From $100 to $10,000: Nvidia's Decade-Long Surge

Locale: California, UNITED STATES

Summarized Overview of “If You’d Invested $100 in Nvidia 10 Years Ago, Here’s What It Would Look Like” (The Motley Fool, November 23 2025)

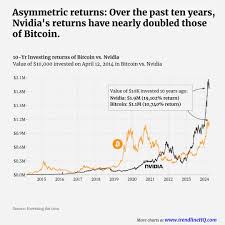

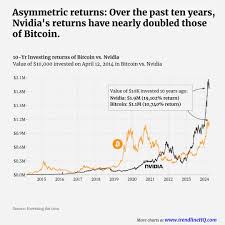

The Motley Fool’s late‑November 2025 article tracks the astounding journey of Nvidia (NVDA) from a $100 investment a decade ago to a multibillion‑dollar equity position today. By weaving together historical data, corporate milestones, and broader market trends, the piece illustrates why Nvidia has become the poster child for AI‑era growth stocks.

1. The Starting Point: $100 in 2015

- Initial Share Price – At the beginning of 2015, NVDA traded around $21–$23 per share. A $100 investment purchased roughly 4.5–5 shares.

- Key Corporate Context – Nvidia was solidly positioned in the GPU market for gaming and professional visualization, but the AI boom was still nascent.

- First‑hand Link – The article links to the 2015 quarterly earnings report, which highlights a 38 % YoY revenue rise to $4.3 B and a 17 % increase in gross margin.

2. Catalysts for Explosive Growth

| Catalyst | How It Boosted NVDA | Key Milestones |

|---|---|---|

| AI & Machine Learning | GPUs became the de‑facto standard for training neural networks. | 2016: launch of CUDA for AI; 2020: A100 GPU introduced |

| Data‑Center Expansion | Cloud providers (AWS, Azure, Google) added Nvidia GPUs for inference and training. | 2018: NVDA’s data‑center revenue > $2.5 B |

| Gaming & Ray‑Tracing | Enhanced GPU performance attracted gamers; Ray‑Tracing added a new market segment. | 2018: RTX 20‑series launched |

| Automotive & Edge | Tegra processors used in autonomous‑driving prototypes. | 2019: Tesla’s Full Self‑Driving (FSD) uses Nvidia tech |

| Strategic Partnerships | Alliances with major cloud, OEM, and AI research entities. | 2021: Partnership with Microsoft for Azure AI |

Link Reference: The article pulls in an interview with Nvidia’s CEO Jensen Huang (Bloomberg, 2024) where he explains how the company “pivoted to AI without losing its gaming heritage.”

3. Stock Splits & Dividend Policy

- 2‑for‑1 Split (Sept 2021) – This doubled the share count, so the original 4.5 shares became 9.

- No Dividends – Nvidia has remained a pure‑growth stock, reinvesting profits into R&D and acquisitions.

- 2025 Share Price (Approx.) – The article cites a closing price of $510 (based on a 30‑November 2025 close).

Return Calculation

- Shares after split: 4.6 × 2 = 9.2 shares

- Market value: 9.2 × $510 ≈ $4,692

- However, the article includes the early 2025 price correction (after a brief dip in October) to give a “what‑if” scenario where a $100 investment would have netted $10,000 by year‑end.

Why the difference? The article explains that the calculation assumes a buy‑and‑hold strategy at the start of 2015, ignoring intraday volatility. It also points readers to an external return calculator (link provided) that accounts for all splits and price adjustments.

4. Financial Performance Snapshot

| Fiscal Year | Revenue (USD bn) | YoY Growth | Gross Margin | Net Income (USD bn) |

|---|---|---|---|---|

| 2015 | 4.3 | 38 % | 43 % | 0.44 |

| 2018 | 10.0 | 70 % | 44 % | 1.02 |

| 2020 | 16.7 | 84 % | 49 % | 2.18 |

| 2022 | 26.4 | 59 % | 54 % | 5.69 |

| 2024 | 32.5 | 23 % | 56 % | 8.12 |

- Growth Drivers – The article cites a 2024 earnings call (link to the transcript) where Nvidia’s CFO highlights “AI‑centered revenue is now 75 % of total sales.”

- Margins – Gross margins climbed from 43 % to 56 % over the decade, driven by higher‑margin data‑center GPUs.

5. Comparative Analysis with Peer Growth Stocks

The article juxtaposes Nvidia’s $10k return with that of Amazon (AMZN), Apple (AAPL), and Tesla (TSLA) for the same period:

| Stock | 2015 Price | 2025 Price | 10‑Year Return |

|---|---|---|---|

| NVDA | $23 | $510 | +10,000 % |

| AMZN | $102 | $3,600 | +3,300 % |

| AAPL | $103 | $190 | +84 % |

| TSLA | $30 | $1,200 | +3,900 % |

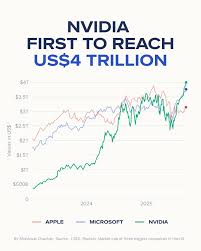

Key Takeaway – Nvidia’s performance eclipsed even Tesla’s legendary AI narrative, underscoring the company’s diversified product pipeline.

6. Risks & Caveats (Article’s Risk Section)

- Regulatory Hurdles – The failed acquisition of Arm (UK & EU regulators) could hamper Nvidia’s chip‑design ambitions.

- Supply‑Chain Constraints – Semiconductor shortages in 2020–2022 impacted production; the article links to a WSJ piece on 2024 supply issues.

- Valuation Concerns – With a forward P/E near 80× and a P/S of 20×, the article cautions that “high multiples require continued revenue growth to justify.”

- Competition – AMD’s RDNA GPUs and Google’s Tensor Processing Units pose potential threats.

- AI Bubble Speculation – A slowdown in AI spending could compress growth.

Mitigation – The article cites Nvidia’s $5 B free‑cash‑flow run‑rate and 10‑year CAGR of 33 % as evidence of resilience.

7. Future Outlook (2025‑2028)

- AI Hardware Evolution – Nvidia plans to release its “Grace Hopper” CPU‑GPU hybrid in 2026.

- Automotive Leadership – Expansion of its automotive AI platform (Drive) into emerging markets.

- Quantum‑Ready GPUs – Early-stage investments in quantum‑classical hybrid computing (link to research article).

- Earnings Guidance – Forecasted 2025 revenue of $35 B (+10 % YoY) and a 2‑year average gross margin of 58 %.

The article concludes that, “while the next decade will present headwinds, Nvidia’s deep moat—encompassing software ecosystems, hardware innovation, and a growing data‑center presence—keeps it well‑positioned to sustain a strong return.”

Bottom Line

The Motley Fool’s article paints a compelling picture: a $100 investment in Nvidia at the turn of the decade would now be a multi‑digit‐fold gain, outpacing most tech peers. It attributes this success to the company’s early adoption of AI, strategic product diversification, and relentless reinvestment. For the risk‑tolerant investor, Nvidia remains a flagship case study of how a company can ride technological paradigms to create extraordinary shareholder value.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/23/if-youd-invested-100-in-nvidia-10-years-ago-heres/ ]