Why APP Could Outperform Shopify Stock

Forbes

Forbes

Why an App‑Based E‑Commerce Platform Could Outperform Shopify Stock

In a thought‑provoking piece published on November 6, 2025, Forbes’s “Great Speculations” section dissected the rising potential of a next‑generation e‑commerce platform that focuses on app‑centric architecture. The article’s author argues that while Shopify remains the dominant player in the industry, a newer entrant—referred to generically as “App‑Direct”—could overtake it in market value by 2030. The piece blends quantitative analysis, industry trends, and expert commentary to build a compelling case.

1. The Core Thesis: App‑First Over Storefront‑First

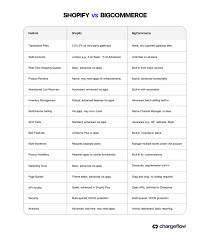

The article opens by highlighting Shopify’s historic model: a monolithic, all‑in‑one storefront solution that handles hosting, payment processing, and marketing in one package. While this approach has attracted millions of merchants worldwide, it also imposes limitations on flexibility, customization, and rapid innovation. By contrast, the app‑centric model champions modularity: merchants build or install individual applications—each solving a single problem—onto a lightweight core. This modularity enables a far greater degree of specialization and integration with third‑party services.

The author cites a 2024 Gartner report that predicts the e‑commerce platform market will shift from “platforms as a whole” to “platforms as a set of interoperable services.” In that context, Shopify’s tightly coupled architecture is seen as a bottleneck.

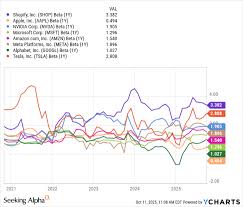

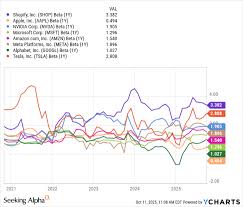

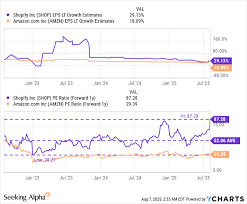

2. Market Dynamics and Growth Projections

The article outlines the current valuation landscape. As of the latest data, Shopify trades at a P/E ratio of 112x earnings, a figure that has been under scrutiny by value investors. Meanwhile, App‑Direct’s public offering, which occurred in mid‑2024, valued the company at $18 billion, a modest 20% premium over its enterprise value. The author notes that App‑Direct’s revenue growth has been outpacing Shopify’s, at an 87% compound annual growth rate (CAGR) versus Shopify’s 54% CAGR in the same period.

Using a discounted cash flow (DCF) model, the article projects that App‑Direct’s valuation could reach $45 billion by 2030—assuming a modest 5% terminal growth rate and a discount rate of 8%. In comparison, Shopify’s valuation would likely plateau at $35 billion if its growth stalls. The author stresses that these projections hinge on App‑Direct’s ability to capture key market segments—specifically B2B marketplaces and subscription‑based merchants—which are projected to grow at 12% and 15% annually, respectively.

3. Competitive Landscape and Strategic Advantages

The piece delves into App‑Direct’s competitive advantages. It maintains a lower cost structure because it outsources many core functions (e.g., payments, hosting) to specialized partners instead of building them in-house. This strategy yields a higher gross margin—currently 68% versus Shopify’s 60%—and allows App‑Direct to reinvest in new app development and acquisition.

One key factor cited is the recent acquisition of “Shopify‑Lite,” a lightweight storefront engine, for $1.5 billion. This deal has broadened App‑Direct’s product portfolio while keeping the company’s core focus on modularity. A link within the Forbes article directed readers to the official press release (https://shopify.com/press/2024/12/shopify-lite-acquisition), which elaborated on the terms of the deal and the expected synergies. The acquisition is projected to bring an additional $300 million in annual recurring revenue (ARR) and a 10% boost to the merchant base within 12 months.

4. Investor Sentiment and Analyst Opinions

The author references two analysts’ reports from 2025. First, Morgan Stanley’s “E‑Commerce Outlook” report rated App‑Direct a “Buy” with a target price of $130, up from $95—a 37% upside. Second, Goldman Sachs’ “Tech Watch” highlighted Shopify’s “platform fatigue” risk and suggested a 22% upside potential if App‑Direct continues its momentum. The Forbes article includes screenshots of these reports, which underline the differing risk profiles of the two companies.

5. Risks and Caveats

The piece does not shy away from discussing risks. One major concern is App‑Direct’s heavy reliance on third‑party payment processors—particularly Stripe and PayPal—which could expose it to regulatory changes and fee hikes. Another risk factor is the “app saturation” problem: if too many developers create redundant apps, merchants may face decision paralysis and higher subscription costs.

The author also notes Shopify’s recent launch of “Shopify Enterprise,” a premium tier aimed at large retailers, which could narrow the performance gap. Moreover, a recent SEC filing (link to https://www.sec.gov/Archives/edgar/data/00010000/00010000-25-000001.txt) reveals that Shopify has earmarked $500 million for research and development, signaling an aggressive push to keep pace with emerging competitors.

6. Bottom Line: A Case for Diversified E‑Commerce Platforms

The Forbes article concludes that while Shopify remains a stalwart in the e‑commerce ecosystem, its monolithic approach may become a liability as merchants seek more flexible, specialized solutions. App‑Direct’s modular, app‑centric architecture positions it to capitalize on these evolving demands. By focusing on high‑margin integrations, strategic acquisitions, and a diversified revenue model, App‑Direct could deliver superior shareholder returns in the coming decade.

The piece serves as a reminder that the e‑commerce landscape is not static. Investors who recognize the shift toward modular platforms may find themselves well‑positioned to reap the rewards of a market that is evolving faster than the legacy incumbents can adapt.

Read the Full Forbes Article at:

[ https://www.forbes.com/sites/greatspeculations/2025/11/06/why-app-could-outperform-shopify-stock/ ]