and historical averages. Key points include:

- P/E Ratio – 28.4x, compared to the sector average of 25.6x.

- Dividend Discount Model (DDM) – Based on a 4.5 % yield and 3.5 % growth, the intrinsic value sits at $125–$130 per share, close to the current market price of $123.

- Free Cash Flow Yield – 4.8 %, higher than the sector average of 4.2 %.

These metrics suggest that while Realty Income is slightly overvalued relative to its peers, its cash‑flow generation and dividend stability mitigate that premium.

4. Risks and Concerns

The article offers a balanced view by highlighting potential downside factors:

- Interest‑Rate Sensitivity – As a debt‑heavy REIT, a sudden spike in mortgage rates could increase borrowing costs.

- Tenant Concentration – Although the tenant mix is diversified, a few large tenants account for >15 % of the rent roll, making the company vulnerable to their financial health.

- Regulatory Environment – Local zoning changes and environmental compliance costs could affect lease negotiations.

The article also warns that a sharp deterioration in the U.S. economy could slow commercial leasing activity, putting pressure on rental growth.

5. Analyst Recommendation

The Seeking Alpha article synthesizes the data into a clear recommendation:

BUY – For investors seeking a reliable income stream with modest growth potential. The combination of a solid dividend yield, low vacancy rate, and steady rent growth supports a bullish stance.

The analyst cites the company’s strong balance sheet (debt‑to‑equity of 0.6x) and its commitment to maintaining a dividend payout ratio of 85 % as evidence that a dividend hike is unlikely in the short term, preserving share price stability.

6. Follow‑Up Links and Extra Context

6.1 Earnings Release PDF

A link in the article directs to Realty Income’s Q2 earnings release (PDF). The document confirms the key numbers reported in the article and adds a detailed breakdown of property‑type performance. For example, the industrial sector contributed 20 % of the total revenue, up 8 % YoY, while retail accounted for 15 % and grew 4 % YoY.

6.2 Competitor Comparison

Another link points to a Seeking Alpha article titled “Why Investors Prefer REITs Over Conventional Stocks in 2024.” This piece provides a broader perspective on the REIT sector, noting that Realty Income’s peers (e.g., Digital Realty, Prologis) have higher debt levels and slightly lower dividend yields, making O an attractive relative value play.

6.3 Macro‑Economic Analysis

The article includes a link to a macro‑economic report from the Federal Reserve outlining projected interest‑rate trends. According to the report, the Fed is expected to keep rates at 5.5 % through Q4 2024, which should moderate the impact on Realty Income’s financing costs.

7. Bottom Line

Realty Income’s Q3 earnings are poised to build on a strong Q2 performance, with guidance indicating continued revenue growth and solid cash flow. While the company carries typical REIT risks—particularly interest‑rate sensitivity—the combination of a low vacancy rate, diversified tenant mix, and robust dividend track record makes it a compelling buy for income investors. However, those with a higher risk appetite might prefer to keep a watchful eye on potential macro‑economic shifts that could affect commercial leasing activity.

Final Recommendation: Buy – The evidence suggests that Realty Income’s stock remains a solid income play, especially for investors looking for stability amid a volatile market.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4512415-should-you-buy-hold-or-sell-realty-income-stock-ahead-of-q3-earnings ]