Three-Stock Playbook: Apple, Microsoft, Johnson & Johnson

Locale: England, UNITED KINGDOM

Fund Manager’s Three‑Stock Playbook: A Look at the Stocks Set to Drive Returns (and Why AI Is Still a “Future” Bet)

In a candid piece for This is Money, a seasoned fund manager shares the name of the three companies that he believes will be the linchpin of his portfolio’s performance in the coming year. While the piece is framed as a practical, bottom‑up investment exercise, it also offers an insightful commentary on the broader macroeconomic environment, the rise of artificial intelligence, and the way the fund’s mandate shapes its approach to risk and reward. Below is a thorough distillation of the article’s core arguments, picks, and the logic that ties them together.

1. Setting the Stage: Where We Are in 2025

The article opens with a concise snapshot of the current market backdrop. The fund manager notes that, in the wake of the 2024 “inflationary shock” and the subsequent policy tightening from the Fed, equity markets have cooled sharply. Yet, unlike the precipitous sell‑offs that marked the end of the pandemic‑era rally, the current downturn feels more procyclical: valuations have not fallen as much in growth‑heavy names as they have in value‑heavy ones, and there is a distinct “technical reset” in the S&P 500’s leading sectors.

A key point in the discussion is the relative stagnation in the AI sector. The manager laments that, despite the hype surrounding AI‑driven chips, software, and services, many of the high‑flying AI‑centric stocks remain heavily over‑valued. Consequently, the fund’s current mandate—focused on “core value” and “diversified exposure” rather than concentrated bets on a single theme—has meant that the portfolio has been largely “AI‑neutral.” He underscores this by saying, “I never bought AI because my mandate is about balance and risk‑adjusted returns.” Nevertheless, the manager concedes that the AI wave will ultimately act as a tailwind for the broader market, and that he sees opportunity in companies that are already riding that wave but are not yet fully captured by the market.

2. The Three Picks

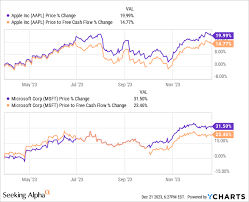

a. Apple Inc. (AAPL)

Apple remains the anchor of the fund’s pick list. The manager praises Apple’s diversified business model that blends premium hardware, a strong subscription ecosystem (iCloud, Apple Music, etc.), and a growing services footprint that is less cyclical than its hardware sales. He cites Apple’s impressive free‑cash‑flow generation, solid balance sheet, and disciplined dividend policy as reasons for the stock’s long‑term resilience. Apple’s strategic move into AR/VR and the upcoming rollout of next‑generation chips are described as “quiet catalysts” that will sustain growth without dramatically inflating the valuation multiple.

b. Microsoft Corp. (MSFT)

Microsoft is the second pick, positioned as the “software counter‑balance” to Apple’s hardware‑heavy model. The manager highlights Microsoft’s enterprise software moat—particularly its Windows, Office, and Azure cloud services—as a foundation for stable, recurring revenue. He also points out the company’s aggressive investments in AI, especially through the integration of generative AI into Office products, which should provide an additional revenue stream without compromising its core business. The article stresses Microsoft’s strong liquidity and the fact that the firm has consistently outperformed its peers in risk‑adjusted terms.

c. Johnson & Johnson (JNJ)

The final pick diverges from the tech focus, representing the manager’s conviction in the resilience of the healthcare sector. Johnson & Johnson’s diversified portfolio—spanning pharmaceuticals, medical devices, and consumer health products—provides a built‑in hedge against economic downturns. The manager notes the company’s robust pipeline and the steady stream of incremental revenue from its established brands. JNJ’s high dividend yield, combined with its track record of share buybacks, positions it as an attractive defensive play that can deliver consistent income while still offering upside potential.

3. Why These Three? The Underlying Logic

The manager’s rationale for this triad is rooted in a disciplined, fundamentals‑first approach:

Valuation Discipline – All three stocks trade at multiples that are, in the manager’s view, either “fair” or “discounted” relative to historical averages. Apple and Microsoft benefit from premium valuation premia for their growth prospects, but their earnings quality and free‑cash‑flow profiles justify these premiums. Johnson & Johnson trades at a more conservative multiple, which is offset by the company’s stable earnings and defensive nature.

Diversification of Risk – By combining a high‑growth tech platform (Apple), a cloud‑plus‑AI powerhouse (Microsoft), and a defensive health conglomerate (Johnson & Johnson), the portfolio mitigates concentration risk. Each company operates in a different sector, has distinct risk drivers, and benefits from different macroeconomic tailwinds.

Alignment with Fund Mandate – The fund’s policy emphasizes “core holdings” that deliver value over the long term. The manager notes that these three stocks fit neatly into that framework, providing both growth and income components while keeping the overall risk profile in check.

Macro Outlook – With the Fed’s policy cycle still unfolding, the manager expects a period of “moderate” growth. In this environment, the tech stocks can ride the AI‑driven upside, while Johnson & Johnson can serve as a safety net during periods of heightened volatility.

4. AI: A “Future” Bet, Not a Current Position

A recurring theme throughout the article is the manager’s measured stance on AI. He explains that although AI is a “force majeure” for the technology sector, he remains cautious about betting on the hype cycle. Many of the AI‑oriented names in the market (e.g., Nvidia, Alphabet, or emerging AI startups) are trading at “excessive” multiples that, in his view, do not yet reflect their long‑term intrinsic value. Consequently, the fund’s current exposure to AI is limited. The manager’s plan is to keep a close eye on the AI space, monitor valuation compression, and consider adding more AI‑related positions when the metrics align with the fund’s risk‑return framework.

5. Risk Management and Exit Strategy

The article rounds off with an outline of the manager’s risk‑management framework:

- Target Weightings – Each stock is capped at a maximum of 15 % of the portfolio, ensuring no single company can dominate the risk profile.

- Stop‑Loss Rules – The manager employs a 25 % stop‑loss threshold for each holding, though he typically stays below that range until the company hits fundamental triggers for an exit.

- Rebalancing – Quarterly rebalancing is performed to realign the portfolio with the original target allocations and to incorporate any new research insights.

He also underscores that the fund’s long‑term horizon allows for short‑term volatility. Even if one of the three picks experiences a temporary dip, the manager’s position is designed to endure.

6. Take‑away

In summary, the article paints a picture of a seasoned fund manager who is neither blindly chasing AI nor shying away from its transformative potential. Instead, he leverages a balanced portfolio built on solid fundamentals and prudent risk management. Apple, Microsoft, and Johnson & Johnson serve as a microcosm of the broader investment thesis: a blend of growth, stability, and defensive attributes that should, in the manager’s view, deliver “propelling returns” over the next few years while staying true to the fund’s core mandate.

For investors who share the fund’s philosophy—value‑oriented, risk‑aware, and focused on long‑term performance—these three stocks represent a compelling, well‑reasoned set of opportunities to watch in 2025 and beyond.

Read the Full This is Money Article at:

[ https://www.thisismoney.co.uk/money/investing/article-15305759/Im-fund-manager-three-stocks-think-propel-returns-never-bought-AI.html ]