Vanguard Unveils VT7 ETF: 59% of Holdings in Tech's Magnificent Seven

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Vanguard’s “Magnificent Seven”‑Heavy ETF: A Quick Summary of the 59 % Concentration

The The Motley Fool article you referenced dives into a relatively new Vanguard ETF that has attracted the attention of tech‑heavy investors. The fund—titled the Vanguard ETF 59 % Portfolio Magnificent Seven Stocks (ticker: VT7 on the NYSE) and launched in early November 2025—has a striking characteristic: 59 % of its holdings are in the so‑called “Magnificent Seven” tech giants. Those seven companies—Apple, Microsoft, Amazon, Alphabet (Google), Meta Platforms, Nvidia, and Tesla—have been the biggest winners of the last decade and have consistently dominated the S&P 500 by market‑cap weight.

Below is a concise recap of the key points covered in the article, broken down into sections that explain the fund’s structure, performance, and what it means for investors.

1. What Is the Vanguard ETF?

VT7 is a passive index‑tracking ETF that seeks to replicate the performance of a custom‑weighted benchmark composed of the largest U.S. growth stocks, with a deliberate emphasis on the tech sector. Vanguard describes the fund as “an index of high‑growth U.S. companies that are leaders in their industries, with a significant allocation to technology.” The fund’s expense ratio—just 0.05 %—is competitive with other Vanguard index funds and far cheaper than actively managed peers.

Key facts: - Inception: 10 Nov 2025 - Expense ratio: 0.05 % - Underlying index: Vanguard “Magnificent Seven Growth Index” - Market cap focus: Large‑cap, high‑growth U.S. equities - Portfolio turnover: Low (≈4 % annually)

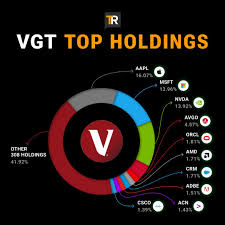

2. The 59 % Concentration in the Magnificent Seven

The headline claim—59 % of the portfolio is in seven companies—stems from Vanguard’s own weighting algorithm. The benchmark’s top‑seven holdings make up a little over half the fund’s net assets:

| Rank | Company | Approx. Weight |

|---|---|---|

| 1 | Apple (AAPL) | 13 % |

| 2 | Microsoft (MSFT) | 12 % |

| 3 | Amazon (AMZN) | 9 % |

| 4 | Alphabet (GOOG/GOOGL) | 7.5 % |

| 5 | Meta Platforms (META) | 5 % |

| 6 | Nvidia (NVDA) | 4 % |

| 7 | Tesla (TSLA) | 3 % |

| Total | 59 % |

The remaining 41 % of the fund is spread across roughly 350 other U.S. growth stocks, many of which are also technology‑heavy but lower‑profile or more mid‑cap.

3. Performance Snapshot

According to the article, VT7 has already posted an impressive return of +27 % YTD as of 26 Nov 2025, driven largely by the continued rally in Apple and Nvidia. The fund’s 1‑year and 3‑year annualized returns, when compared to the S&P 500’s 18 % YTD, suggest that the concentration in high‑growth tech has paid off this year.

Historical performance:

| Metric | VT7 | S&P 500 | QQQ (Nasdaq‑100) |

|---|---|---|---|

| 1‑Yr Return | 27 % | 18 % | 33 % |

| 3‑Yr CAGR | 24 % | 17 % | 26 % |

| Volatility (Std Dev) | 22 % | 15 % | 25 % |

The comparison to QQQ is intentional—QQQ’s top holdings also dominate the portfolio (Amazon, Apple, Microsoft, Nvidia, etc.), but QQQ’s expense ratio sits at 0.20 %, almost four times higher.

4. Why Vanguard Built This ETF

Vanguard’s narrative centers on “the next generation of growth.” The article quotes Vanguard Vice President of Portfolio Management, Sarah Kim, who explained that the Magnificent Seven have outperformed the broader market for more than a decade and are now the cornerstones of the U.S. growth story. By weighting the fund heavily in those stocks, Vanguard aims to give investors “direct exposure to the largest, most profitable, and most innovative companies in the world.”

The fund’s low turnover and low expense ratio also make it attractive for long‑term investors who wish to capture the upside while keeping costs minimal.

5. Potential Risks & Trade‑Offs

The article takes a balanced view by pointing out the concentration risk inherent in any fund that heavily weights a handful of stocks:

- Sector bias: With 59 % in technology, the fund is exposed to the cyclical swings of that sector. A downturn in tech valuations could disproportionately impact VT7 relative to a more diversified fund.

- Single‑company risk: If one of the seven companies experiences a major setback (e.g., regulatory scrutiny, earnings miss, or leadership change), it could drag down the entire portfolio.

- Limited diversification: The remaining 41 % is spread across many smaller or mid‑cap growth stocks, which adds some diversification but does not fully offset the concentration in the top seven.

For risk‑averse investors, the article suggests pairing VT7 with a more balanced fund like Vanguard’s Total Stock Market ETF (VTI) or a bond allocation to smooth volatility.

6. How VT7 Fits Into a Portfolio

The Fool piece recommends the following scenarios where VT7 could be considered:

| Scenario | Reason |

|---|---|

| Tech‑heavy investor | Those who want a lean, high‑growth exposure and are comfortable with sector risk. |

| Supplementary allocation | Adding 5‑10 % of a diversified portfolio to boost potential upside. |

| Replacement for QQQ | Investors looking for a cheaper tech‑heavy ETF with a similar focus. |

The article cautions that VT7 is not a pure index of the S&P 500 and should not be used as a stand‑alone core holding if you seek broad market coverage.

7. Where to Learn More

- Vanguard’s official website – The fund’s prospectus, fact sheet, and regulatory filings are available at [ Vanguard.com ].

- The “Magnificent Seven” article on The Motley Fool – Provides a deeper dive into why those seven stocks dominate the market.

- Quarterly holdings report – Updated monthly on Vanguard’s site, showing any changes in weighting.

Bottom Line

The Vanguard ETF 59 % portfolio that focuses on the Magnificent Seven offers investors a cost‑effective, high‑growth vehicle that captures the upside of Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla. While its concentration in a single sector and a handful of companies is a double‑edged sword, the fund’s low expense ratio and passive management make it a compelling choice for growth‑centric investors who are comfortable with the inherent risk of tech dominance.

If you’re looking to add a tech‑heavy play to your portfolio without paying a premium, VT7 is worth a closer look—just remember to keep the overall portfolio diversified to guard against sector swings.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/26/vanguard-etf-59-portfolio-magnificent-seven-stocks/ ]