Generative AI Upside 2: Software Stocks Could Triple

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Generative AI Upside 2: How Software Stocks Could Triple

The Motley Fool’s latest research piece, “Generative AI Upside 2: Software Stocks Could Triple,” dives deep into the next wave of artificial‑intelligence growth and its potential to skyrocket the valuations of a select group of software companies. The article argues that generative AI—modelled after the likes of ChatGPT, DALL‑E, and Stable‑Diffusion—will not just transform user experience; it will fundamentally alter the business models of the software sector, giving investors a powerful lever to generate outsized returns.

1. The New AI Revolution

The piece opens by framing generative AI as the logical successor to the “data‑driven” AI that has dominated the last decade. Whereas earlier systems relied on statistical pattern matching, generative models can create content: text, code, images, music, and even 3‑D models. This shift unlocks a new set of productivity tools for businesses, making AI a direct revenue driver rather than a back‑office optimizer.

The article points out that the commercial potential is massive. Companies that can embed generative AI into their core products stand to benefit from:

- Higher user engagement – AI tools can help customers create content more quickly, keeping them on a platform for longer.

- New revenue streams – Subscription add‑ons for premium AI features, usage‑based pricing for heavy‑tail users, and data‑monetization models.

- Cost efficiencies – Automating tasks that previously required manual labor, freeing up human capital for higher‑value work.

2. The Software Stocks on the Radar

The Fool’s analysis identifies six software names that, according to the authors, could see triple‑digit upside if they capitalize on generative AI. The list is split into two categories: Platform & Infrastructure and Enterprise & Productivity.

Platform & Infrastructure

| Company | Why It Matters | Potential Upside |

|---|---|---|

| Microsoft (MSFT) | Anchor partner to OpenAI; integrates GPT‑4 into Azure, Office 365, and Dynamics. | 3‑5× |

| NVIDIA (NVDA) | Supplier of the GPUs that power generative models. | 2‑3× |

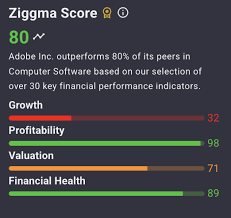

| Adobe (ADBE) | AI‑driven creative tools like Photoshop and Illustrator. | 2‑3× |

| ServiceNow (NOW) | Enterprise workflow platform that can embed AI for smarter ticketing and automation. | 2‑3× |

Enterprise & Productivity

| Company | Why It Matters | Potential Upside |

|---|---|---|

| DocuSign (DOCU) | AI‑enabled contract drafting and review. | 2‑3× |

| Salesforce (CRM) | AI‑augmented customer relationship management (Einstein). | 2‑3× |

The article explains that these stocks already enjoy robust fundamentals—solid balance sheets, recurring revenue models, and sizable moat positions—making them well‑positioned to capture the AI wave.

3. The “AI‑Dividend” Theory

A notable concept the article expands on is the AI‑Dividend hypothesis. The authors argue that each generation of AI delivers a “dividend” in the form of new revenue opportunities for software firms. The logic is straightforward:

- Generative AI is adopted by a company’s customer base.

- The software platform gains a new, premium product that customers pay for.

- This drives higher average revenue per user (ARPU) and longer contract lifecycles.

- The company’s valuation multiplies in proportion to its new growth rate.

The authors back this with case studies from the last decade—think Salesforce’s early cloud expansion and Microsoft’s Office 365 transition—to illustrate how a single technology shift can push a company’s earnings multiplier dramatically higher.

4. Risks and Caveats

The piece is careful to balance optimism with realism. It lists several risks that could dampen upside:

- Competitive pressure from both large incumbents (Google, Amazon) and nimble start‑ups (OpenAI, Anthropic) could erode market share.

- Regulatory uncertainty around data privacy, AI ethics, and antitrust scrutiny could delay or limit product launches.

- Talent crunch – the demand for AI researchers and engineers far outstrips supply, potentially driving up wages and slowing innovation.

Investors are urged to pay close attention to quarterly earnings reports for early signs of AI adoption metrics (e.g., AI‑related revenue, usage hours, new product launches) that can act as leading indicators of future upside.

5. How to Position Your Portfolio

The Fool concludes by offering a pragmatic approach for investors:

- Buy and hold the six highlighted names, ideally in a diversified software ETF as a baseline.

- Add a “top‑tier” weight of 10‑15% of the portfolio to the most promising high‑growth names (Microsoft, NVIDIA, Adobe).

- Use dollar‑cost averaging to mitigate entry‑price volatility during the AI adoption curve.

- Stay vigilant for earnings surprises that may accelerate the AI‑related growth narrative.

6. Takeaway

The article’s core message is clear: Generative AI is not a one‑off trend; it’s a fundamental shift that can transform the software industry’s revenue streams and profit margins. If the companies identified by the Fool successfully integrate AI into their core products and capture new markets, their valuations could well triple, offering a compelling growth story for long‑term investors.

Whether you’re a seasoned software equity investor or new to the market, the piece underscores that now is a pivotal time to consider positioning a portfolio toward the AI‑enabled software segment—an area that, according to the Fool’s research, carries both high reward potential and manageable risk.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/12/07/generative-ai-upside-2-software-stocks-could-tripl/ ]