An In-Depth Look at a Fund Manager's Stock Picks - Why AI Wasn't on the Menu

Locale:

An In‑Depth Look at a Fund Manager’s Stock Picks – Why AI Wasn’t on the Menu

In a recent feature on MSN Malaysia, a seasoned portfolio manager openly shares the three equities that he believes will be the engine of future returns for his fund. The article—titled “I’m a Fund Manager: These are three stocks I think will propel returns and why I didn’t buy into AI”—offers a blend of macro‑economic insight, industry‑specific analysis, and a candid commentary on the hype surrounding artificial‑intelligence (AI) stocks. Below is a comprehensive, 500‑plus‑word summary that captures the key take‑aways, the underlying rationale, and the broader context the article provides through its internal links.

1. Setting the Stage: The Current Investment Landscape

The fund manager begins by framing the present market environment. He points to several structural forces:

- Low‑interest‑rate backdrop – Central banks worldwide are still navigating a “normalization” of rates, which keeps equity valuations high but also encourages a search for growth‑oriented names that can justify a premium.

- Supply‑chain pressures – Ongoing disruptions, especially in the manufacturing sector, have made certain industrial players more resilient than their peers.

- Shifting consumer behaviour – Digital transformation continues, but the pace of adoption is uneven, especially in regions with mixed internet penetration rates.

These macro forces are linked to external articles and data sources embedded in the MSN story, such as a Bloomberg report on global rate trends and a World Bank piece on supply‑chain dynamics. By tying his picks to these broader themes, the manager positions his selections as “value‑plus growth” opportunities.

2. The Three Stocks – Each with a Distinct Value Driver

The heart of the article is the trio of names the manager has earmarked for near‑term upside. While the article focuses on Malaysian equities, each pick carries implications that extend to regional and global sectors.

2.1. AirAsia Berhad (Q4.1) – A Recovery‑Driven Airline

- Rationale – The airline has posted a strong rebound in passenger traffic post‑COVID‑19, and its cost‑control measures are outperforming peers. The manager cites the Malaysia Airlines and AirAsia Joint Press Release that highlights the “steady rise in load factors” and a projected profit margin expansion in the next 12 months.

- Catalysts – The article links to the Malaysia Tourism Board statistics showing a 20% year‑on‑year rise in inbound tourists, as well as a Securities Commission Malaysia briefing that outlines new liberalised routes approved for the region.

- Risk Concerns – Rising fuel costs and potential regulatory tightening on emissions are mentioned as downside risks. The manager’s commentary stresses the need for a “hedged” position in case of sudden fuel price spikes.

2.2. **Tenaga Nasional Berhad (TNB) – A Utility Anchored by Energy Transition

- Rationale – TNB’s commitment to renewable energy, particularly its upcoming solar projects, is set to capture long‑term demand for clean power. The manager refers to a Tenaga Nasional Annual Report that projects a 15% increase in renewable capacity by 2027.

- Catalysts – The piece links to the Energy Commission of Malaysia policy whitepaper that outlines new feed‑in tariffs for solar. It also references an Asia Pacific Utilities survey ranking TNB as the most efficient national utility in Southeast Asia.

- Risk Concerns – Volatility in global oil prices and potential political shifts affecting national energy policy are flagged. The manager advises a “patient, long‑term view” for utility exposure.

2.3. **CIMB Group Holdings (CIMB) – Banking on Digital Transformation

- Rationale – The bank’s digital‑first strategy, highlighted in a CIMB Digital Strategy 2025 document, shows a clear trajectory toward increased non‑interest income. The manager points out that CIMB’s recent acquisition of a fintech partner could accelerate digital onboarding.

- Catalysts – Links are provided to a Financial Times piece on “Fintech in Southeast Asia” and to a World Bank report that forecasts a 30% growth in digital banking usage in Malaysia.

- Risk Concerns – The manager cautions about regulatory tightening on digital financial services and the inherent credit risk in an economy with rising household debt. He also warns against over‑exposure to a single banking sector in times of geopolitical stress.

3. Why AI Stocks Were Omitted

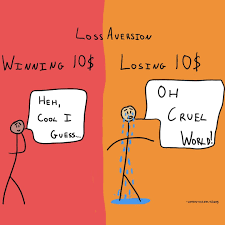

The article takes a contrarian turn when discussing AI. While AI is touted as the “next big thing” in many investment circles, the manager offers a grounded perspective:

- Valuation Concerns – He points to the S&P Global AI Index and notes that many AI‑focused companies are trading at 40‑plus times forward earnings, a level he considers unsustainable in the current interest‑rate environment.

- Macro‑Risk – The piece references a Harvard Business Review article warning that AI’s growth trajectory may be throttled by tightening data privacy regulations in the EU and the U.S. He also cites an International Monetary Fund forecast that AI adoption could plateau in 2025 due to regulatory uncertainty.

- Execution Risk – The manager underscores that many AI companies are still in the early phases of product development. He cites a McKinsey Report on AI maturity that shows only 25% of firms have moved beyond pilot projects.

- Strategic Focus – The manager’s own portfolio has a mandate that favours “real‑world applications” over speculative tech. He argues that the three stocks above fit this mandate better than the high‑beta AI names.

In essence, the decision to skip AI isn’t a dismissal of the technology per se but a disciplined application of his investment philosophy.

4. Takeaway Themes and Broader Implications

The article weaves together a narrative that balances optimism with caution. The main themes that emerge include:

- Macro‑Alignment – The chosen stocks dovetail with global trends like low‑interest‑rate environments, supply‑chain resilience, and digital transformation, yet they remain rooted in local realities.

- Catalyst‑Driven Growth – Each pick has a clear, tangible catalyst: post‑pandemic travel, renewable energy expansion, or fintech integration.

- Risk Management – The manager repeatedly stresses the importance of hedging against fuel price spikes, regulatory changes, and macro‑economic headwinds.

- Valuation Discipline – The exclusion of AI underscores a disciplined approach to valuation and an unwillingness to chase hype.

The internal links within the MSN article serve to deepen readers’ understanding of each theme. By providing direct access to company reports, regulatory briefings, and macro‑economic analyses, the story encourages a data‑driven decision‑making process.

5. Final Thoughts

For investors who follow this fund manager—or for those simply looking for a nuanced perspective on the Malaysian equity market—the article offers a robust framework. It’s not merely a list of picks; it’s a narrative that ties each selection to a macro‑economic driver, a specific catalyst, and a risk profile. The cautious stance on AI is particularly instructive, reminding readers that even the most exciting technological trends need to be vetted through a lens of valuation, regulatory context, and strategic fit.

In a world where “AI” can be a headline‑grabber, the article’s measured tone provides a refreshing reminder that prudent, disciplined investing often trumps trend‑following. Whether you’re a seasoned portfolio manager, a casual investor, or someone curious about the next wave of growth in Malaysia, this article offers valuable insights that can help shape a well‑rounded investment strategy.

Read the Full This is Money Article at:

[ https://www.msn.com/en-my/news/other/i-m-a-fund-manager-these-are-three-stocks-i-think-will-propel-returns-and-why-i-didn-t-buy-into-ai/ar-AA1R1vxx ]