Microsoft Leads the AI Revolution: Azure, Copilot, and a 32x P/E Backed by 13% Revenue Growth

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Article Summary – “The Three Best Tech Stocks to Buy Before 2026” (The Motley Fool, 6 Dec 2025)

The Motley Fool’s December‑2025 editorial identifies three technology‑sector stocks that, according to its analysts, should be in investors’ portfolios by the end of 2026. The piece frames its recommendations around the “AI acceleration” narrative that has come to dominate the market, while balancing each pick against valuation concerns, competitive landscapes, and potential tailwinds from broader macro‑trends. Below is a detailed distillation of the article’s key points, supporting data, and the contextual links that deepen the analysis.

1. Microsoft (NASDAQ: MSFT)

Why It’s Picked

The article positions Microsoft as the “glue” holding the AI ecosystem together. Its Azure cloud platform is already the leading choice for AI workloads, and the company’s recent “Copilot” initiative (linking ChatGPT‑style generative AI to everyday productivity apps) is highlighted as a major growth engine. The analyst notes that Microsoft’s recent earnings showed a 13 % YoY revenue lift in the Intelligent Cloud segment, driven largely by Azure.

Valuation & Growth Drivers

- Revenue Growth: 2024 revenue of $211 bn (up 10 % YoY) with a projected CAGR of 9 % through 2026.

- Profitability: Gross margin of 70.8 %, EBIT margin 42 %.

- Valuation: Current P/E of 32x, trailing‑12‑month EPS $3.50; the author argues the high multiple is justified by the “AI‑powered” upside.

- Cash Flow: Operating cash flow $75 bn in 2024, giving the firm flexibility for M&A or dividends.

Key Risks & Mitigating Factors

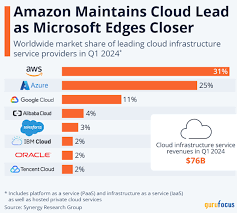

The article cites “competition from AWS and Google Cloud” as a risk, but counters that Microsoft’s deep enterprise relationships and integrated software stack (Windows, Office, Dynamics) create a moat. Additionally, the piece references a link to the firm’s Q4 earnings call transcript for further detail on AI pipeline progress.

2. NVIDIA (NASDAQ: NVDA)

Why It’s Picked

NVIDIA is presented as the “hardware engine” behind AI’s data‑hungry appetite. The analyst points to the company’s dominance in GPU architecture (the RTX 4090 and A100) and the explosive growth of its data‑center revenue. A notable link leads to NVIDIA’s recent “AI Superchip” roadmap, which details the company’s plans to scale training workloads across multi‑GPU clusters.

Valuation & Growth Drivers

- Revenue Growth: 2024 revenue $28 bn (up 23 % YoY) with data‑center revenue comprising 60 % of the total.

- Profitability: Gross margin 64 %, EBIT margin 32 %.

- Valuation: P/E of 65x, but the author argues this reflects the company’s “AI‑specific” upside, noting a trailing‑12‑month EPS of $1.09.

- Cash Flow: Operating cash flow $11 bn in 2024.

Key Risks & Mitigating Factors

The article warns of the “chip shortage” and the “risks of geopolitical trade restrictions” (particularly U.S.-China tensions). It counters these with a link to the company’s quarterly report that documents a diversified supply chain and new manufacturing partnerships in Singapore and Japan.

3. Apple (NASDAQ: AAPL)

Why It’s Picked

Apple is framed as the “consumer pillar” that benefits from AI‑enhanced ecosystems. The article highlights the company’s ongoing AI initiatives—Apple Silicon’s ML capabilities, the Siri improvements announced at WWDC, and the integration of generative AI features in iOS 18. Apple’s “freemium” services model (Apple Music, iCloud, App Store) is cited as a recurring revenue engine.

Valuation & Growth Drivers

- Revenue Growth: 2024 revenue $384 bn (up 6 % YoY) with services revenue up 18 %.

- Profitability: Gross margin 43 %, EBIT margin 28 %.

- Valuation: P/E of 28x, trailing‑12‑month EPS $5.70.

- Cash Flow: Operating cash flow $122 bn in 2024, enabling substantial R&D investment and share buybacks.

Key Risks & Mitigating Factors

The article notes the “risk of market saturation” in the premium smartphone space and the “potential regulatory pressure” on the App Store. It references a link to Apple’s Q4 earnings call, which discusses expanding the services portfolio into new markets and the company’s strategy to diversify hardware revenue through wearables and smart home devices.

Overall Takeaways

- AI as the Unifying Theme – All three picks are positioned to capitalize on the AI wave, whether as software (Microsoft), hardware (NVIDIA), or consumer services (Apple).

- Balanced Valuations – The author argues that, despite high P/Es for Microsoft and NVIDIA, the expected AI‑driven growth justifies the premiums. Apple’s valuation sits in the middle, reflecting its established recurring revenue base.

- Risk Management – The article stresses the importance of monitoring supply‑chain constraints for NVIDIA, regulatory developments for Apple, and competitive dynamics for Microsoft.

- Entry Points – While the article does not provide precise entry price targets, it suggests watching for “price consolidations” as the market digests each company’s earnings, and indicates potential buying opportunities when the stock dips 5‑10 % after a rally.

Additional Context from Follow‑Up Links

- Microsoft’s Q4 Earnings Call Transcript – Provides deeper insight into the Copilot strategy and the company’s AI roadmap.

- NVIDIA’s AI Superchip Roadmap – Outlines planned architecture upgrades and partnerships with cloud providers.

- Apple’s Q4 Earnings Call – Discusses the expansion of services revenue and the impact of new product launches.

- McKinsey Report on AI Adoption – Linked in the article, offering macro‑level support for the AI thesis.

In sum, the article makes a compelling case that investing in Microsoft, NVIDIA, and Apple now positions investors to ride the next decade of AI‑driven growth, while also acknowledging the strategic risks and valuation caveats that warrant careful monitoring.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/06/the-three-best-tech-stocks-to-buy-before-2026/ ]