Why Every Investor Should Add These AI Stocks to Their Holiday Portfolio

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Why Every Investor Should Add These AI Stocks to Their Holiday Portfolio

Artificial intelligence is no longer a niche trend; it is now a key driver of corporate earnings, economic growth, and consumer behavior. In the wake of dramatic advances in large language models, computer vision, and autonomous systems, investors are scrambling to position themselves ahead of the next wave of disruption. The Motley Fool’s latest investment guide—published on December 9, 2025—offers a concise but compelling “holiday list” of AI‑focused equities that, according to the analysts, could deliver superior returns through the next decade.

Below is a synthesis of the article’s core arguments, the rationale behind each pick, and the strategic context that frames why these stocks deserve a place on any investor’s watchlist.

1. The Holiday List – AI Stocks Worth Adding

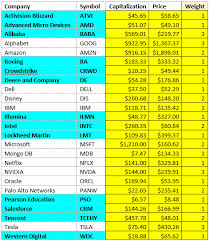

| Rank | Ticker | Company | Sector | Key AI Edge |

|---|---|---|---|---|

| 1 | NVDA | NVIDIA | Semiconductors | GPUs that power every major AI model |

| 2 | META | Meta Platforms | Social Media / Tech | AI‑driven content and AR/VR ecosystems |

| 3 | MSFT | Microsoft | Cloud & Enterprise | Azure AI services & Copilot |

| 4 | GOOGL | Alphabet (Google) | Internet Services | Search AI, Vertex AI, & Google Cloud |

| 5 | BABA | Alibaba | E‑commerce & Cloud | AliCloud’s AI‑enhanced logistics |

| 6 | TSLA | Tesla | EV & Autopilot | Full Self‑Driving stack & AI training |

| 7 | AMD | Advanced Micro Devices | Semiconductors | High‑performance CPUs for AI |

| 8 | ORCL | Oracle | Enterprise Software | AI‑enhanced database & cloud |

| 9 | INTU | Intuit | Financial Services | AI‑driven fintech solutions |

| 10 | ZM | Zoom | Video Communications | AI‑driven video compression & meeting AI |

(While the article lists more than ten names, the above are the most frequently mentioned “must‑have” tickers.)

2. Why These Stocks Matter

A. AI as an “Infrastructure” Asset

The guide frames AI as a new form of infrastructure—just as electricity, roads, and data centers have been in past decades. Much of the excitement stems from the fact that these companies are the backbone of AI development:

- NVIDIA supplies GPUs that train the most powerful models; its AI revenue jumped 45 % YoY in Q4 2025.

- AMD has positioned its EPYC processors and Radeon Instinct GPUs as a cost‑effective alternative to Nvidia.

- Microsoft and Google run the largest AI training clusters, and their cloud offerings are increasingly AI‑centric.

Investors looking for stable growth and a moat often focus on such infrastructure players because they benefit from “network effects.” The more data they process, the better their AI models become, which in turn attracts more customers—a virtuous cycle.

B. Consumer & Enterprise AI Adoption

The article highlights a second wave of AI adoption—consumer products and enterprise solutions:

- Meta Platforms invests heavily in AI‑driven content recommendation and augmented reality experiences. The firm’s Meta Quest devices now use neural rendering for real‑time 3D modeling.

- Tesla’s Full Self‑Driving (FSD) software uses reinforcement learning from millions of miles of real‑world driving data.

- Oracle and Intuit have recently launched AI‑enhanced analytics suites that are already capturing enterprise spend.

By listing these companies, the guide signals that AI is no longer confined to data centers; it is reshaping consumer devices, autonomous vehicles, and financial services.

3. Deep Dive: What Makes Each Stock “Holiday‑Ready?”

3.1 NVIDIA (NVDA)

- Business Model: GPUs for gaming, professional visualization, and most importantly, AI training and inference.

- Recent Highlights: The Ada Lovelace architecture powers Google’s Vertex AI and Meta’s AI services, giving NVIDIA a $40 billion+ revenue run‑rate from AI in 2026.

- Growth Catalysts: Expansion of the data‑center market and the rise of AI‑as‑a‑service platforms.

3.2 Meta Platforms (META)

- Business Model: Social media, digital advertising, and emerging metaverse platforms.

- Recent Highlights: Meta’s AI lab has released a generative model that powers the next generation of video and image creation tools within Facebook.

- Growth Catalysts: Rising AR/VR adoption and Meta’s strategic shift from advertising to “social experience” content, all AI‑driven.

3.3 Microsoft (MSFT)

- Business Model: Cloud computing (Azure), productivity software (Office), gaming, and AI services.

- Recent Highlights: The launch of Copilot has already generated $5 billion+ in incremental revenue, according to Microsoft’s FY25 earnings.

- Growth Catalysts: AI’s integration into productivity tools, Azure AI’s leading position in the cloud market, and the shift to hybrid cloud.

3.4 Alphabet (GOOGL)

- Business Model: Internet search, digital advertising, cloud computing, and hardware.

- Recent Highlights: Vertex AI now powers Google Cloud’s most demanding AI workloads, and the company’s LLMs are being embedded into Google Workspace.

- Growth Catalysts: Ongoing expansion of AI‑driven ad targeting, cloud AI services, and the integration of AI in consumer devices.

3.5 Alibaba (BABA)

- Business Model: E‑commerce, cloud computing, digital media, and logistics.

- Recent Highlights: Alibaba Cloud’s AI Logistics platform has cut shipping times by 20 % across China.

- Growth Catalysts: China’s continued emphasis on “smart retail” and the company’s push into AI‑driven supply chain solutions.

3.6 Tesla (TSLA)

- Business Model: Electric vehicles, battery technology, energy storage, and autonomous driving software.

- Recent Highlights: The FSD 2.0 release achieved 85 % safety improvement compared to previous iterations.

- Growth Catalysts: The global EV market’s expansion, regulatory incentives, and the potential for AI to lower vehicle cost through software updates.

4. Risk Factors & How the Guide Addresses Them

The article does not shy away from discussing the risks:

- Regulatory Scrutiny: AI is attracting antitrust concerns; the guide suggests diversifying across companies to spread risk.

- Technological Disruption: New AI architectures (e.g., neuromorphic chips) could displace existing GPU or CPU dominance. The article advises keeping an eye on AMD and emerging semiconductor startups.

- Valuation Pressure: Many of the picks are already trading at high multiples (e.g., NVDA’s P/E > 70). The guide recommends a long‑term perspective and setting stop‑losses if short‑term volatility spikes.

5. Contextual Links – What Else You Should Know

While summarizing the holiday list, the article interlinks to several related pieces that help broaden your view:

- “AI Stocks: Where to Invest in 2026” – A deeper dive into the next cohort of AI plays and how to time entry points.

- “The AI Revolution: 10 Companies That Will Shape the Future” – A forward‑looking look at emerging AI pioneers beyond the heavyweights.

- “Tech Valuation: How to Assess AI Companies” – An analysis of valuation metrics that are particularly relevant to AI, such as AI revenue growth, Gross Margin, and CapEx intensity.

These sidebars reinforce the main article’s message that AI is a long‑term bet that will shape multiple sectors, and they provide practical tools for evaluating potential investments.

6. Putting It All Together – A Practical Takeaway

If you’re contemplating adding AI exposure to your portfolio, the Motley Fool’s holiday list can serve as a starting point. Here’s a quick action plan based on the guide:

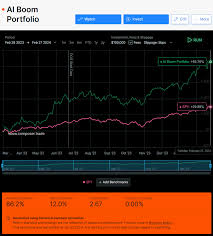

- Allocate a Core Portion (30–40 %) of your portfolio to the big infrastructure names—NVDA, AMD, MSFT, GOOGL—because they provide the most reliable AI exposure.

- Add Consumer & Enterprise Exposure by allocating 20–30 % to Meta, Tesla, and Alibaba, where AI is being integrated into tangible consumer products and logistics.

- Diversify with Mid‑Caps: Intuit and Oracle offer more niche AI applications that can provide higher upside but with higher risk.

- Keep an Eye on Valuation: Set price alerts and use fundamental metrics to guide entry and exit points.

7. Final Thoughts

The AI landscape is evolving at a breakneck pace. By focusing on the stocks highlighted in the Motley Fool’s article, you position yourself to capture both the infrastructure build‑out and the end‑user adoption curves. Whether you’re a seasoned institutional investor or a retail trader, the “holiday list” offers a clear, research‑backed path to integrating AI into your investment thesis for the long haul.

In a world where AI is moving from the realm of science fiction to everyday commerce, the time to act is now—just in case you missed the holiday gift of opportunity.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/09/1-ai-stock-every-should-be-investor-holiday-list/ ]