Aflac Stock: Overvalued Due To Risks In Japan (NYSE:AFL)

The Japanese Pillar of Aflac’s Business

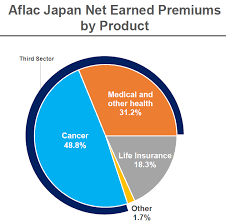

Japan represents a substantial portion of Aflac’s premium income. The company’s “International” business segment, which includes its Japanese operations, accounted for roughly 25 % of total premiums in 2022. While this geographic diversification had been marketed as a hedge against domestic U.S. economic cycles, the article argues that it actually creates a single point of vulnerability. The Japanese market is heavily regulated, subject to abrupt policy changes that can compress margins. Moreover, the insurer’s flagship product—a supplemental health plan that complements national health insurance—faces fierce competition from both domestic players and multinational firms expanding into the Japanese market.

The piece cites a 2023 regulatory report that notes impending changes to Japan’s “universal health coverage” framework, which could reduce the need for supplemental insurance. If a large swath of Japanese consumers shift toward national coverage or alternative wellness programs, Aflac’s revenue base may contract faster than the company’s capital structure can absorb.

Currency and Economic Headwinds

Aflac’s Japan business is heavily exposed to the Japanese yen. In the wake of the Bank of Japan’s prolonged dovish stance and a series of global interest‑rate hikes, the yen has trended sharply against the dollar. Although a stronger yen can benefit overseas earnings when converted back to dollars, the article argues that the volatility creates unpredictable cash‑flow swings, especially when coupled with Japan’s sluggish economic growth. The company’s earnings reports have already shown a higher proportion of earnings variability in the last two quarters, a trend the author correlates with the yen’s fluctuations.

The author also points to the U.S. dollar’s rising borrowing costs. Aflac has a sizeable debt load, and interest‑rate hikes increase financing expenses. The combination of higher debt servicing costs and the risk of a weak Japanese economy paints a cautionary picture for investors who have traditionally viewed Aflac as a low‑risk dividend payor.

Competitive Dynamics and Pricing Pressure

Japan’s insurance market is dominated by three incumbents—Meiji Yasuda, Sompo, and Mitsui Life—that have a long‑standing relationship with the local population. These competitors have begun to offer bundled services that combine health, life, and pension products, thereby reducing the necessity for standalone supplemental insurance. Aflac’s pricing strategy, which relies on a premium‑plus model, faces the risk of erosion if competitors offer lower‑priced alternatives or more flexible coverage.

The article references a 2022 survey conducted by the Japan Insurance Association, which revealed a growing preference for “value‑based” insurance products over traditional policy models. Aflac’s current product mix, heavily weighted toward fixed‑premium policies, may fail to capture this shift. The author argues that the company’s failure to adapt could result in declining market share, forcing Aflac to engage in price wars or to raise premiums—both of which could have detrimental effects on cash flow.

Dividend Sustainability and Capital Allocation

One of Aflac’s biggest selling points to investors is its consistent dividend payout. The company has maintained a 70‑80 % payout ratio for the past decade, a ratio that is attractive to income‑focused investors. The Seeking Alpha piece cautions that sustaining this payout level becomes problematic if the Japanese segment’s profitability erodes. Aflac’s capital allocation strategy—currently favoring stock buybacks over new product development—may not provide sufficient cushion against a downturn in Japan.

The article quotes a senior analyst from a Japanese brokerage who notes that Aflac’s current capital adequacy ratio may remain within regulatory limits, but any significant drop in premiums could push the company toward a more conservative approach. Aflac would likely have to cut dividends or buybacks, unsettling investors who have come to rely on the company’s “dividend‑stability” narrative.

Valuation Concerns

When it comes to pricing, the article uses the dividend discount model (DDM) to project a fair value for Aflac’s shares. Assuming a conservative 5 % growth in Japanese premiums and a 3.5 % discount rate, the model outputs a target price of $45–$48 per share, a 15‑20 % discount to the current market price. The author stresses that this calculation is sensitive to assumptions about Japan’s regulatory environment and competitive dynamics; a single misstep could widen the valuation gap even further.

The article also examines technical indicators, noting that Aflac’s stock has broken out of a long‑term consolidation pattern and has recently traded above its 200‑day moving average. While such patterns often signal bullish momentum, the author warns that if the underlying fundamentals—particularly the Japanese revenue stream—fail to support the price, the stock could experience a swift correction.

Bottom Line

Aflac’s long‑term track record, high dividend yield, and strong U.S. brand make it an appealing fixture on many income portfolios. However, the Seeking Alpha article brings attention to the fact that the company’s valuation is heavily tied to a single foreign market that is experiencing regulatory, competitive, and economic headwinds. The concentration of risk in Japan, the company’s exposure to currency swings, and a pricing model that may not adapt quickly enough to consumer preferences create a scenario where the current stock price may be too high relative to its future cash‑flow prospects.

Investors should consider whether Aflac’s dividend yield and growth potential justify the implied risk premium. As the Japanese insurance landscape evolves and macroeconomic pressures mount, the company’s ability to sustain its dividend and grow its earnings could prove more fragile than the market’s current valuation suggests.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4838748-aflac-overvalued-due-to-risks-in-japan ]