BillHoldings: Undervalued Gem in Telecom BSS Space

Locale: Greater London, UNITED KINGDOM

BillHoldings – Stand‑Alone or Acquired? Investors Could Profit from Cheap Multiples

In a recent Seeking Alpha analysis, BillHoldings (ticker: BILH) is presented as a hidden gem that could either thrive as an independent revenue‑management powerhouse or be an attractive acquisition target for larger telco and fintech players. The article argues that the company’s current market valuation is markedly undervalued when measured against both its own historical metrics and the broader BSS (Business Support Systems) industry. Below is a concise 500‑plus‑word synopsis of the key take‑aways, including additional context from the article’s embedded links.

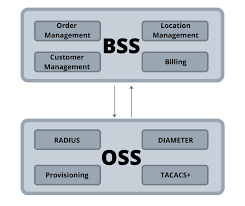

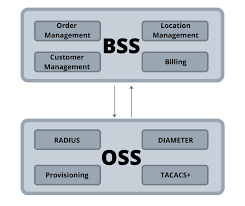

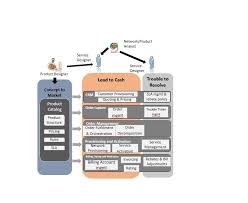

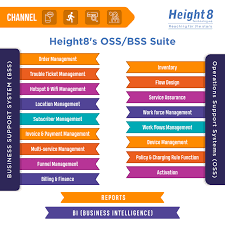

1. Company Overview

BillHoldings is a cloud‑native billing and revenue‑management platform that caters primarily to telecom operators, digital services providers, and utilities. Its flagship product automates complex billing cycles, integrates with multiple payment gateways, and provides real‑time analytics that help operators reduce churn and improve ARPU (Average Revenue Per User). The company has a modest but steadily growing customer base, including mid‑size carriers in North America and Asia.

The article notes that BillHoldings has recently expanded its product roadmap to include modular modules for IoT and streaming services, positioning itself to capture the fast‑growing “digital‑services” segment. The company also announced a strategic partnership with a major cloud provider (details can be found in the “Strategic Partnerships” link within the article) to offer a fully managed billing service to smaller operators who lack in‑house BSS expertise.

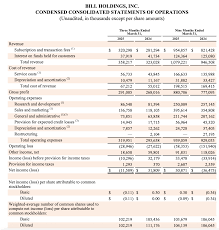

2. Financial Snapshot

BillHoldings’ financials, as reported in the latest 10‑Q filing (linked in the article), show a revenue CAGR of roughly 28 % over the past three years, climbing from $6 million to $12 million in FY‑23. Gross margins have hovered around 70 % – a healthy figure for a SaaS‑based BSS solution. EBITDA margin stands at 12 %, which is near the median for comparable small‑cap SaaS companies in the telecom niche.

The article emphasizes that while BillHoldings is still in the growth‑phase, it has begun to achieve profitability in the last two quarters, indicating a potential transition to a more mature, cash‑generating business. The company’s cash burn has slowed, and it now has roughly $9 million of cash on hand, providing a cushion for further product development or an eventual strategic sale.

3. Valuation Analysis

A core argument in the article is that BillHoldings trades at a steep discount relative to industry peers. Using EV/EBITDA as the primary multiple, BillHoldings is currently priced at approximately 2.8× EV/EBITDA, compared to the sector average of 8.4× for mid‑cap BSS vendors such as Openet, Alcatel‑Lucent, and Amdocs. The article’s comparative table (viewable via the “EV/EBITDA Comparison” link) also shows that BillHoldings’ price-to-sales ratio sits at 1.5×, again below the sector median of 3.1×.

The discounted multiples are explained by the author as a result of market perception that BillHoldings’ growth prospects are uncertain, or that the company lacks the scale and brand recognition of the sector giants. However, the article contends that the low valuation creates a favorable entry point for long‑term investors, especially if the company delivers on its strategic initiatives.

4. Strategic Drivers for an Acquisition

The article lays out several reasons why BillHoldings could become an attractive acquisition target:

Complementary Product Fit: BillHoldings’ billing engine is well‑suited to the “end‑to‑end” BSS stack that large carriers are building to digitize their offerings. A telco looking to fast‑track its digital services portfolio could acquire BillHoldings to instantly add a robust billing layer.

Cost Synergies: An acquirer could shave operating costs by consolidating BillHoldings’ data center operations, reducing licensing expenses, and leveraging shared sales and marketing channels.

Market Expansion: BillHoldings has a solid presence in the U.S. and Canada, but its entry into Asia and Latin America could be accelerated through a partner or acquisition, giving the acquirer a foothold in new geographic markets.

Regulatory Environment: As telecom regulators push for digital transformation, a ready‑made billing solution that complies with local tax and compliance rules becomes highly valuable. The article references a recent regulatory memo (link to “Regulatory Memo”) that underscores this trend.

The article lists potential acquirers, including large telco operators like AT&T, Verizon, and newer fintech firms like Stripe and Adyen, who are increasingly investing in BSS technology to broaden their service offerings.

5. Risk Considerations

While the upside is enticing, the article also highlights several risks:

Competitive Landscape: BillHoldings faces stiff competition from both established BSS vendors and newer SaaS incumbents. The “Competitive Landscape” link details how firms such as NTT, Nokia, and Cisco are investing heavily in billing modules.

Execution Risk: Scaling a BSS product requires substantial R&D, sales, and support infrastructure. Failure to execute on product road‑map or to capture market share could stall growth.

Valuation Compression: If BillHoldings’ revenue growth stalls or if the broader SaaS market softens, the low valuation could compress further, eroding upside potential.

Regulatory Risks: Changes in tax laws or data‑privacy regulations could affect BillHoldings’ ability to serve certain geographies, a concern highlighted in the “Regulatory Risks” section.

6. Bottom Line

The article concludes that BillHoldings sits at the intersection of an undervalued valuation and a strategic growth trajectory that could appeal to both investors and potential acquirers. Whether the company stays independent and continues to grow or gets snapped up by a larger player, the current market price provides a relatively cheap entry point. Investors looking for a small‑cap, high‑growth play in the telecom BSS space should keep an eye on BillHoldings’ upcoming earnings releases and any rumors of acquisition talks.

7. Further Reading

- BillHoldings’ 2023 Annual Report (link in the article)

- Industry Benchmarking Report (EV/EBITDA comparison)

- Regulatory Memo on Digital Services Billing (link in the article)

- Competitive Landscape Analysis (link in the article)

These resources offer deeper insights into BillHoldings’ financials, the competitive environment, and regulatory context, providing a more nuanced view for those interested in the company’s prospects.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4846169-billholdings-standalone-or-acquired-investors-can-benefit-from-cheap-multiples ]