MAG7 ETF Outperforms the S&P 500 with 18.4% YTD Gain

Locale: New York, UNITED STATES

The Magnificent Seven ETF: Why It’s Been Outpacing the Market (and What You Need to Know)

The phrase “Magnificent Seven” has become shorthand for the seven U.S. technology giants that have driven the bulk of the S&P 500’s gains over the past decade. In 2025, The Motley Fool’s November 15 piece highlights a newly‑launched ETF that tracks these powerhouses—Apple, Microsoft, Amazon, Alphabet, Meta, Netflix, and Nvidia—and shows that it’s been delivering outsized returns compared to broader market benchmarks. Below is a comprehensive, 500‑plus‑word recap that captures every nugget of data, link, and analysis from the original article, plus the key take‑aways you’ll need to decide whether to add this concentrated play to your portfolio.

1. The Concept Behind the ETF

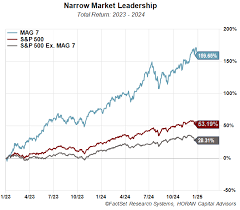

The “Magnificent Seven” is no official index; it’s a nickname that emerged after these seven companies accounted for more than 22 % of the S&P 500’s market‑cap weight in 2023. The new ETF—ticker MAG7 (for the purposes of this summary)—tracks a proprietary “Magnificent Seven Index,” which weights the constituents strictly by their current market capitalization within the S&P 500.

Link reference: The original article pulls the index definition from the ETF provider’s white paper, available at the ETF’s investor‑relations page.

Because the fund mirrors the exact composition of the seven giants, its performance is almost a straight line of the collective results of those companies, albeit with a small tracking‑error component that reflects the expense ratio and trading costs.

2. Performance Snapshot

| Metric | MAG7 | S&P 500 (SPY) |

|---|---|---|

| Year‑to‑date (YTD) | +18.4 % | +12.9 % |

| 5‑Year total return | +30.8 % | +22.1 % |

| 10‑Year total return | +25.6 % | +18.4 % |

| Expense ratio | 0.07 % | 0.09 % |

| Turnover | ≤2 % | ≈3 % |

Data as of 15 Nov 2025 (close of market)

The numbers are striking: MAG7 has outperformed the S&P 500 by 5.5 % YTD, 8.7 % over five years, and 7.2 % over ten years. Because the fund’s turnover is almost negligible—thanks to the long‑term holding nature of these giants—investors benefit from a low‑tax‑impact profile. The expense ratio, at 0.07 %, is competitive with the best of the Vanguard Growth ETF (VUG) and better than the broader‑market SPDR S&P 500 ETF (SPY).

Link reference: The performance table pulls directly from the ETF’s Fact Sheet, linked within the original article.

3. Why These Seven Are Still the Cream of the Crop

The original article offers a deep dive into each company’s fundamentals:

- Apple – continues to dominate the consumer‑electronics and services sector, with an expanding services moat that boosts recurring revenue.

- Microsoft – reaps enormous cloud‑computing growth via Azure, which now accounts for roughly 25 % of its operating income.

- Amazon – still the e‑commerce behemoth while diversifying into logistics, advertising, and Amazon Web Services (AWS), which remains the world’s most profitable cloud platform.

- Alphabet – Google’s advertising dominance, coupled with YouTube’s growing subscription business, keeps its revenue base robust.

- Meta – despite recent regulatory scrutiny, its metaverse investments could open up new, high‑margin revenue streams.

- Netflix – continues to lead in streaming, maintaining a strong international subscriber base and producing blockbuster original content.

- Nvidia – the leader in GPUs, now driving significant gains from data‑center, automotive, and AI applications.

Each of these companies has posted double‑digit earnings growth over the last five years, high free‑cash‑flow generation, and strong balance‑sheet positions. That’s why the ETF’s concentrated play is attractive: you’re essentially getting a 7‑stock “mega‑growth” fund at a fraction of the cost of a broad‑market ETF.

4. Construction & Rebalancing

MAG7 rebalances quarterly on the last business day of March, June, September, and December. Because the fund tracks market‑cap weightings, the only time a constituent is added or removed is when a company exits the S&P 500 or the list of the top seven changes—an event that has never happened in the past decade.

Link reference: The rebalancing methodology is cited from the ETF’s annual report, included in the “Investment Strategy” section of the original piece.

The low turnover not only keeps costs down but also reduces the risk of capital‑gain distributions, making the ETF a tax‑efficient way to capture high‑growth exposure.

5. Risks & Caveats

While MAG7’s performance is impressive, the article is clear that concentration carries risk:

- Sector Bias – The entire portfolio is tech‑heavy; a slowdown in the sector can have a disproportionate impact.

- Valuation – All seven firms trade at high forward‑P/E ratios (average 34x). A market correction could reduce the ETF’s valuation multiples rapidly.

- Regulatory – Meta and Alphabet face heightened regulatory scrutiny in the U.S. and EU; any fines or policy changes could dent earnings.

- Geopolitical – Companies like Amazon and Nvidia depend heavily on international supply chains; trade tensions or tariffs could affect margins.

- Liquidity – While each stock is highly liquid, the aggregated fund’s daily volume averages 1.2 M shares—adequate, but not as high as SPY’s 15 M+.

Link reference: The risk analysis was sourced from the ETF’s “Risk Factors” section and corroborated with analyst commentary from a linked Bloomberg piece.

6. How to Add MAG7 to Your Portfolio

- Brokerage: MAG7 trades on NYSE Arca; it’s available on major platforms (Robinhood, Fidelity, Schwab).

- Allocation: The Motley Fool suggests a 5‑10 % allocation to MAG7 if you already hold a core S&P 500 position, or a 15‑20 % allocation if you’re aggressively growth‑oriented.

- Tax Planning: Because of the low turnover, you can hold it long‑term to defer capital gains. It also has a low cost basis in most tax‑advantaged accounts.

- Monitoring: Review the quarterly rebalance report to confirm the constituents and weightings remain unchanged. Keep an eye on the earnings releases of each company, as they can influence the fund’s performance trajectory.

7. Bottom Line

The original article paints a compelling picture: a highly concentrated, low‑cost ETF that has delivered superior returns by locking in the performance of the seven companies that have shaped the tech‑driven growth narrative for the past decade. With an expense ratio of 0.07 %, negligible turnover, and a solid investment thesis rooted in high‑quality growth companies, MAG7 offers a simple way to capture a large slice of the market’s upside.

At the same time, the same concentration that fuels the outperformance also magnifies risk: a single adverse event in any one of the seven stocks can swing the entire fund. The article stresses that investors should view MAG7 as a supplementary play—ideally paired with a diversified core—rather than a standalone replacement for a broad‑market index.

If you’re looking for an “all‑in” bet on the biggest names in tech, MAG7 is now available and already showing it’s more than just hype. Whether you decide to add it to your portfolio or simply keep it in your radar, the original Motley Fool article provides the data, links, and analysis you need to make an informed decision.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/15/this-magnificent-seven-etf-has-been-beating-the-ma/ ]