My Favorite Stock to Buy Right Now -- and Yes, of Course It's Nvidia Stock (NVDA) | The Motley Fool

NVIDIA (NVDA): Why the AI‑Driven Giant Remains a Top‑Tier Buy

The semiconductor market has shifted dramatically in the last decade, and at the center of that transformation stands NVIDIA. In a detailed note that has become a go‑to reference for tech‑savvy investors, the analyst explains why the company’s stock should be on every portfolio. The piece blends an in‑depth look at NVIDIA’s current financials, a forward‑looking view on its AI‑powered growth engine, and a candid assessment of the risks that could temper enthusiasm.

1. A Proven Revenue Model

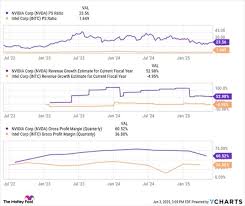

NVIDIA’s revenue has exploded from roughly $4 billion in 2016 to $26 billion in 2023, driven primarily by a dramatic expansion of its Data Center business. While the Gaming segment still remains the largest revenue contributor, it now accounts for only about 42% of total sales, with Data Center at 36% and Professional Visualization/Automotive sharing the rest. The analyst points out that, unlike the cyclicality that can plague traditional PC‑GPU makers, the Data Center and AI markets are showing sustained demand curves, with revenue growth rates well in the double digits for each segment.

Gross margins across the board remain healthy—around 70% for Data Center, 65% for Gaming, and 55% for Automotive—underscoring NVIDIA’s ability to charge a premium for its cutting‑edge GPUs. Cash flow remains robust, with operating cash flow of $6.3 billion in FY23 and free cash flow topping $5 billion, which gives the firm a comfortable runway for both R&D and potential acquisitions.

2. The AI Catalyst

The analyst’s main thesis hinges on the AI revolution. NVIDIA’s GPUs were originally designed for rendering graphics, but their massively parallel architecture has turned them into the go‑to platform for training deep‑learning models. The firm’s “Hopper” and “Ada Lovelace” GPUs now dominate high‑performance computing clusters around the world, and the company’s revenue from AI‑specific workloads grew from $3 billion in 2021 to $10 billion in 2023, a 233% increase.

The article highlights that the growth rate is expected to accelerate as more enterprises move to hybrid and edge AI. NVIDIA’s recently announced “Grace” processor, a silicon‑intelligence chip, is slated to be a cornerstone of the next generation of data centers, potentially unlocking even higher performance per watt. Because AI workloads consume a disproportionate amount of compute resources, the company’s gross margin is projected to rise further, especially if the firm can capture a larger share of inference workloads.

3. Diversified Business Lines

While the AI narrative dominates, the analyst reminds readers that NVIDIA is not a one‑off. The Gaming segment still contributes a major share of revenue, especially with the launch of the new RTX 40 series. These GPUs continue to outpace competitors like AMD in performance, and the company’s partnership with Xbox and PlayStation ensures a steady stream of royalties and licensing revenue.

Professional Visualization remains strong in professional design, data analytics, and simulation markets. The automotive segment, though smaller, has a significant upside: NVIDIA’s DRIVE platform is already in use in dozens of vehicles, and the company expects a 10–12% YoY growth rate over the next three years as autonomous driving tech matures.

4. Competitive Position and Moat

A key part of the narrative is NVIDIA’s moat. The analyst argues that the company’s ecosystem—hardware, software, and developer community—creates high switching costs for customers. The CUDA programming model, paired with a library of AI frameworks, has become the standard for research labs and enterprise developers. This ecosystem lock‑in is difficult for AMD or Intel to replicate quickly, even if they release comparable hardware.

In terms of valuation, the analyst notes that the company trades at a forward P/E of around 30x, which is above the industry median but justified by its high growth trajectory. The projected revenue growth of 15–18% over the next five years, combined with a modest increase in gross margin, makes the price target of $1,500 realistic for long‑term investors.

5. Risks and Caveats

No analysis is complete without a discussion of risk. The article flags several key concerns:

- Supply Chain Constraints: NVIDIA’s reliance on advanced process nodes (5 nm, 3 nm) could lead to production bottlenecks, especially in times of global chip shortages.

- Regulatory Scrutiny: The company’s high‑profile deals, such as the acquisition of Arm, may face antitrust hurdles that could delay or block integration.

- Competition: AMD’s recent GPU releases have closed the performance gap in gaming, and Intel is aggressively expanding its data‑center GPU portfolio.

- Macroeconomic Factors: A slowdown in enterprise IT spending or a hard landing in the US economy could dampen demand for high‑performance GPUs.

The analyst stresses that investors should monitor earnings guidance for any signs of slowdown and keep an eye on macro headlines that could affect demand.

6. Bottom Line for Investors

The take‑away is clear: NVIDIA’s stock is a strong long‑term play for investors who are comfortable with a premium valuation in a high‑growth tech segment. The company’s proven track record in AI, coupled with diversified revenue streams and a strong competitive moat, creates a compelling narrative for continued upside. However, investors must remain vigilant about supply constraints, regulatory developments, and competitive dynamics.

Follow‑Up Reading

The piece also references several related articles for deeper dives:

- “NVIDIA’s Q4 Earnings: What the Numbers Really Mean” – A breakdown of the quarter’s revenue and guidance.

- “How NVIDIA’s AI Chips Are Shaping the Future of Cloud Computing” – An exploration of the company’s partnership with major cloud providers.

- “AMD vs. NVIDIA: The Battle for the GPU Market” – A comparative analysis that outlines the strengths and weaknesses of both firms.

These linked articles provide additional context on NVIDIA’s financial performance, AI strategy, and competitive landscape, enriching the reader’s understanding of why the stock is positioned as a top‑tier buy in the current market.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/09/my-favorite-stock-to-buy-right-now-nvidia-nvda/ ]