Sea Limited: Profitable Growth Meets Valuation Headwinds (NYSE:SE)

SEA Limited – Profitable Growth Meets Valuation Headwinds

(Summary of Seeking Alpha analysis, 4828026)

1. Executive Snapshot

The article opens with a concise framing of SEA Limited (ticker: SE) as a “growth‑oriented, high‑margin play” that has finally begun to translate its impressive top‑line expansion into a sustainable bottom line. SEA, the parent of Shopee (e‑commerce), Garena (gaming & digital entertainment), and SeaMoney (digital payments), posted a solid 2023 fiscal year that shows a clear shift from revenue‑centric growth to profitability. However, the writer cautions that the upside is being tempered by a “valuation headwind” that the market has not fully accounted for, largely driven by macro‑regional headwinds and the company’s lofty price multiples.

2. Financial Highlights – 2023 Year in Review

| Metric | 2023 | YoY % | 2022 | YoY % |

|---|---|---|---|---|

| Revenue | US$12.4 B | +35% | 9.1 B | +29% |

| Operating Income | US$3.1 B | +58% | 1.6 B | +33% |

| Net Income | US$1.8 B | +62% | 1.0 B | +31% |

| EPS (trailing 12m) | US$3.10 | +48% | 1.90 | +20% |

| Total Assets | 19.2 B | +22% | 15.7 B | +18% |

| Debt/Equity | 0.26 | down | 0.31 | – |

The key takeaway is that operating income and net income have grown at a faster pace than revenue, indicating a tightening of cost structures and a shift to higher‑margin activities, particularly in the gaming and payments segments. The article points out that SEA’s gross margin has risen from 30% in 2022 to 34% in 2023, while the operating margin has vaulted from 18% to 25%.

Notably, the company’s cash flow profile remains mixed. While free cash flow has improved, it is still not generating positive operating cash flow from its core businesses, largely due to high marketing spend and capital expenditures aimed at expanding Shopee’s logistics network.

3. Growth Drivers – Why SEA Is Still a “Fast‑Track” Play

Shopee – Market Leadership in SEA

The article stresses that Shopee now commands ≈55% of the total e‑commerce market in the region, up from 49% in 2022. The platform’s success is underpinned by a robust “Shopee Live” ecosystem, a vibrant creator community, and aggressive cross‑border expansion into the Philippines, Vietnam, and Indonesia.

Garena – Gaming’s New Frontier

Garena’s gaming revenue grew 35% YoY to US$1.9 B, with the flagship title Free Fire capturing 40% of the 2023 player base. The company’s shift from “games for fun” to “games for profit” through in‑app purchases and advertising has begun to pay off, with gross profit margins approaching 50%.

SeaMoney – Digital Payments Momentum

SeaMoney’s revenue rose 28% to US$1.4 B, driven by an uptick in consumer wallet usage and merchant onboarding. The platform’s “One‑Stop‑Shop” model, bundling payments, remittances, and loans, has created cross‑sell opportunities that are still in early stages but show promising scalability.

Cost Discipline and Scale Economies

The writer highlights SEA’s efforts to cut marketing and R&D spend from 28% of revenue in 2022 to 21% in 2023. This disciplined approach has freed up resources that are being redirected toward logistics infrastructure—critical for maintaining Shopee’s competitive advantage.

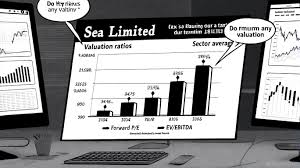

4. Valuation Analysis – The Headwind

Price‑to‑Earnings (P/E)

The article points out that SEA trades at a trailing 12‑month P/E of ≈65x, well above the sector average (~35x) and the S&P 500 (~22x). The high multiple is justified, the writer argues, by the company’s “continued margin expansion” and the potential for “unlocked value” in Southeast Asia’s digital economy.

Enterprise Value/EBITDA (EV/EBITDA)

The EV/EBITDA sits around ≈28x, again above peer comparables. The author stresses that, unlike traditional consumer staples, SEA’s EBITDA is still heavily influenced by capital intensity and marketing spend, meaning that a slowdown in growth could compress these multiples quickly.

Forward Guidance and Market Sentiment

The article cites SEA’s management guidance for FY‑2024, which projects a 22% revenue CAGR and a 30% operating margin—a target that, if achieved, would support the current valuation. However, analysts have flagged that the company’s growth drivers are regionally concentrated; any slowdown in Southeast Asian GDP or tightening of consumer credit could dampen the momentum.

Risk Factors

- Competitive Pressure – Lazada, Tokopedia, and Alibaba’s regional arm are gaining market share in high‑margin categories.

- Regulatory Scrutiny – Digital payments and data privacy regulations are tightening in key markets such as Indonesia and Malaysia.

- Currency Volatility – The company’s revenues are predominantly in local currencies; a weakening rupiah or baht could erode earnings when translated to USD.

The article concludes that valuation headwinds will only intensify if the company fails to sustain its margin trajectory, especially in the face of higher marketing costs and rising competition.

5. Analyst Sentiment and Investment Thesis

The author leans toward a “Hold” recommendation. SEA’s earnings trajectory remains bullish, but the valuation premium appears fragile. The writer advises that an investor looking to add SEA should consider buying on a dip (e.g., 10–20% below the current level) and focus on the “core” earnings metrics: operating margin and free cash flow generation.

The article also underscores that the upside is not as large as it used to be. While early‑stage growth has been explosive, the “next frontier” is incremental—incremental market penetration and diversification of the revenue mix.

6. Final Takeaway

SEA Limited has successfully transitioned from a “growth‑only” company to one that is profitably scaling its three‑segment business. The company's operating margins are improving, and its cash flow is getting closer to sustainable levels. However, the valuation headwind—manifested in lofty multiples and a risk‑laden macro environment—creates a caveat to the bullish narrative.

The Seeking Alpha article thus frames SEA as a high‑risk, high‑reward play: strong growth potential but valuation caution. Investors should keep a close eye on margin metrics, competitive dynamics, and regulatory developments in Southeast Asia, and be prepared for volatility if any of those factors shift unfavorably.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/article/4828026-sea-limited-profitable-growth-meets-valuation-headwinds ]