Energy Stocks Poised for Growth as Demand Surges - Jay Peters' Take

CNBC

CNBCLocale: New York, UNITED STATES

Energy Stocks Poised for Growth as Demand Surges – Jay Peters' Take

The energy landscape is shifting at an unprecedented pace. With the twin forces of a recovering global economy and the transition to a low‑carbon future driving electricity demand higher, CNBC analyst Jay Peters argues that a handful of energy equities are positioned to capture significant upside. In his November 6, 2025 piece, Peters lays out a concise playbook that blends conventional power players with the next generation of clean‑energy innovators.

1. Solar: The “Sun on the Wall Street”

Peters starts with the solar sector, noting that the cost of photovoltaic (PV) modules has fallen 35 % over the past five years, while installations in the United States and Asia have surged. NextEra Energy (NEE), the world’s largest renewable‑energy utility, remains a cornerstone. Its dual‑focus on wind and solar, combined with a robust debt‑free balance sheet, gives it a competitive moat. Peters highlights that NEE’s free‑cash‑flow yield sits above the sector average, making it an attractive pick for dividend‑seeking investors.

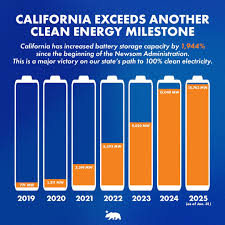

For pure play solar, Peters flags Enphase Energy (ENPH) and SunPower (SPWR). Both companies have benefited from a shift toward rooftop solar in the U.S. and a rapidly growing battery‑integrated solution market. Enphase’s microinverter technology has seen adoption rates climb 12 % YoY, while SunPower’s flagship high‑efficiency panels have helped it capture premium segments in California’s CAISO market.

2. Wind: From “Old‑Energy” to “New‑Energy”

Wind energy, Peters notes, has become a “true mainstream” investment as cost parity with coal and gas narrows. Ørsted (ORSTED) is highlighted for its strong portfolio of offshore wind farms in the North Sea and a pipeline of projects in the U.S. and China. Ørsted’s focus on “green” financing has secured several €5 bn green bonds, reducing its debt‑to‑EBITDA ratio to 0.6x—a level rarely seen in the wind space.

Onshore wind giants Vestas Wind Systems (VWS) and Siemens Gamesa (SGEN) are noted for their high installed capacity growth. Peters points out that Vestas has recently secured a $3 bn offshore wind deal in Portugal, while Siemens Gamesa has expanded into the U.S. market through a joint venture with GE Renewable Energy. Both companies boast a dividend yield around 2 %, offering a balance between growth and income.

3. Battery Storage & Energy‑Tech

The surge in electric‑vehicle (EV) adoption and the intermittent nature of renewables has turned battery storage into a “new catalyst.” Peters identifies Tesla Energy (TSLA) and Enphase again for their integrated battery solutions. Tesla’s Powerwall and Powerpack units have a 70 % market share in the U.S. residential and commercial markets, and the company’s acquisition of a lithium‑ion factory in Nevada positions it for supply‑chain advantage.

Peters also points to Energy Vault (EVTL), a niche player that uses water‑based gravity storage to provide grid‑scale solutions. With a current market cap of $350 m and a 12 % YoY revenue increase, EVTL exemplifies the “high‑growth, high‑risk” niche that can offer outsized returns for contrarian investors.

4. Midstream & Pipeline: The Backbone of Energy Infrastructure

While renewable generation receives the lion’s share of headlines, midstream infrastructure remains essential. Peters recommends Kinder Morgan (KMI) and Enterprise Products Partners (EPD) for their exposure to natural‑gas pipelines. Both companies are riding a 10 % increase in natural‑gas throughput, and their dividend yields sit at 5.3 % and 5.1 % respectively—above the sector median.

Peters cautions, however, that regulatory headwinds in the U.S. (e.g., potential carbon‑pricing policies) could compress margins. He suggests monitoring the outcomes of the upcoming Federal Energy Regulatory Commission (FERC) rule changes on pipeline emissions.

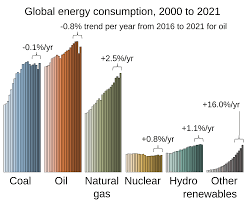

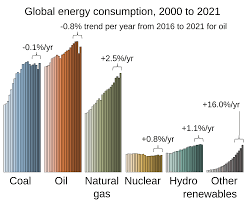

5. Oil & Gas: A “Double‑Edge” Opportunity

Despite a clear shift to clean‑energy, Peters argues that oil & gas stocks still present a “time‑limited upside.” Exxon Mobil (XOM) and Chevron (CVX) are highlighted for their robust balance sheets and dividend yields of 4.6 % and 4.8 %. With OPEC+ easing output cuts and a 5 % rebound in U.S. gasoline consumption, crude‑oil demand in North America is expected to rise 3 % over the next year.

Peters also references the International Energy Agency’s (IEA) 2025 outlook, which forecasts a 1.5 % increase in global oil demand, driven largely by China’s transportation sector. He notes that any delay in China’s transition to EVs could create a “demand tailwind” for majors like BP (BP) and Shell (RDSA).

6. Risk Factors & How to Mitigate Them

- Policy risk – Renewable subsidies may be scaled back as fiscal constraints tighten. Investors should look for companies with a diversified revenue base.

- Price volatility – Energy commodity prices can swing dramatically. Hedging strategies and fixed‑income overlays can provide downside protection.

- Technological disruption – Battery efficiency breakthroughs or advances in hydrogen technology could disrupt current wind/solar economics. Staying invested in a diversified energy basket mitigates sector‑specific shocks.

Peters recommends a balanced energy portfolio: 30 % renewable generation, 20 % midstream infrastructure, 20 % battery storage, and 30 % traditional oil & gas, all with a focus on dividend yield and debt‑free balance sheets.

7. Bottom Line: “The Upside Is Real, But It Requires Discipline”

Jay Peters’ analysis underscores that the energy sector is not a one‑size‑fits‑all play. While the long‑term trend points toward renewables, short‑ to medium‑term dynamics still favor a mix of clean‑energy innovators, pipeline infrastructure, and traditional energy majors. By combining rigorous financial metrics—debt ratios, free‑cash‑flow yield, and dividend payout ratios—with a keen eye on macro‑policy trends, investors can position themselves to capture the upside of a sector in transition.

As Peters succinctly puts it: “The energy renaissance is underway. Investors who blend disciplined fundamentals with an eye for emerging technologies will reap the rewards.”

Read the Full CNBC Article at:

[ https://www.cnbc.com/2025/11/06/some-energy-stocks-offer-further-upside-from-rising-demand-jay-peters-says.html ]