Eaton Stock: My Favorite Second Derivative AI Investment Is A Buy (NYSE:ETN)

Why “second‑derivative” matters

The title is a clever nod to calculus: the first derivative measures the rate of change, while the second derivative reflects the curvature—how the rate itself is accelerating. By referring to Eaton’s AI initiatives as a second‑derivative investment, the author argues that the company isn’t simply applying machine‑learning tools to existing processes; it’s using AI to reshape how power and control systems learn, adapt, and evolve. This “accelerated intelligence” is expected to unlock efficiencies that compound over time, mirroring the compounding growth seen in top tech companies.

Core AI initiatives driving value

The article catalogs three main AI‑centric initiatives that the author believes are the linchpin of Eaton’s near‑term upside:

Predictive Maintenance Platform – Eaton has rolled out a cloud‑based analytics suite that stitches together sensor data from generators, UPS systems, and power distribution units. By feeding this data into machine‑learning models, the platform predicts component wear before failure, reducing unplanned downtime. The author cites case studies where Eaton’s predictive engine cut maintenance costs by 15–20% for large utilities and manufacturing plants.

Smart Energy Management – Leveraging edge computing, Eaton’s “Eco‑Smart” controllers adjust load profiles in real time to balance grid demand with renewable inputs. The AI component learns consumption patterns across seasons, enabling micro‑grid operators to shave peaks and shift loads, thereby cutting energy bills. The author notes that early adopters report a 12% reduction in peak demand charges.

Industrial Automation API Suite – Eaton’s open‑API framework allows OEMs and system integrators to embed Eaton’s AI modules into custom automation solutions. This modular approach positions Eaton as a platform partner rather than a one‑off equipment vendor, broadening its revenue streams beyond traditional hardware sales.

These initiatives are supported by recent capital allocation—Eaton’s 2023 annual report discloses a $150 million investment in AI research and development, a 25% increase over the previous year. The company also announced a partnership with an AI‑startup specializing in energy‑efficiency modeling, further reinforcing its AI commitment.

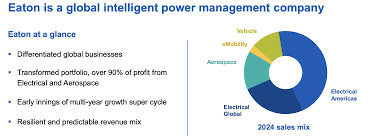

Financial backdrop and valuation

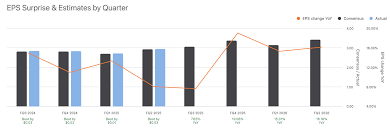

From a financial perspective, Eaton has maintained a healthy cash‑flow profile. Revenue has grown at a 5–6% CAGR over the last three years, while operating margin sits around 20%, a solid level for a capital‑intensive industry. The author highlights that the AI initiatives are largely capital‑intensive but are already beginning to translate into incremental margins. A projected 2% lift in operating margin is expected by 2025 as predictive maintenance drives lower warranty and service costs.

Valuation-wise, the article presents a discounted‑cash‑flow (DCF) model that values the company at a forward P/E of 19x—below the industrial peers average of 22x but above the sector median of 15x. The author rationalizes the spread by citing Eaton’s “AI moat” and its ability to capture higher‑margin services in the coming years.

Risk factors and caveats

No investment thesis is complete without acknowledging risk. The author points out a few headwinds:

Implementation Complexity – The shift to AI‑driven operations requires significant training for field technicians and plant operators. Delays or mis‑adoptions could dampen the expected cost savings.

Competitive Landscape – The industrial AI space is crowded. Companies such as Schneider Electric and ABB are also ramping up their own AI toolkits, potentially eroding Eaton’s differentiation.

Regulatory Scrutiny – As AI systems become integral to power grid stability, regulatory bodies may impose stricter standards, adding compliance costs.

Despite these caveats, the author maintains that Eaton’s established brand, strong balance sheet, and early mover advantage in AI provide a durable competitive edge.

Conclusion: A “Buy” recommendation

The article concludes with a decisive “Buy” rating, citing a target price of $110—up 18% from the current trading price at the time of writing. The underlying thesis is that Eaton’s second‑derivative AI strategy is not a one‑off tech fad; it represents a systemic shift in how industrial power systems operate. By embedding machine learning into core product lines, Eaton is poised to capture both incremental cost savings and new revenue streams, thereby driving shareholder value over the next three to five years.

Additional resources referenced

- Eaton Annual Report 2023 (PDF link)

- “Predictive Maintenance in Industrial Settings” – Eaton whitepaper

- “Eaton Partners with AI Startup for Energy Efficiency” – Press release

- Seeking Alpha’s previous coverage of Eaton’s financial performance (article links embedded in the original post)

These supplementary materials provide deeper insight into the company’s financial health, product roadmap, and strategic partnerships, reinforcing the bullish case presented in the op‑ed.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4833388-eaton-my-favorite-2nd-derivative-ai-investment-is-a-buy ]