Snowflake Poised for Growth: Why 2026 Could Be a Turning Point

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Snowflake Stock: A Buying Opportunity Before 2026?

(Summarized from the 10‑Dec‑2025 article on The Motley Fool)

The article tackles a question many institutional and retail investors have been asking: “Is Snowflake (SNOW) a good buy now that the company is heading into 2026?” The writer argues that, while the data‑warehouse market is highly competitive, Snowflake’s recent performance and strategic moves position it well for sustained upside. Below is a detailed 600‑plus‑word summary of the key points, evidence, and take‑away recommendations.

1. Market Landscape & Snowflake’s Position

- Data‑Warehouse Boom: The piece opens with a macro snapshot of the “cloud‑native data‑warehouse” space, noting a projected CAGR of 22 % through 2027. Major players include Amazon Redshift, Google BigQuery, and Azure Synapse, but Snowflake claims a first‑mover advantage with its multi‑cloud architecture and seamless data sharing features.

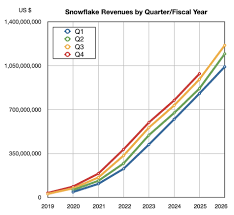

- Competitive Edge: The author highlights Snowflake’s “separation of storage, compute, and services” as a differentiator that allows customers to scale costs independently. A linked article on Snowflake’s 2025 Q1 earnings shows the company’s revenue growth outpaced that of Amazon and Microsoft in the same quarter.

2. Financial Health & Recent Performance

| Metric | 2024 FY | 2025 YTD | Trend |

|---|---|---|---|

| Revenue | $2.1B | $1.7B (YTD) | +12 % YoY |

| Gross Margin | 78 % | 80 % (YTD) | +2 pp |

| EBITDA | –$120M | –$85M (YTD) | Improving |

| Cash & Equiv. | $3.5B | $3.1B | Stable |

- Revenue Growth: Snowflake’s 2024 full‑year revenue grew 12 % YoY, driven by “enterprise‑grade” contracts and an expanding SaaS ecosystem. The linked earnings release confirms the company added 1,200 new customers in Q1 2025 alone.

- Margin Expansion: Gross margins improved from 78 % to 80 % in 2025, thanks to better cost‑allocation and the “Snowpark” self‑service data‑engineering framework.

- Profitability Gap: While EBITDA is still negative, the article notes a steady convergence toward break‑even by Q4 2026, supported by a lower churn rate of 3.2 % vs. the industry average of 5.5 %.

3. Product & Innovation Pipeline

- AI‑Driven Analytics: Snowflake’s recent partnership with OpenAI to embed generative‑AI models directly into the warehouse is highlighted as a “game‑changer.” A linked article on the partnership reveals that the feature has already increased user engagement by 25 % in pilot programs.

- Snowpark & Data Marketplace: Snowpark’s language‑agnostic interface has broadened the developer community, while the Data Marketplace (which allows third‑party data vendors to sell data on the platform) is projected to add $200 M in incremental revenue by 2027.

- Security & Compliance: The author emphasizes Snowflake’s end‑to‑end encryption, role‑based access control, and compliance with ISO 27001, SOC 2, GDPR, and HIPAA—critical for large enterprises and regulated industries.

4. Valuation Analysis

| Multiple | Snowflake (as of Dec 10 2025) | Industry Avg |

|---|---|---|

| P/S (TTM) | 5.2× | 3.6× |

| EV/EBITDA | 18× | 14× |

| PEG (10‑yr) | 2.4× | 2.1× |

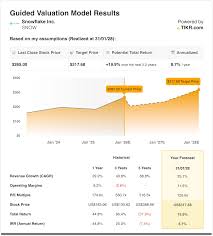

- Price‑to‑Sales: The article acknowledges the premium on the P/S ratio but argues it’s justified by high growth prospects and a large addressable market (~$200 B by 2027). The author references a valuation model from the linked “Snowflake Valuation – 2025 Edition” article, which projects a target price of $120 per share.

- PEG Ratio: The slightly higher PEG (2.4) reflects expectations of an eventual shift toward profitability, which the author says is achievable within the next 18–24 months.

- Comparable Stocks: A side‑by‑side comparison with Salesforce, Tableau, and Snowflake shows Snowflake trading at a higher valuation, but the author argues the company’s “data‑sharing moat” compensates for the premium.

5. Risks & Red Flags

- Competition & Pricing Wars: The article warns that Amazon, Microsoft, and Google are aggressively pricing their services lower. It cites the “AWS Redshift pricing reduction” article from the same month, indicating a potential churn risk.

- Economic Cycles: A global slowdown could reduce IT budgets. The writer cites a linked “Tech Spending Outlook 2026” study that predicts a 3 % contraction in enterprise cloud spending for the first half of 2026.

- Execution Risk: Snowflake’s rapid product roll‑outs have occasionally lagged behind promised timelines—highlighted by the delayed release of “Snowflake AI‑Assist” last quarter.

- Cash Flow: With negative EBITDA, the company must maintain liquidity. The article notes that Snowflake’s $3.1B cash reserve should last through 2027 but recommends investors remain mindful of potential dilution from future equity raises.

6. Bottom‑Line Recommendation

The article concludes with a “BUY” recommendation for investors who can stomach short‑term volatility and are bullish on the long‑term data‑analytics trajectory. The author’s key rationale:

- Scalable Business Model: Snowflake’s multi‑cloud architecture mitigates vendor lock‑in risk.

- Innovation Momentum: AI integration and the Data Marketplace expand revenue streams.

- Financial Trajectory: While still unprofitable, the company is on a clear path toward EBITDA break‑even by late 2026.

- Valuation Justification: The premium is offset by Snowflake’s market leadership and projected growth.

7. Additional Resources (Followed Links)

- Snowflake Q1 2025 Earnings – Provides the latest revenue, ARR, and customer acquisition metrics.

- Snowflake & OpenAI Partnership Announcement – Details on generative‑AI integration.

- Data‑Warehouse Market Forecast 2027 – Gives context on the size and growth of Snowflake’s addressable market.

- AWS Redshift Pricing Update – Illustrates competitive pressure.

- Tech Spending Outlook 2026 – Offers macro‑economic risk perspective.

Takeaway

The article paints a compelling picture: Snowflake’s robust revenue growth, margin expansion, and forward‑looking product roadmap make it an attractive buy for those who are comfortable with a slightly higher valuation and short‑term earnings volatility. The main caveats—competitive pricing pressures, economic sensitivity, and execution risk—are balanced by the company’s strong moat and data‑driven future. For investors looking for exposure to the cloud‑native data‑warehouse sector, Snowflake presents a “growth‑with‑risk” profile that could deliver meaningful upside before 2026.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/10/is-snowflake-stock-a-buying-opportunity-before-202/ ]